Well, bears may not have much time until monthly inflows kick in later this week, but they’re certainly making the most of what they have. There’s lots of economic data beginning Thursday — GDP, PCE inflation and Chicago PMI, to name a few — plus Dell’s earnings Thursday night and a now much-anticipated speech by Ben Bernanke on Friday. Fasten your seatbelts — with any luck, the bulls will have enough good news to make the most of the new money coming into the market later this week, plus pre-holiday periods tend to be positive too.

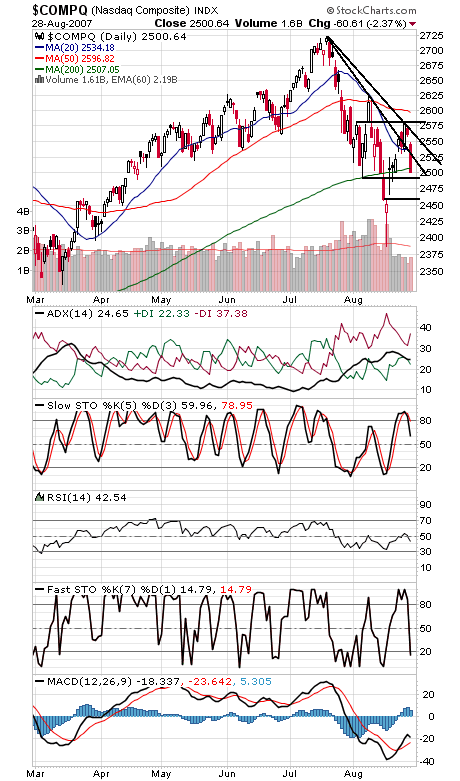

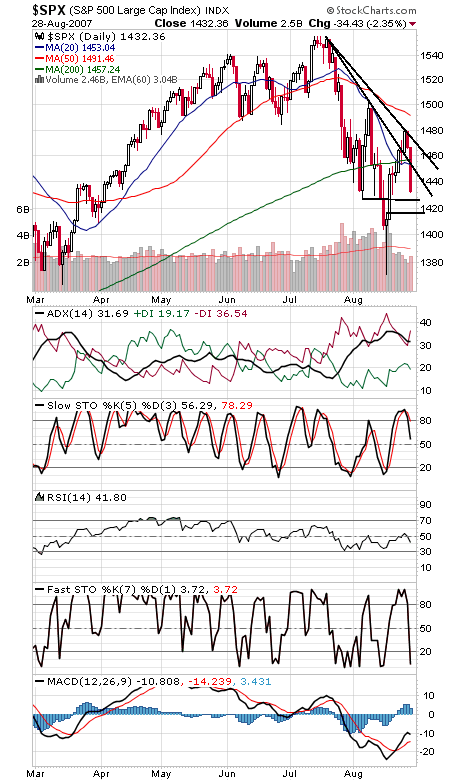

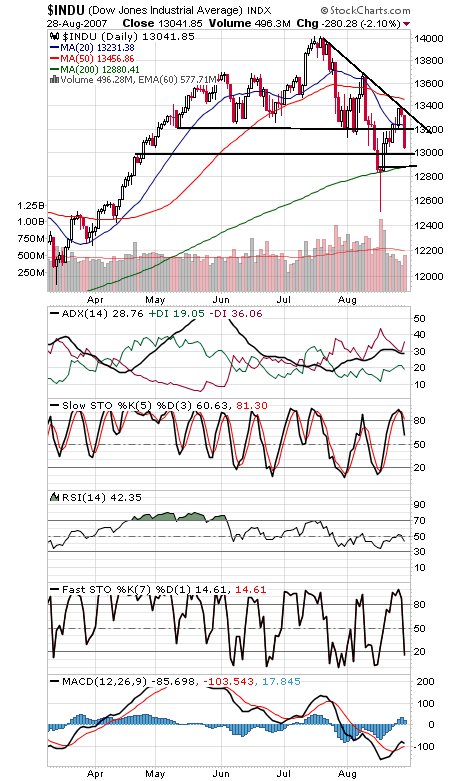

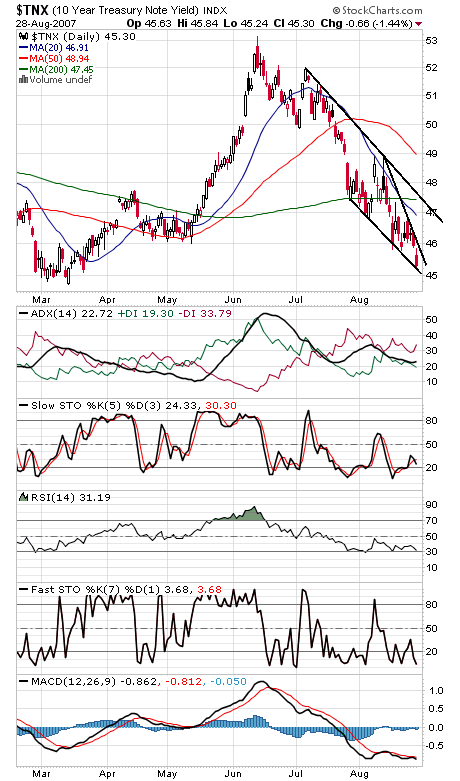

Today’s action was strong enough to send the Nasdaq and S&P (first two charts below) crashing back through their downtrends cleared just two days ago. That makes 2525 and 1450-1457 first resistance. Next support levels are 2490 and 2460-2466 for the Nasdaq and 1427 and 1416 for the S&P. The Dow (third chart) has support at 13,000 and 12,850-12,890, and 13,200 and 13,340 are the levels to beat to the upside. Bond bulls (fourth chart) were proved right again today. No sign of reversal there yet.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association