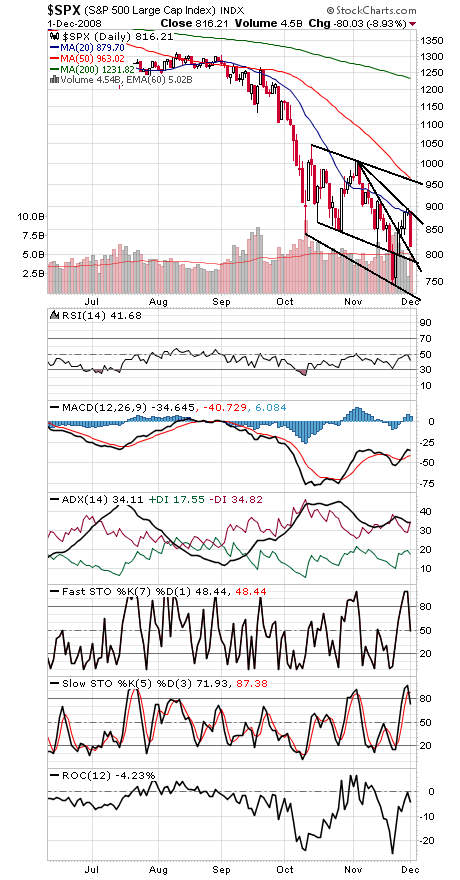

Today’s action is certainly disappointing after the strides made by the bulls last week. About the only good news is that the recent rally seemed to be met with a lot of skepticism — at least there didn’t seem to be a whole lot of major bottom calls — so perhaps any work that must be done on the downside will be somewhat limited.

The S&P (first chart below) didn’t even make it to the top of the trading range at around 950 before getting slammed. Support is 785-800, 768-775 and 741-750, while a move above 880-900 would look good for the bulls’ case.

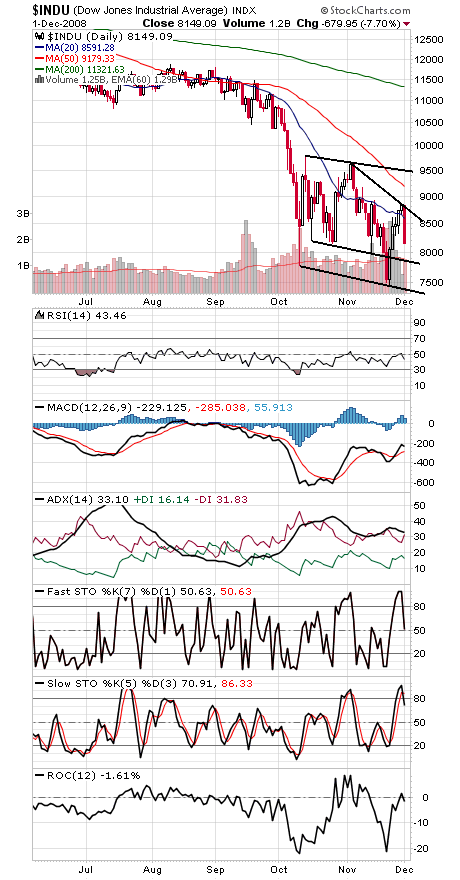

The Dow (second chart) has support at 7850-8000 and then 7400-7500. To the upside, a move above 8700-8831 could suggest that another wave up has begun.

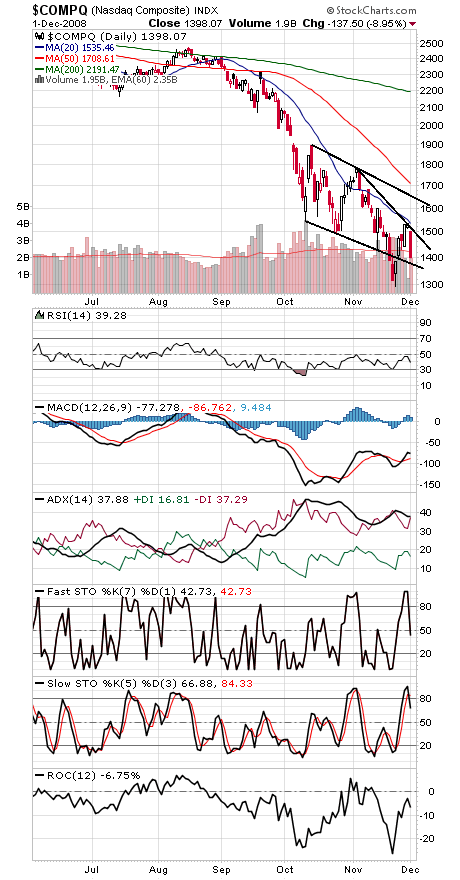

The Nasdaq (third chart) needs to hold 1370 or it could revisit 1300. To the upside, 1500-1535 is the level to beat.

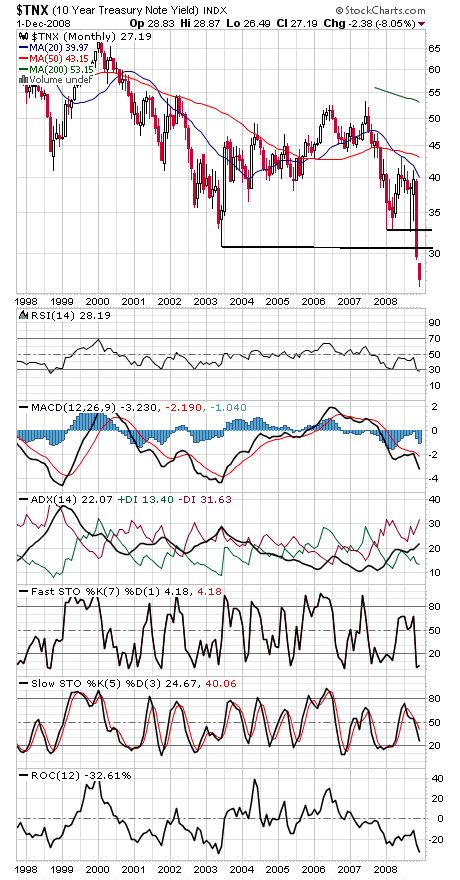

And finally, a stunning rally in treasuries (fourth chart) to the lowest level since the mid-1950s. How much lower is anyone’s guess, but certainly those flight-to-safety positions will need to unwind for stocks to find lasting support.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.