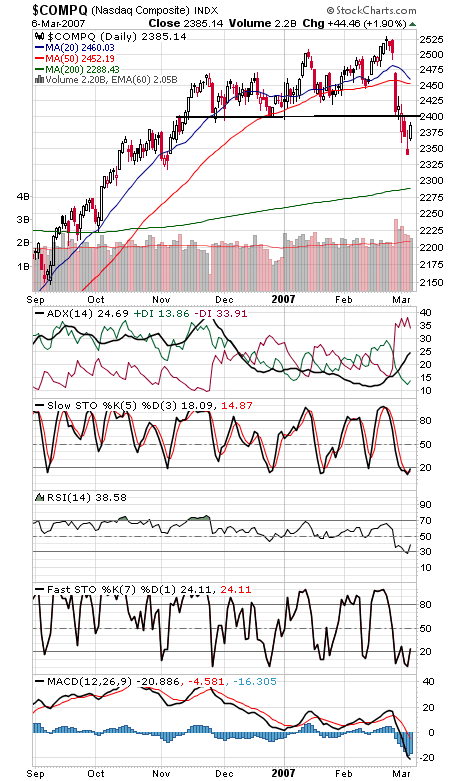

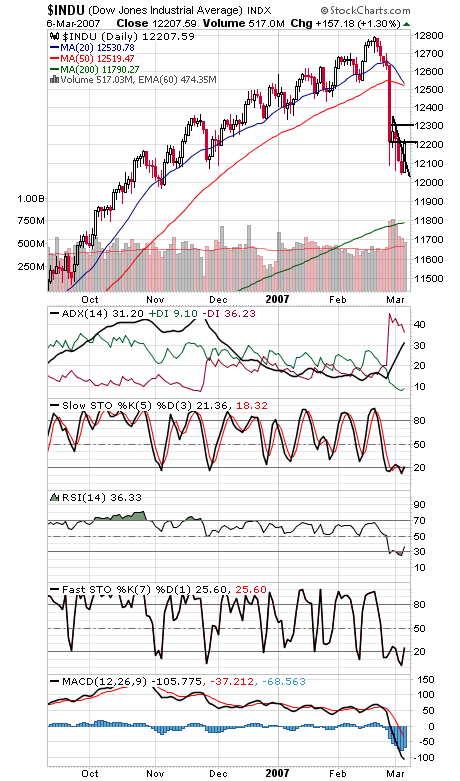

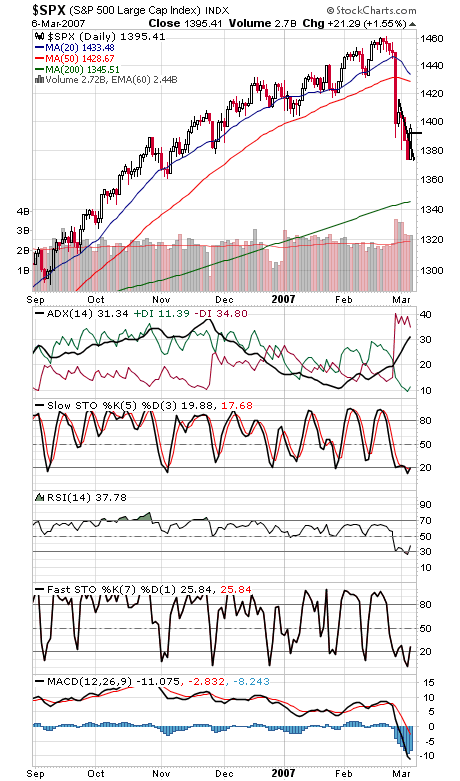

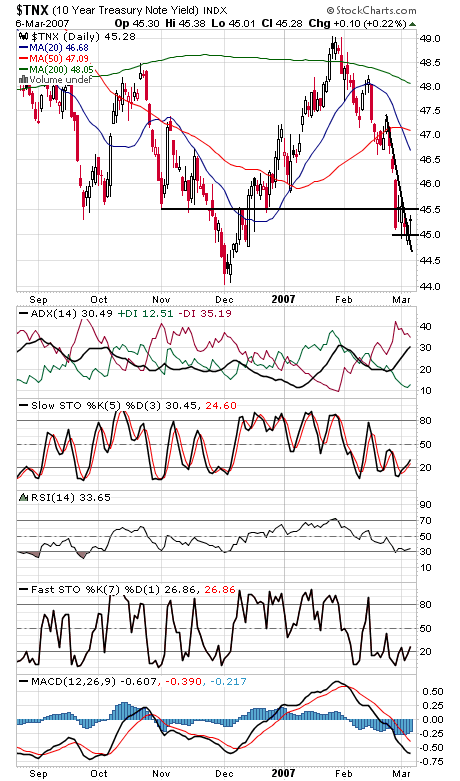

We’ve had an unusual — and potentially bullish — development in the market the last two days. After yesterday’s 90% downside volume day on the NYSE — the second in a week — we had a 90% upside volume day today on both the Nasdaq and NYSE. Such extremes in close proximity suggest that investors who panicked yesterday had a change of heart today; such washouts can be bullish, as Paul Desmond of Lowry’s Reports pointed out in an award-winning work a few years ago. To demonstrate, just take a look at the chart of the Nasdaq (first chart below) and see all the sellers stranded in yesterday’s small candlestick body who had to buy back at higher prices today. A pretty reversal there, but we still wouldn’t be surprised to see yesterday’s lows revisited and retested after a bounce, and preferably on lower volume and better internals. 2370 and 2361 are support on the Nasdaq, and 2390-2400 is first resistance. The Dow (second chart) has support at 12,186, 12,150, 12,130 and 12,100, and resistance is 12,225, 12,300 and 12,353. The S&P (third chart) has support at 1389-1392 and 1382, and first resistance is 1398-1402. The reversal in treasuries (fourth chart) was a little more tentative today.