After rallying through two years of Fed rate hikes and inflation fears, the market already seems convinced that the Fed can limit any economic weakness. The lack of fear of a recession is almost as amazing as the market’s unwavering faith in the Fed’s ability to control inflation. Are we really going to get through the weakest part of the four-year cycle without fear of inflation or a hard landing catching up with the markets? Time for a correction is running out; in a couple of weeks, the cycles will begin to turn positive, although four-year cycle lows have come as late as November or December. But one thing is clear about the history of mid-term year lows: they tend to hold for at least the following three years, with 1930 the last exception. So whatever the year’s low — at the moment, 10,683 on the Dow — it’s likely to last for some time as we head into the most positive part of the four-year cycle. Has the four-year cycle low already occurred? In a matter of days, the answer will become “likely.”

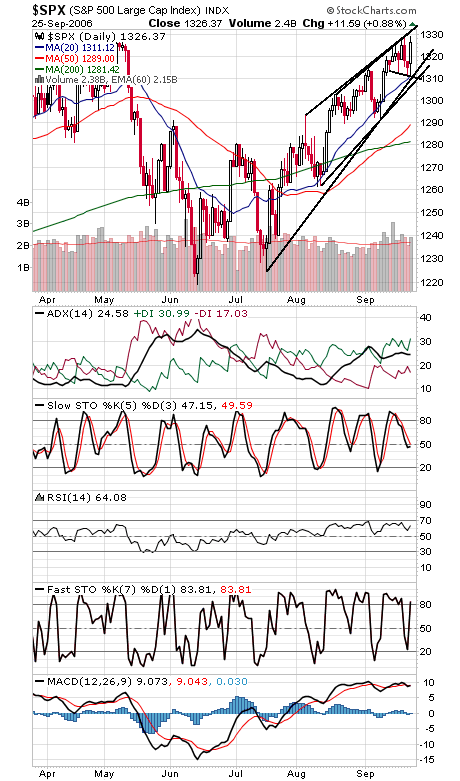

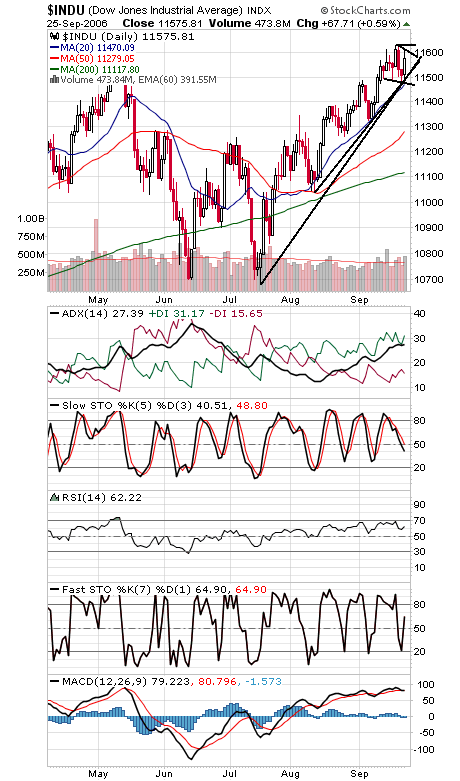

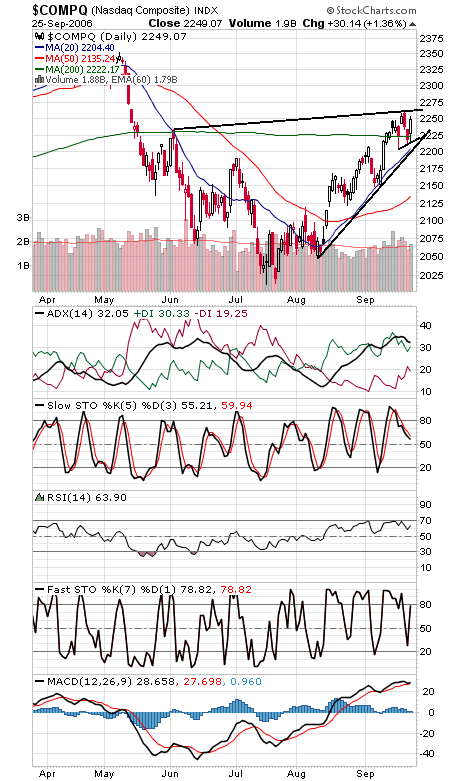

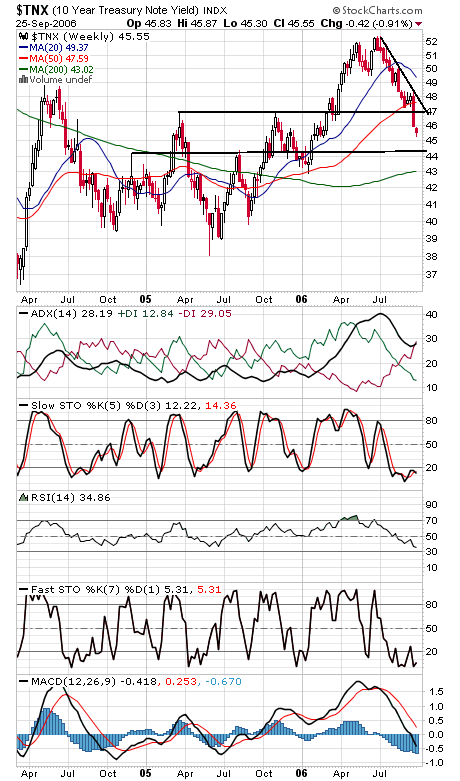

The S&P (first chart below) briefly hit a new multi-year high, but appears range-bound in a broadening pattern between 1310-1311 and 1332-1333. The Dow (second chart below) faces resistance at 11,610-11,630, 11,640-11,670 and 11,722-11,750, and 11,470-11,510 is critical support. The Nasdaq (third chart) has support at 2232, 2222, 2217 and 2205, and resistance is 2262. The only slowdown panic appearing in the markets has been in bond yields (fourth chart).