|

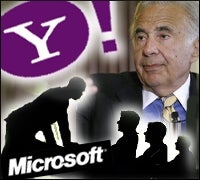

Yahoo’s annual investor meeting on Friday will be a magnet for discontent over the company’s failure to reach a merger deal with Microsoft and complaints about the company’s past performance.

But any real action to reshape Yahoo’s (NASDAQ: YHOO) course is likely to take place only after the meeting, once activist investor Carl Icahn and two outside nominees join an expanded 11-member board as part of a deal with the company to avoid a proxy battle.

Far from a showdown over control of Yahoo, Friday’s annual meeting has the makings of a noisy media circus where the issue of whether Yahoo should remain independent or not competes with older protests over executive pay and human rights policies.

For while the exercise of shareholder democracy will allow investors small and large to vent over what might have been, the outraged speeches are likely to have only symbolic effects since Icahn withdrew his overt challenge to Yahoo’s board.

“I am sure that Yahoo management will take a verbal beating,” said Jim Friedland, an analyst at Cowen and Company. “I just don’t think that the annual meeting is where the debate over Yahoo strategy is going to take place.”

In a blog post on Thursday, Icahn downplayed the importance of the event, saying he plans to skip the meeting himself.

Icahn lashed out at how current corporate governance rules give large mutual funds so much say in control of company board, “no matter how strongly a large number of shareholders feel about the board’s previous actions.”

The billionaire signaled he plans to step up pressure on Yahoo executives once he joins the board and not become a “rubber stamp” for management policies.

Icahn had failed to convince large investors that if he had won control of Yahoo at the upcoming annual meeting, that he had any alternative for turning the business around, other than to sell it in part or in whole to Microsoft. These included Legg Mason fund manager Bill Miller, owner of 4.4 percent of the company’s stock, who has fully supported Yahoo’s board.

Yahoo has said Microsoft’s (NASDAQ: MSFT) various proposals have undervalued its business and instead has agreed to a pending search advertising partnership with archrival Google (NASDAQ: GOOG).

Canaccord Adams analyst Colin Gillis compared Icahn’s role to the proverbial fox in the hen house.

“It is not going to be a retirees’ board. The benefit of having Icahn on the board is the status quo is broken. It is going to be under an awful lot pressure to act,” Gillis said.

Icahn, who owned 4.98 percent of Yahoo, said he had met with Yahoo Chief Executive Jerry Yang and Chairman Roy Bostock this week and remained optimistic he could work with them, even with disagreements.

Icahn will be appointed and the remaining two board seats will be chosen from a list that includes Icahn’s original slate of candidates and Jonathan Miller, former chairman and CEO of Time Warner’s (NYSE: TWX) AOL.

A three-ring circus

Three shareholder proposals opposed by the company will be put before shareholders for the second year running.

[cob:Pull_Quote]The first is a “pay for performance” plan and calls for executive compensation at Yahoo to be linked to how well the company performs versus Internet peers. Currently executive compensation is based largely on time served and not conditioned on performance, critics have complained. A similar proposal won 34.6 percent of shareholder votes last year.

Two other loosely related proposals ask the board to adopt an anti-censorship policy and to pay more attention to human rights in markets where it is active, specifically China.

Ahead of the Beijing Olympics, these votes may resurrect old wounds stemming from Yahoo’s indirect role in turning over e-mails that Chinese authorities used to prosecute dissidents.

Wall Street analysts see only a small chance that a protest vote would reshape the existing board.

“Some of the bigger shareholders want to push for a new CEO,” he said. “They won’t do so at Friday’s meeting.”

Sanford C. Bernstein analyst Jeffrey Lindsay agreed a negative vote against Yang or other directors would put pressure on them to leave, although they are under no pressure to do so under Yahoo bylaws, corporate governance experts say.

[cob:Special_Report]”There is a small possibility that shareholder disappointment results in Jerry Yang being moved aside in a sort of bloodless coup,” Lindsay said.

Former CEO Terry Semel stepped down one week after last year’s meeting, where board members were chastised by shareholders over the company’s slumping financial results, excess executive pay and human rights record.

“The clock is ticking on Jerry. Everybody knows that,” said Canaccord Adams analyst Colin Gillis.

Investor advisory firms are split on whether to fully support the reelection of Yahoo’s board, but their reviews have less weight since Icahn reached a deal that effectively guaranteed the reelection of the existing board.

Two firms, Glass Lewis & Co. and Proxy Governance, have recommended that Yahoo shareholders vote against Bostock and two other directors in protest over the company’s track record on executive pay.

Separately, ISS Governance Services recommended in its own report last week that investors vote to reelect all existing Yahoo board members. But ISS differed with Yahoo management on a nonbinding proposal to be put forward Friday, recommending to its base of institutional investors that they vote for the “pay for performance” plan that Yahoo management has opposed.