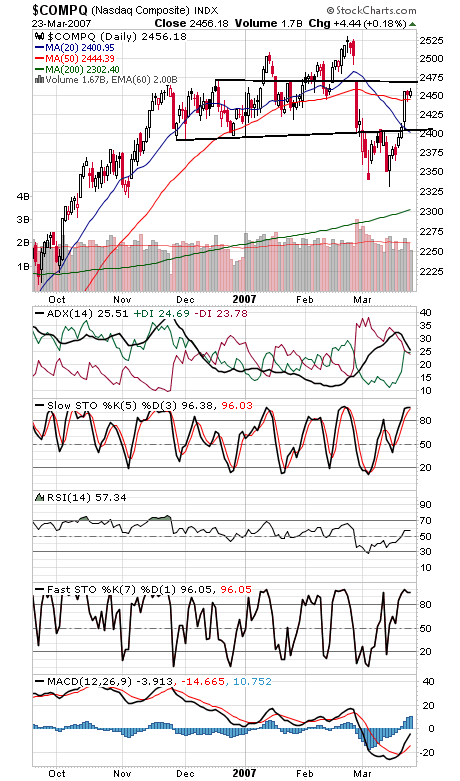

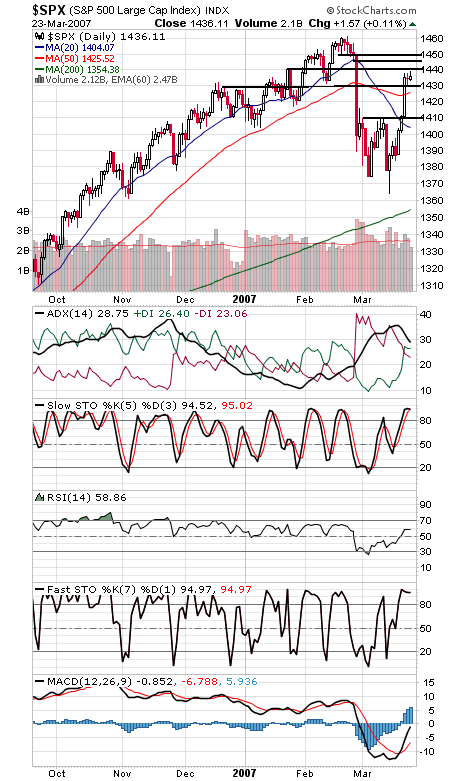

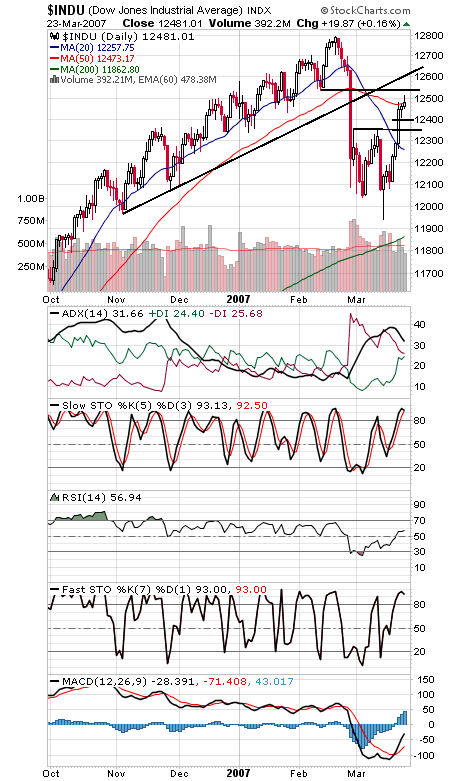

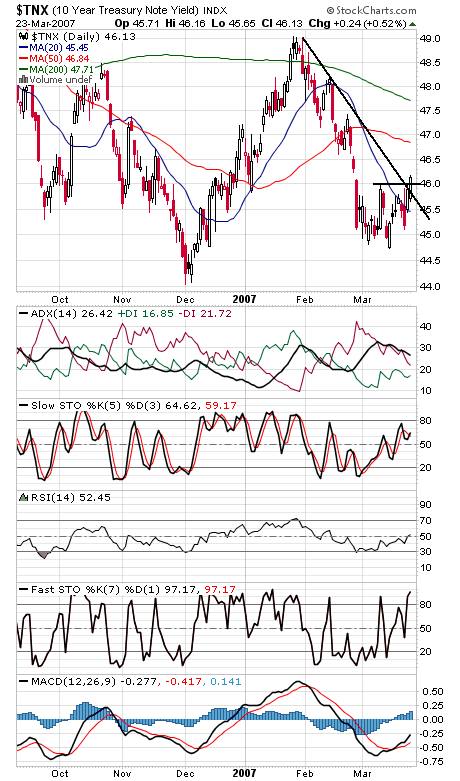

Stocks continue to hold up nicely, and an additional point in favor of the bulls is that commercial futures traders made a big move toward the long side on the big Nasdaq and S&P contracts this week. Those moves occurred by Tuesday, just before Wednesday’s big rally; perhaps the CFTC will someday publish those reports on a more timely basis. This pullback sure looks a lot like last summer’s in a lot of ways: a sharp break, a base followed by a rally, a lot of bearish sentiment and strong buying by the commercials. That said, the rally since mid-March looks like it’s near five complete waves — three moves up interspersed with two waves down or sideways — so we could be due for a pullback soon. Still, with end of the month buying right around the corner, the market could continue to surprise to the upside. The Nasdaq (first chart below) has support at 2440-2445 and 2432, and resistance is 2471. The S&P (second chart) faces resistance at 1440, 1445 and 1450, and support is 2430 and 2426. The Dow (third chart) managed to close above its 50-day average today. 12,550 and 12,600 are next, and support is 12,450, 12,400 and 12,350. Bond yields (fourth chart) had a big breakout today on the housing numbers.