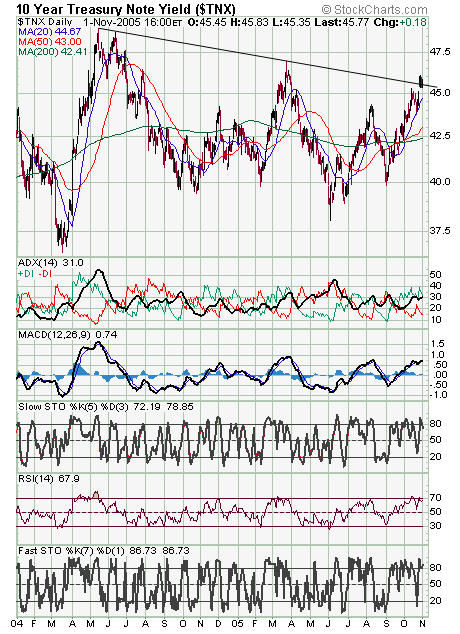

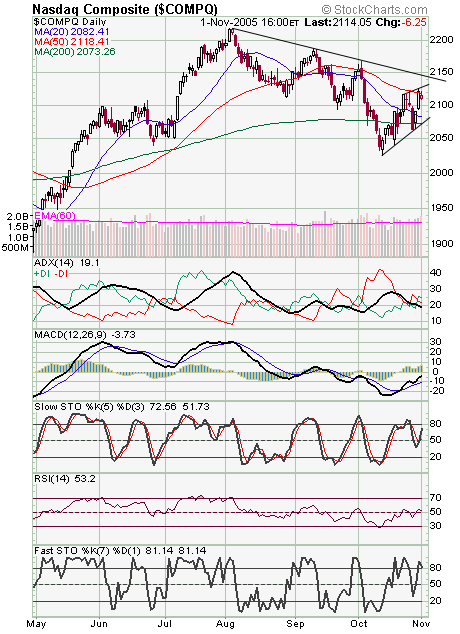

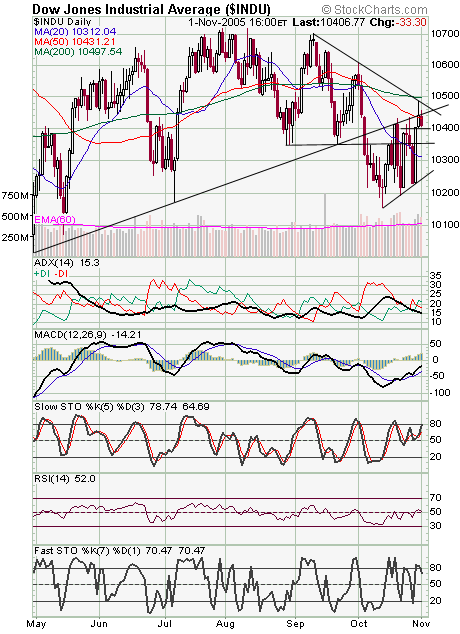

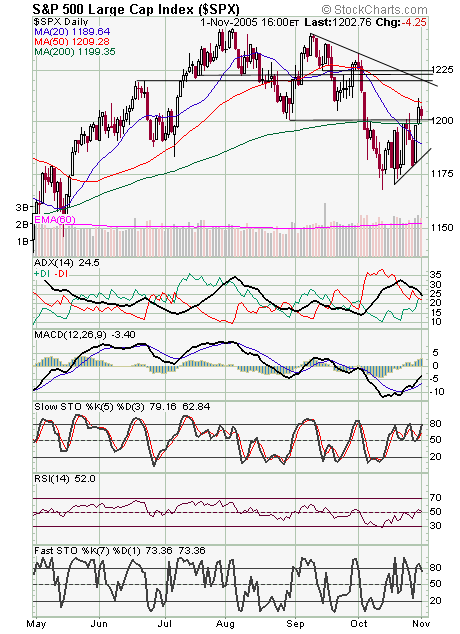

A slow day today, so we’ll focus on one of the most important developments in the market recently. Commercial traders, considered the “smart money” in the futures market, went long on the S&P 500 last week for the first time since 1998-1999. While their timing isn’t perfect, this is nonetheless an encouraging development for stock market bulls. The timing of any rally will have much to do with long-term interest rates (first chart below), which remain stubbornly uncooperative here. The Nasdaq (second chart) faces resistance at 2130 and 2145, and 2109, 2100, 2090-2094 and 2073 are support. The Dow (third chart) faces resistance at 10,445, 10,480 and 10,500, and support is 10,400 and 10,350. The S&P (fourth chart) faces resistance at 1209 and 1220, and 1199-1201 is important support.