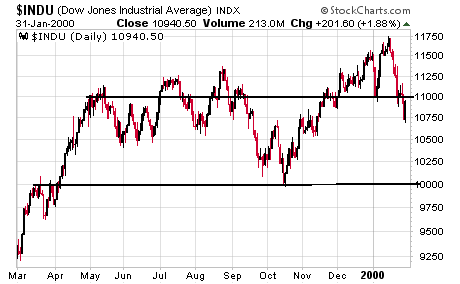

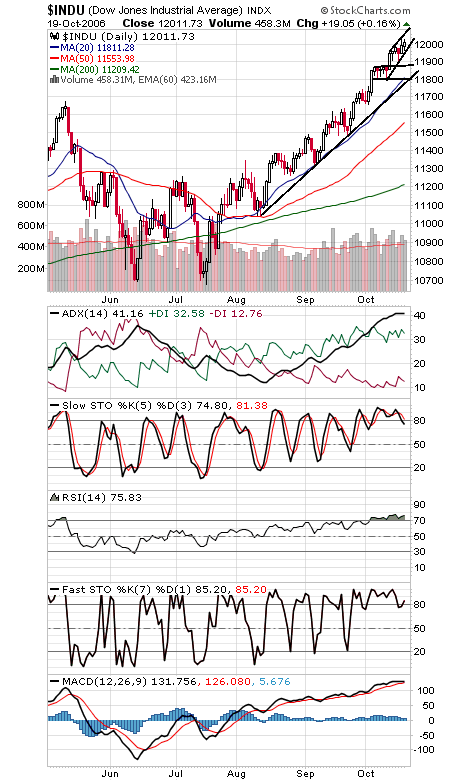

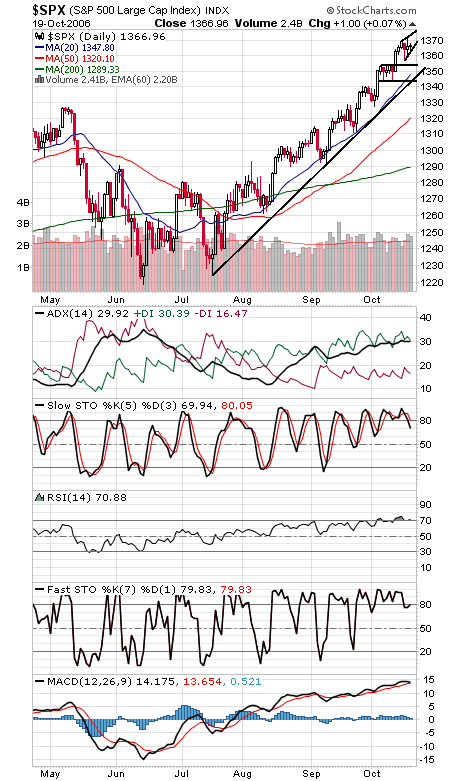

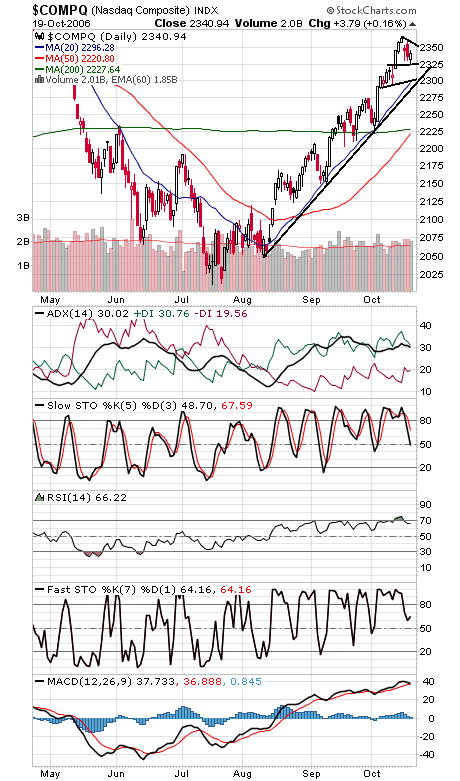

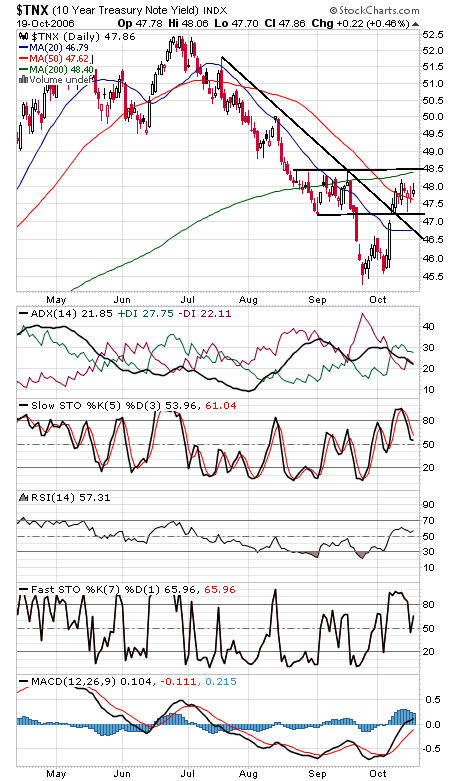

A record today, but an unimpressive one, with chips and financials down, but at least Transports were up. That could mean that the rest of the market will now play catch up to the Dow, but it’s just as likely that we’ll finally see a bit of a correction. The history of big round numbers and the Dow is an unimpressive one, with the index overextending to take out the big level and then struggling with it for some time (see first chart below). It took three weeks to take out 10,000 the first time back in March 1999, and 11,000 was even tougher. We’ll see how long it takes to get significant movement above 12,000. On the plus side, the market is entering the strongest part of the four-year cycle, but it sure could use a break before then. The Dow (second chart) faces first resistance at 12,050, while support is 11,975, 11,880 and 11,800. The S&P (second chart) faces tough resistance at 1376-1389, and support is 1365, 1360, 1354 and 1344. It’s worth noting that the Dow and S&P both put in “inside days” completely within yesterday’s range, a sign of indecision here. The Nasdaq (third chart) remains the laggard here. Resistance is 2354-2355, 2362-2364 and 2375, and support is 2323-2325 and 2290-2300. Bond yields (fourth chart) remain range-bound between 4.72 and 4.85.