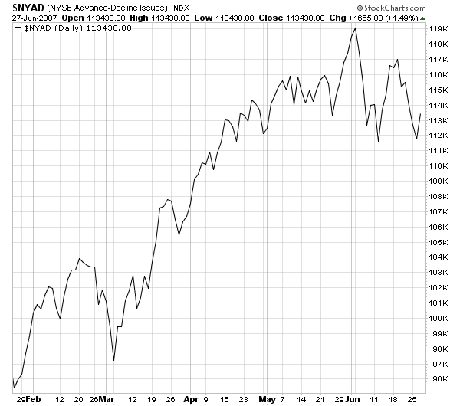

It was a little close for comfort, but the NYSE advance-decline line (first chart below) gave us the positive divergence we were hoping for, putting in a higher low as the major indexes retested their lows. One hint that the market might turn today was early strength in small caps and techs that had the NYSE advance-decline line positive while the Dow and S&P were still in the red. The market now has the positive end-of-the-month and pre-holiday cycles to get a rally started over the next week. There’s been enough of a washout for that to happen, and if the indexes can clear their recent highs, we could be headed significantly higher.

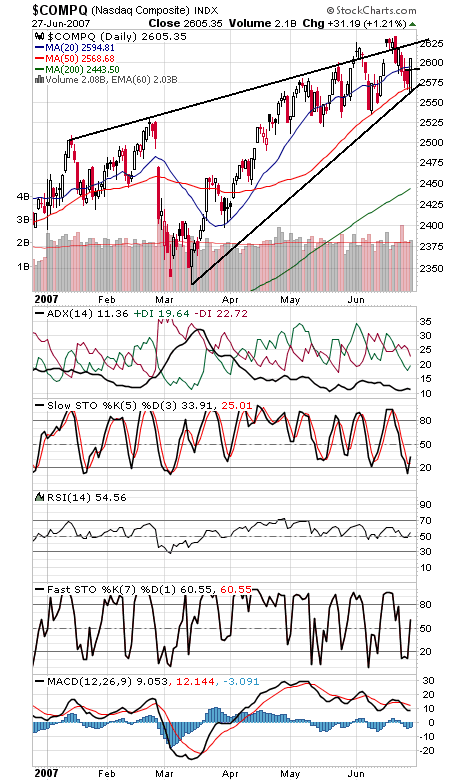

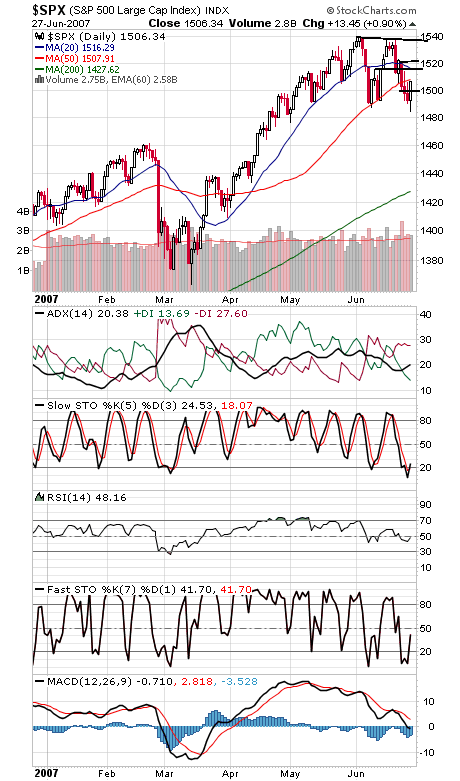

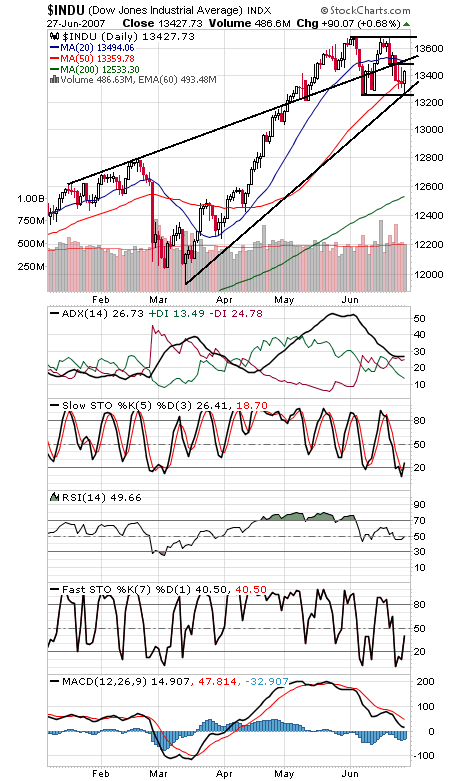

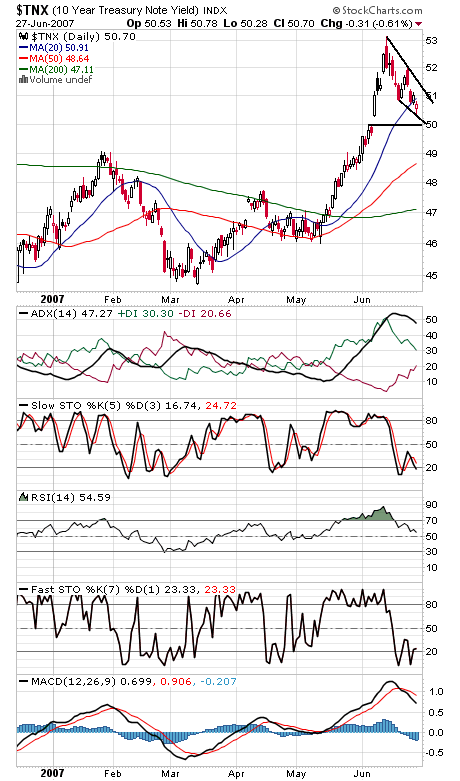

The Nasdaq (second chart) put in a strong turnaround today. Resistance is 2625 and 2635, and support is 2592-2595 and 2585. The S&P (third chart) has resistance at 1508, 1515 and 1521, and support is 1500 and 1495. The Dow (fourth chart) has resistance at 13,480-13,520, and support is 13,380. The 10-year yield (fifth chart) continues to drift lower, but 5.0% will likely prove tough.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association