This is how major bottoms feel, like everyone’s trying to get through the door at once, but the numbers don’t quite support a major bottom just yet. For one, we had 89.5% upside volume on the NYSE — very impressive, but the gold standard for a major bottom is 90%, per Paul Desmond of Lowry Research, who’s been studying major bottoms for a few decades.

Still, another 80% upside day tomorrow would be just as good, and the buying pressure was impressive enough that this rally could stick around a while.

It’s also an important recovery of the major support lost yesterday.

All good signs for stock market bulls after the most intense bout of selling since 1974.

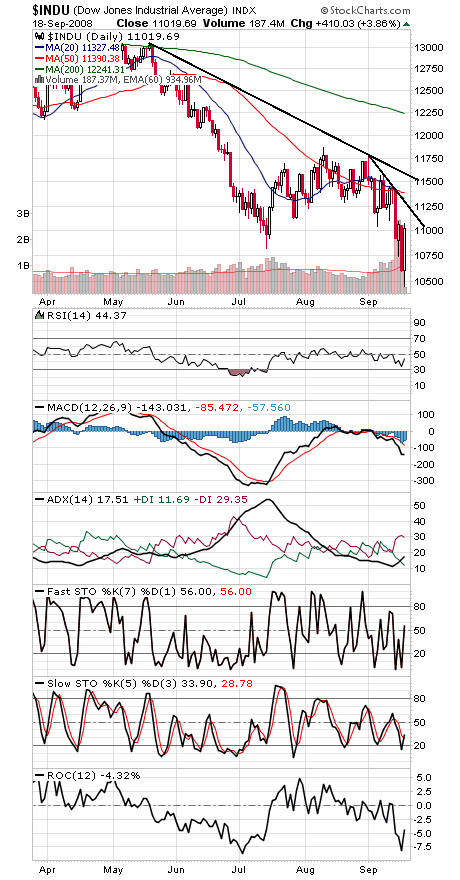

The Dow (first chart below) still has major support at 10,683-10,827 — and that level will remain important until the next four-year cycle low in 2010. To the upside, 11,250 and 11,400 are the next hurdles.

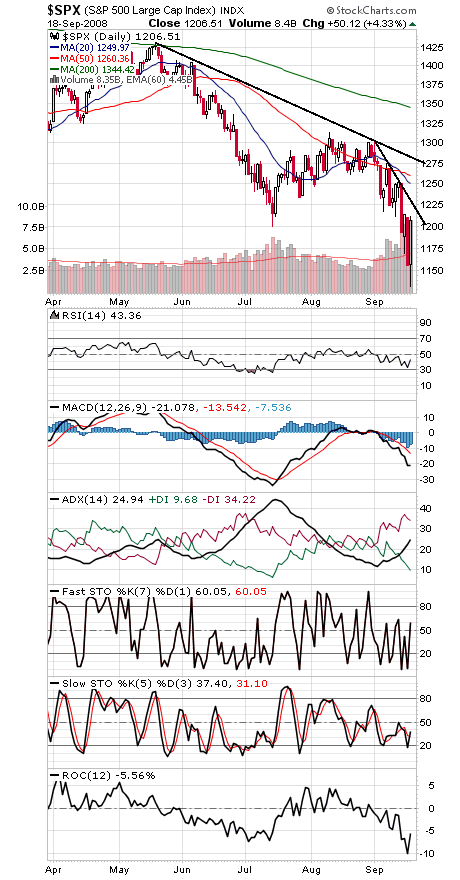

The S&P (second chart) faces resistance at 1225 and then 1250-1260. Support is 1163-1175.

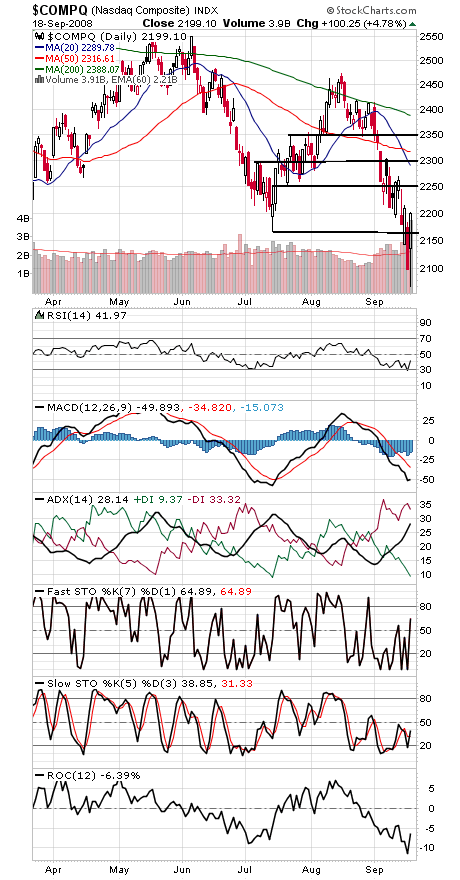

The Nasdaq (third chart) faces resistance at 2250, 2300-2316 and 2350, and support is 2140-2155 and 2120.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.