NEW YORK — Lenovo’s latest ThinkPad laptop release, the Z60 series, may be lighter than ever, but it carries weighty ambitions for the number three computer maker.

With the help of experienced IBM executives who joined Lenovo after it bought Big Blue’s money-losing PC division, China’s Lenovo is launching a slick marketing campaign and aggressive growth strategy as it bids for big-league PC-maker status.

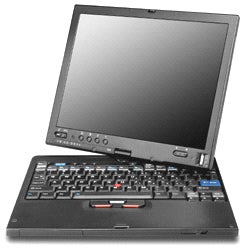

|

| The ThinkPad Z Series Tablet Source: Lenovo |

Beyond its Z60 launch, unveiled at a press briefing here this week, Lenovo is training its guns on the small- to medium-business market, splashing its name around the globe as a major sponsor of the Winter Olympics in Italy, and positioning its Tablet PC as a growth driver in more mature PC markets.

“We’re gearing up for an end-to-end transaction business model expansion,” Yuanquing Yang, chairman of Lenovo, said during a media event here. “It’s a product-centered model. This includes fast response to changes in the market, and especially in supply situations, quicker delivery and better pricing to our transaction customers.”

Yang said Lenovo will be focused on speed.

“This is very important for our transaction customers,” he said. “We need to be able to respond quickly to market changes and be able to update our technology response to changing product portfolios, as well as changing market activities. Almost every month we will change our product strategy. So speed is very important for delivery on that strategy.”

Big words for a company that holds at best about an 8 percent share of the global PC market, according to IDC stats. Should No. 1 one PC-makers Dell and No. 2 HP be frightened?

“I believe that if Lenovo manages its resources carefully — retains the best people, cuts production cost, targets its marketing and sales efforts, and continues to focus on innovation and quality — then the company is in an excellent position for the long term,” noted Simon Yates, PC analyst for Forrester Research.

“However, any near-term misstep could have a proportionally greater effect on the company than the same misstep would have at Dell and HP.”

|

| Lenovo Chairman Yuanquing Yang on his company’s plans. (Photo: Gene Hirschel) |

As it transitions to its New York headquarters, Lenovo executives — most of them former IBM employees — are taking no chances and reassuring nervous customers of the venerable ThinkPad line.

Take the ZSeries, which is aimed primarily at business markets, said Peter Hortensius, senior vice president of worldwide product development for Lenovo. “It offers the first widescreen multimedia ThinkPad; it is the first to offer [integrated] broadband data capability for cellular and [Wi-Fi] networks.”

The ThinkPad Tablet PC, called the X41T, made its debut at Microsoft’s TechEd conference held in Orlando last June. It too, sports industry-leading thinness (for a tablet) and hybrid battery design.

Already known for taking a licking and still ticking, the latest Z60 ThinkPad sports a magnesium alloy frame, known as the ThinkPad roll cage, with a Titanium cover as an option. According to Hortensius, the design protects the laptop’s innards much like a Formula One racing car can withstand a shock. Its widescreen format averages 14 inches to about 15.4 inches.

“Why is this important? Because we are dead serious about the best quality in the industry,” he said. “PCs are just too important to be just a commodity to buy and use. They need to be ultra-reliable and innovative.”

In many ways, Lenovo has helped breathe new life into IBM’s former PC group, which was often downplayed within IBM because of its lackluster earnings results, compared to high-margin, high-flying moneymakers, such as Global Services or Hardware.

Hortensius’s team within Lenovo now consists of 800 former IBM R&D staffers, a group responsible for filing about 1,000 PC-related patents in the past four years. That brings Lenovo’s total R&D group to 1,700 researchers, scientists and engineers across 12 manufacturing plants and three R&D facilities in China, North Carolina and Japan.

Not only that, Lenovo brought over all the sales and service staff when it inherited 10,000 IBM employees as part of its $1.5 billion purchase of the division.

“Lenovo clearly has two important priorities: moving more aggressively into the SMB space in the U.S. and Europe where IBM’s customers often felt less important than the big enterprise customers and establishing its presence in emerging markets where most of the growth over the next decade will come,” added Forrester’s Yates.

By Forrester’s count, in emerging markets, the number of PCs in use worldwide will reach almost 1.3 billion by the end of the decade, up from about 575 million today. With only about 150 million new PCs coming from mature PC markets in Europe, the U.S., and Asia, the rest will come from emerging markets, such as China, Russia and India.

Forrester forecasts that 566 million new PCs will be in use in the 16 largest emerging market countries by the end of 2010 up from under 100 million today.

That’s a compound annual growth rate of about 30 percent. Add to it a 30 percent market share in China alone and its easy to see, as Yates points out, that Lenovo has the capacity in its current factories in China to best serve this demand without having to build entirely new manufacturing facilities.

On top of that, Lenovo did a pretty good job of shoring up its biggest corporate customers in the US and Europe following the acquisition in this space, he said.

|

| The ThinkPad X Series Tablet Source: Lenovo |

“These big buyers were concerned about buying technology from a Chinese company that they never heard of before with mysterious ties to the Communist government and the military.

They feared that product quality, support, innovation — all the reasons they bought IBM PCs in the first place — would suffer when purchased by a company that cranked out low-end desktops aimed at the Chinese government and consumer market.”

Lenovo responded with a “don’t panic, nothing will change” message. Among the messages conveyed at Lenovo’s media briefing here, this was key.

“They visited many of their big customers to do the face-to-face reinforcement. But they didn’t spend as much time talking to SMB customers and the reseller channels and business partners that support them,” Yates noted.

IBM executives can only whisper so much strategy. After all, it had to sell the division because it was a distant third behind Dell and HP in a market with razor-thin margins from commoditization of the PC.

That leaves the SMB market for Lenovo to chase.

“The only way for Lenovo to avoid losing business in mature markets like the U.S. is to put as much effort into the SMB business as their competitors,” added Yates. “They would have a tough time going into consumer markets where the challenge of selling through retailers and consumers’ increasingly lower price expectations wouldn’t be made up in sheer volume,” he continued.

“SMB is the natural growth spot and SMB buyers can only benefit from having another serious player competing for their business.”

Gene Hirschel contributed to this story.