As we noted on Friday, there were plenty of reasons for bears to be nervous here. That said, today was one of the ugliest 2% gains you’ll ever see, with breadth barely positive on the NYSE and negative on the Nasdaq. The 90% upside volume day that we were looking for for confirmation of a bottom will have to wait for another day.

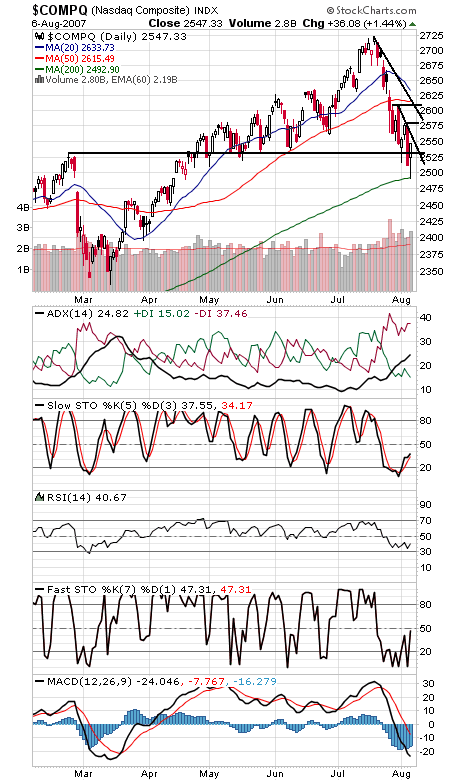

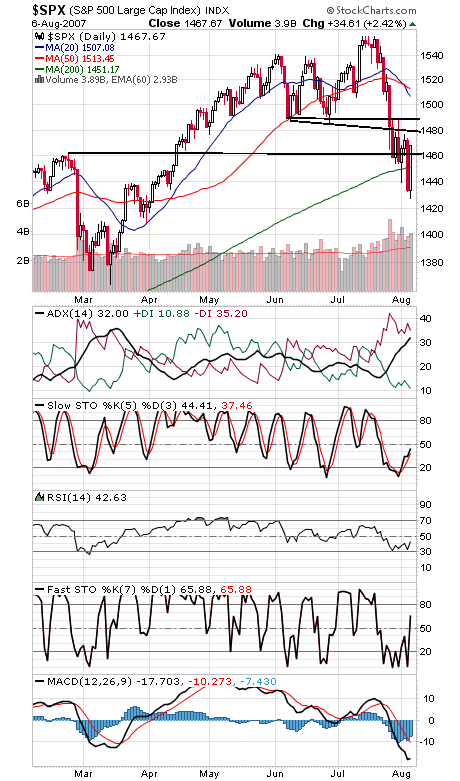

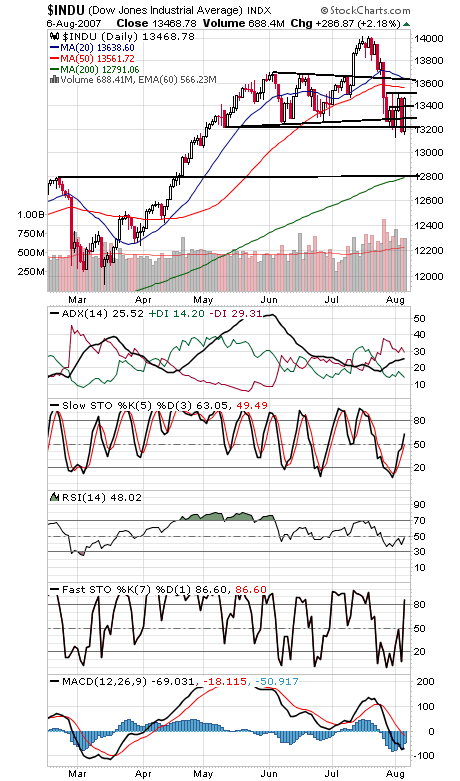

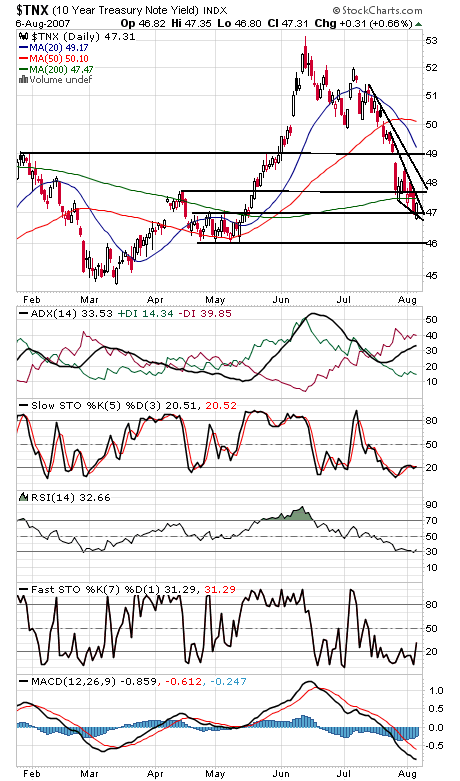

The Nasdaq’s 200-day average (first chart below) provided support today. 2531 is first support, and resistance is 2550, 2576 and 2607-2615. The S&P (second chart) has resistance at 1480 and 1488, and support is 1461 and 1451. The Dow (third chart) is the closest index to breaking out — a move above 13,520 would be a biggie, with 13,560 and 13,640 waiting above that. Support is 13,400 and 13,300. The 10-year yield (fourth chart) went a whole lot deeper than we thought it would — but that’s good fuel for stocks when it unwinds.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association