Today was a 90% upside volume day on the NYSE and Nasdaq, a potential “all clear” signal for the bulls following three 90% downside days in the last month, per the work of Paul Desmond of Lowry’s Reports. 90% downside days can be signs of sellers running out of steam as investors throw in the towel, and a 90% upside day following such heavy selling suggests that investors who sold too late are panicking and jumping back in. Such action can cement bottoms, as has happened on several occasions in recent years.

We still have another day or two of potential confessions from financial companies, and Thursday is the deadline for hedge fund withdrawals, so the next few days could still be rocky.

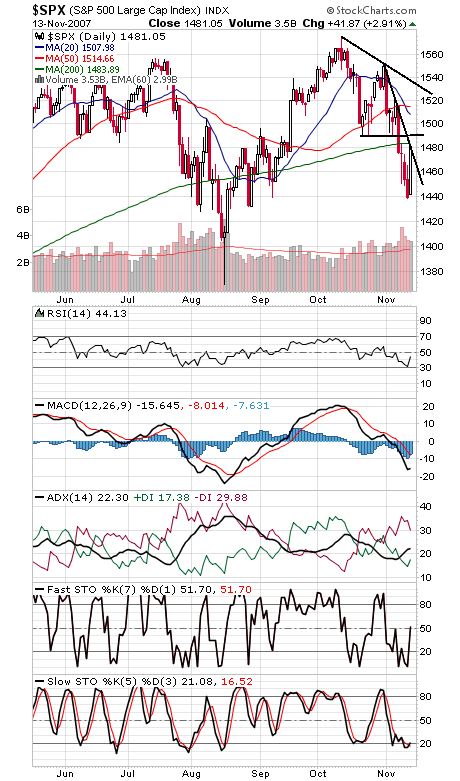

The biggest hurdle for the market is just ahead, the 1484-1491 zone on the S&P 500 (see chart below). If the index can clear that level, it will be another data point in favor of a bottom here. To the downside, 1474, 1472, 1464 and 1458-1461 are support.

We may get a year-end rally yet.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.