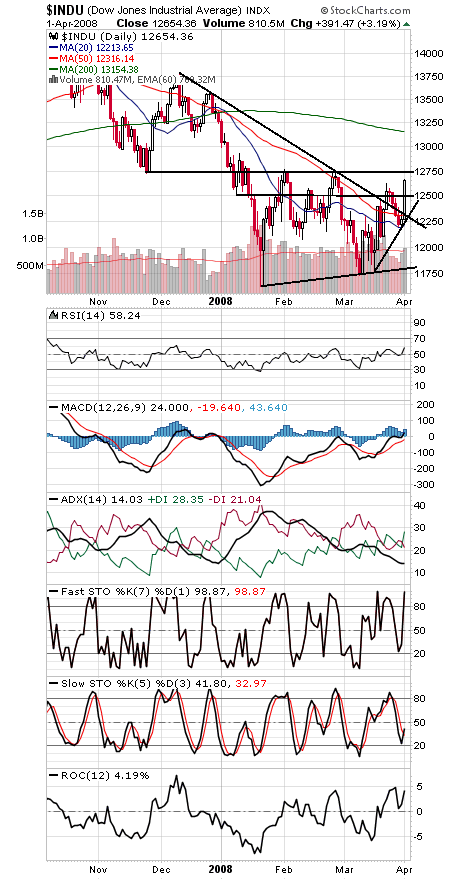

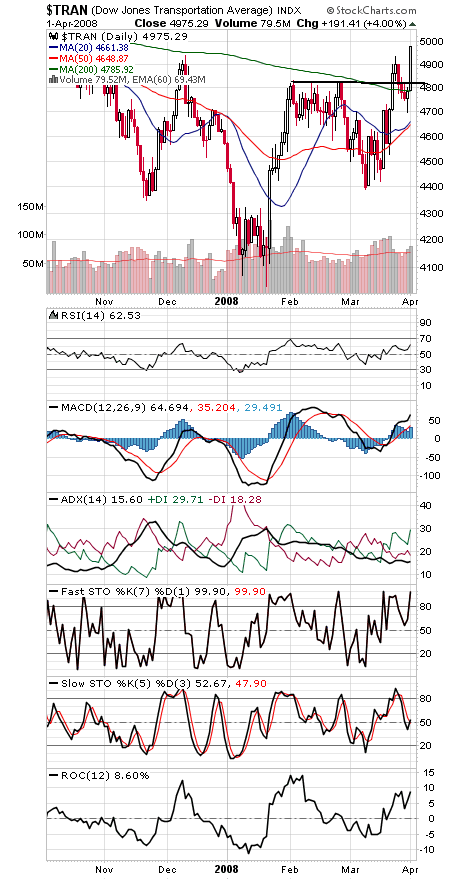

Just 88.84 points separate the Dow (first chart below) from its February high; a close of 12,743.2 or higher would confirm the Transports’ (second chart) close above its February high a week ago. That would generate a Dow Theory bull signal, reversing November’s bear signal, and suggest that the worst of the credit crunch may be behind us.

If the Dow can clear its February high, it could head to 13,000-13,150 before it hits serious resistance. Support on the index can be found at 12,500 and 12,300.

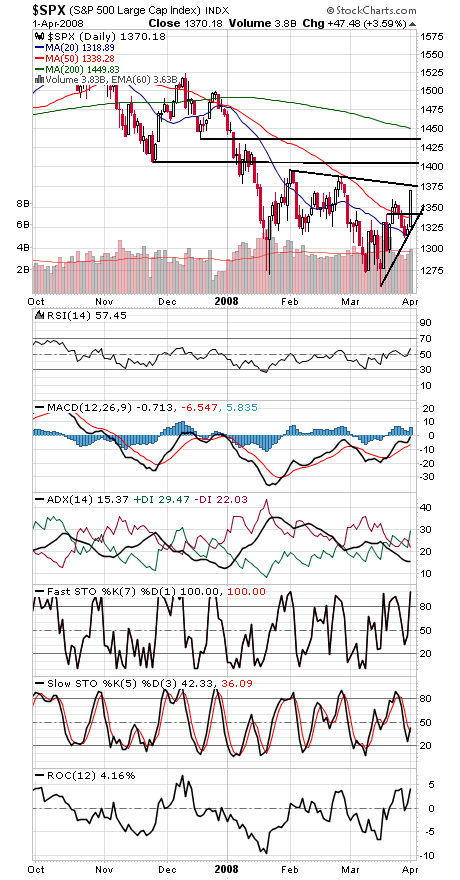

The S&P (third chart) needs to clear 1380 and 1406, and 1350, 1340 and 1330 are support.

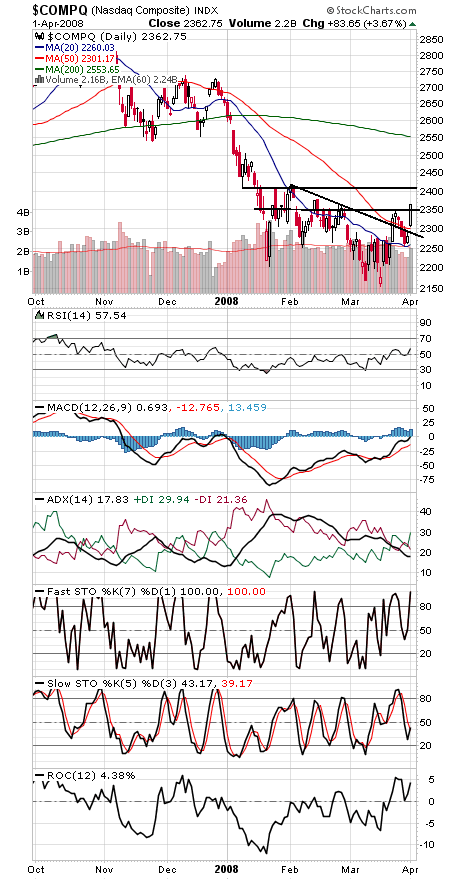

The Nasdaq (fourth chart) faces upside hurdles at 2387-2419, and 2285-2300 should now be strong support, with first support at 2325-2330.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.