A very nice bounce the last two days, setting records in financial stocks, but one critical element has been missing: upside volume.

With just 78% upside volume on the NYSE yesterday, and 71% today, we have yet to see the buying stampede that could cement a major bottom, either a single 90% upside day or back-to-back 80% upside days, per the work of Paul Desmond of Lowry’s Reports.

Until we get that, this looks more like rotation out of commodities and into financials. Given the market-friendly sentiment backdrop, however, even a bear market rally could carry a long way in this environment.

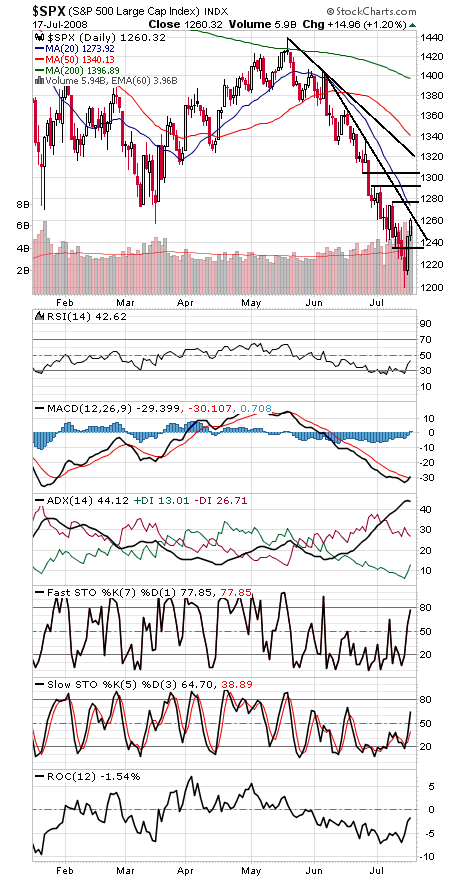

The S&P (first chart below) will open right at a downtrend line tomorrow — a move higher from here would be another point in the bull’s favor. Above 1262, 1277, 1292 and 1304 are next resistance. 1240 and 1234 are support.

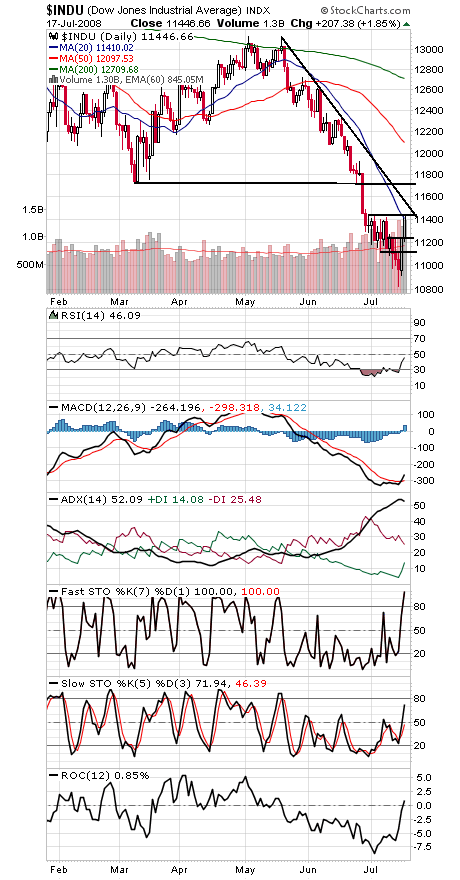

The Dow (second chart) faces major resistance at 11,520 and 11,634-11,750, and support is 11,200-11,240 and 11,123.

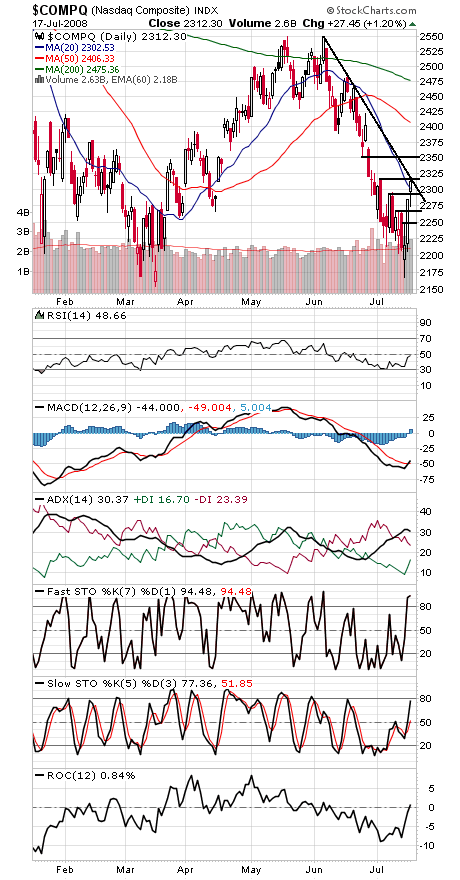

Quite a rally for tech stocks, but the Nasdaq (third chart) seems poised to give some of it back tomorrow. Support is 2300, 2267-2274 and 2250, and resistance is 2320-2329 and 2350.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.