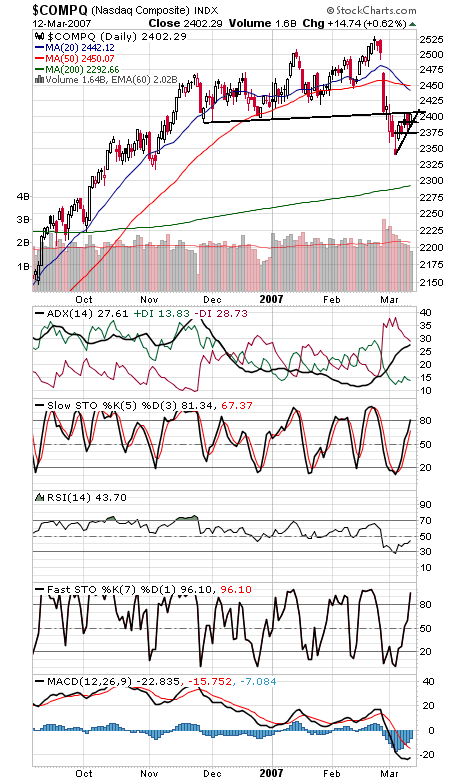

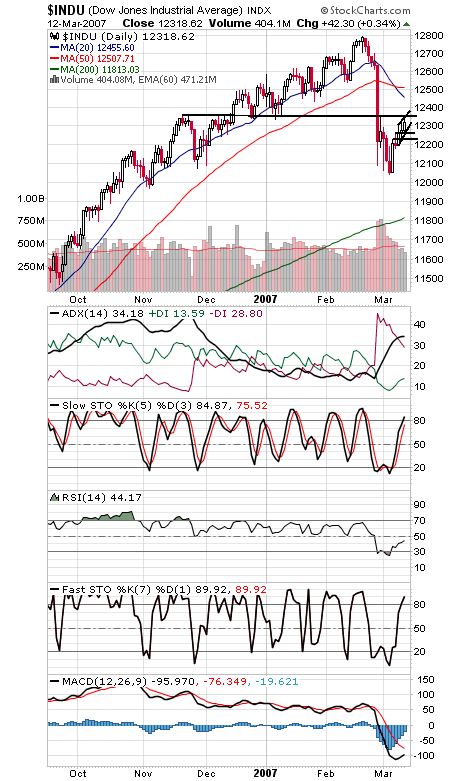

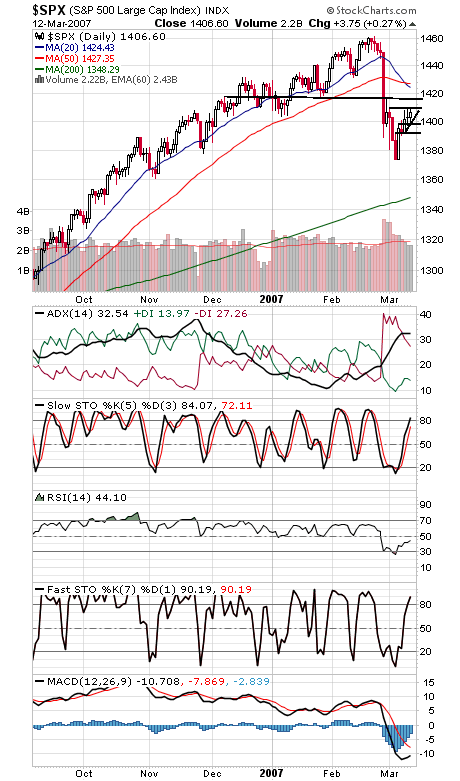

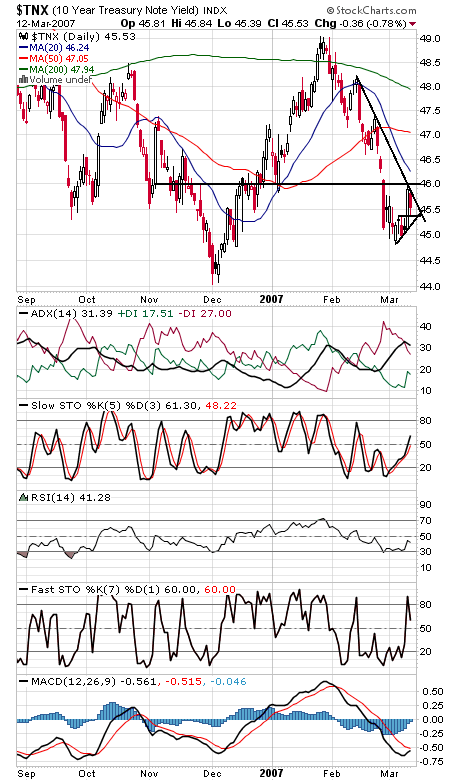

It doesn’t matter whether it’s the CBOE put-call ratio or the ISE sentiment index: there are entirely too many puts out there to get too bearish on the market here. Coupled with last week’s 90-90 reversal on the NYSE, significant downside appears unlikely from here, although a retest of the lows may still lie ahead. The Nasdaq (first chart below) is consolidating at the highs of this run, one pattern that suggests the current rally may have some more upside to it, but first it will have to clear tough resistance at about 2405. Support is 2490 and 2375. The Dow (second chart) was stopped once again at 12,350, and above that lies 12,386. Support is 12,250-12,270 and 12,230. The S&P (third chart) faces resistance at 1410, 1416 and 1418, and 1400-1401, 1397 and 1391 are support. Treasury yields (fourth chart) are running into a little resistance here. Keep an eye on inflation data on Thursday and Friday.