The bears are overcoming a lot of historical strengths, not the least of which is the usual strength of stocks in presidential election years and 10-year bearish extremes in sentiment measures like the weekly Investors Intelligence survey, which today matched its March lows of 45-32 bears-bulls.

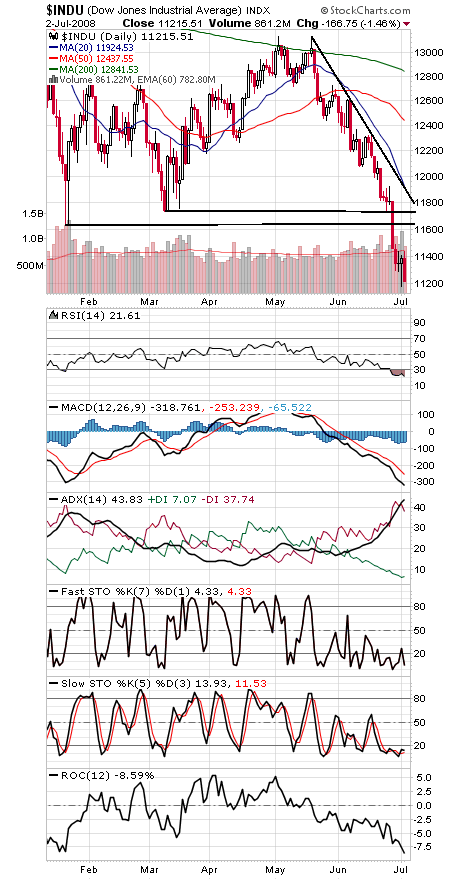

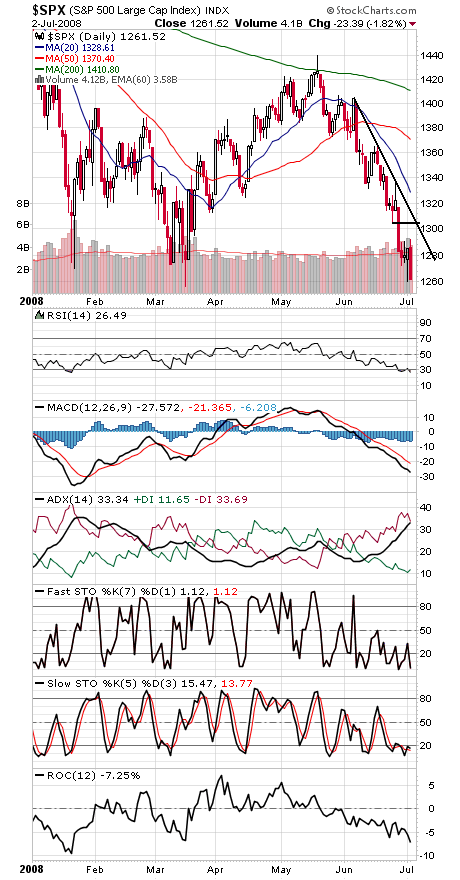

In the short-term, we’d note a couple of minor positives here: the Dow and S&P (first two charts below) did not set a new low today, and new highs and new lows improved dramatically on both exchanges today, a hint that downside momentum is waning in at least some stocks. And the Dow has reached deeply oversold territory for the first time since the January lows.

If 1257 goes on the S&P, the 2006 lows of 1219-1236 are likely to hold, as is 10,683-10,739, the Dow’s 2006 low. Mid-term election year lows have held for at least a few years going back to 1934, and we’re not yet ready to concede that it’s 1930 again.

To the upside, the Dow must clear 11,434-11,500 and 11,634-11,750, and the S&P needs to get back above 1292-1304.

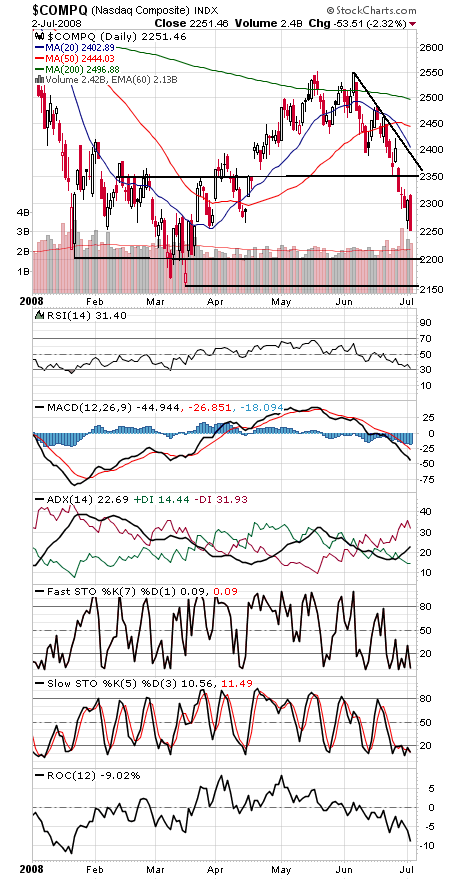

Below 2250, the next support levels for the Nasdaq (third chart) are 2200 and 2155. To the upside, 2317-2330 and 2350 would be a start.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.