Despite some positives, like heavy selling that is more suggestive of a bottom than a top, the bulls just can’t get going here, squandering another opportunity today. On the plus side, monthly inflows should support the market for a few more days, but we otherwise will likely continue to get volatility until the market can cement a good bottom.

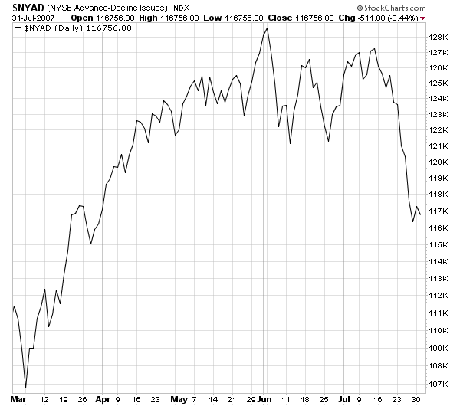

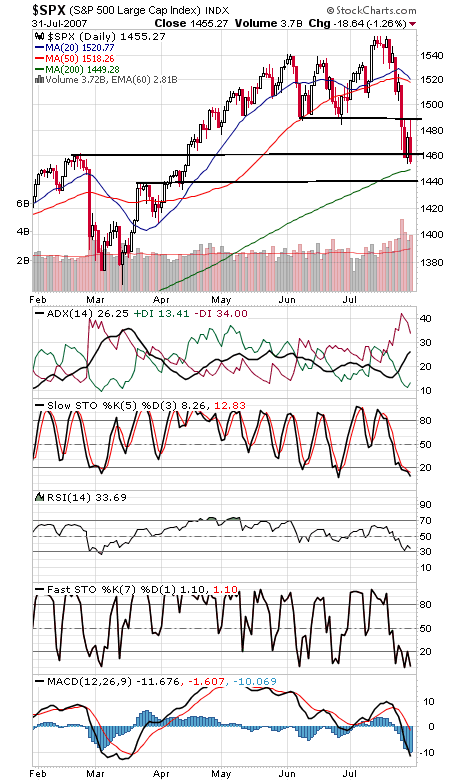

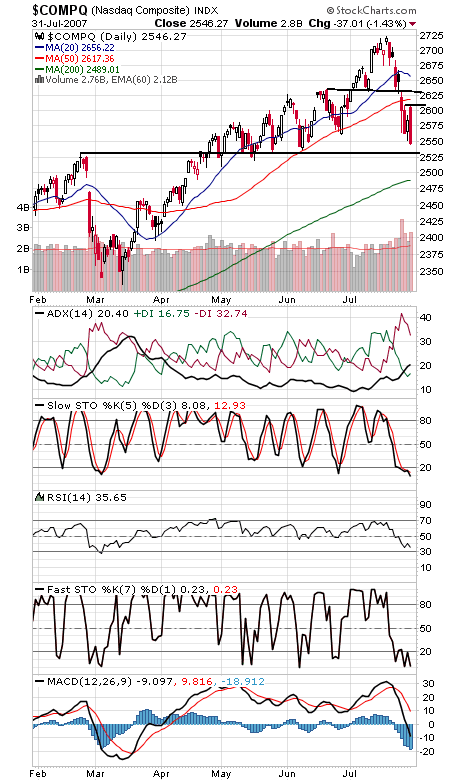

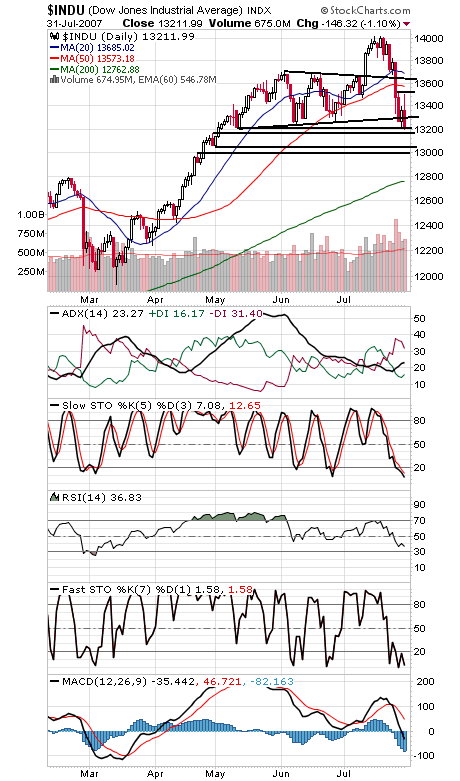

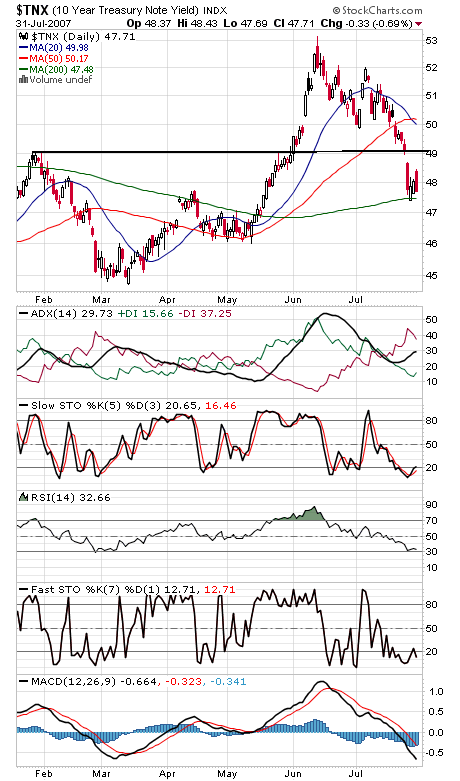

We’d note a mild positive divergence in the NYSE advance/decline line (first chart below), suggesting the possibility of stealth buying here. The S&P (second chart) has support at 1449 and 1439, and a move above 1488 would be a big win for the bulls. The Nasdaq (third chart) about says it all: opening at the highs and closing at the lows. If that doesn’t shake out some weak longs, nothing will. 2531 is important first support, and resistance is 2607-2617 and 2632. The Dow (fourth chart) has support at 13,162, 13,138 and 13,000, and resistance is 13,250-13,310, 13,400 and 13,500-13,520. Bond yields (fifth chart) continue to benefit from flight to quality, but that has been no help for stocks yet.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association