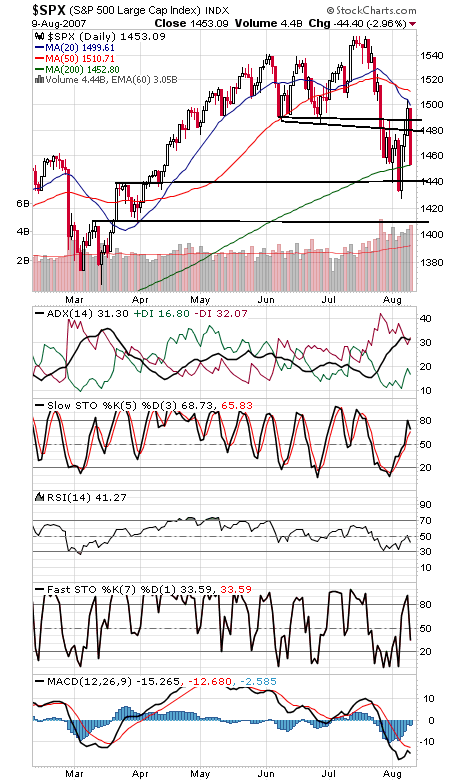

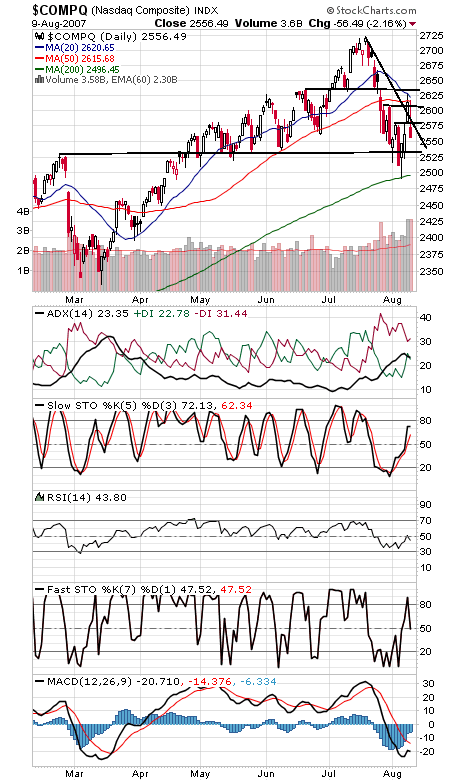

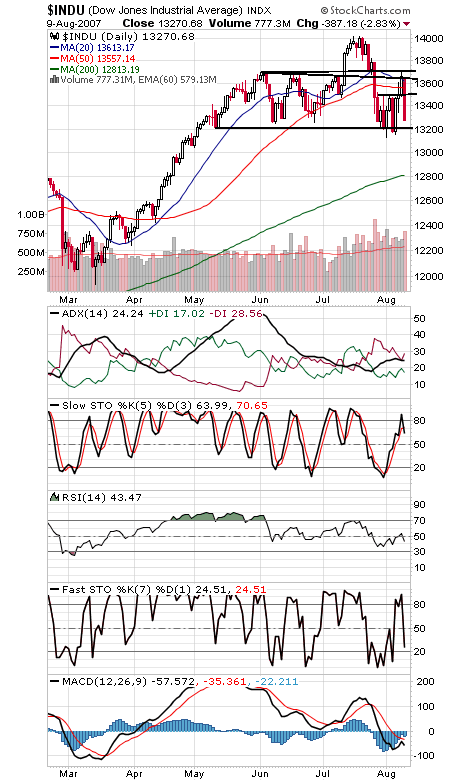

So much for pre-presidential election years being the strongest of the four-year cycle, as only the Dow has beaten T-bills so far this year. Today highlighted one risk we’ve talked about in the last couple of weeks: without a 90% upside volume day to confirm that sellers have been exhausted, the market remains vulnerable, despite all the positive data points supporting the bulls here. That said, the door remains open if sellers can step in and cement a bottom. Until we get that confirmation, the area around the S&P’s 2000 peak will likely continue to give the market trouble.

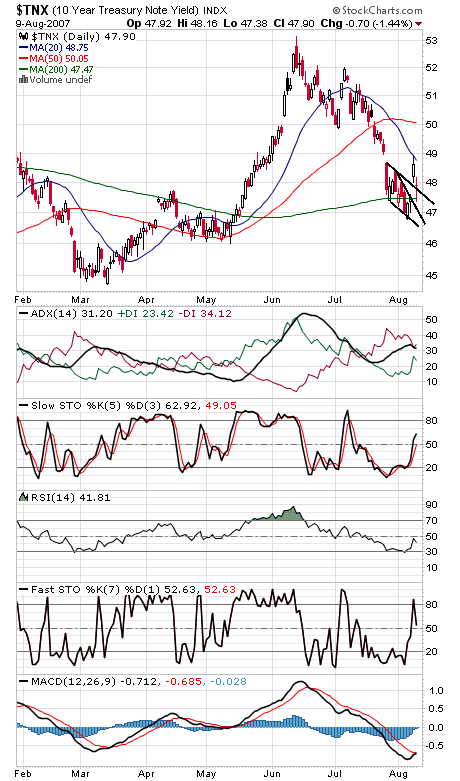

The S&P (first chart below) gave up yesterday’s breakout on the open and headed lower from there. The index is sitting right on its 50-day average, with 1440, 1427 and 1410 the next supports below that, and 1480-1488 is once again resistance. Next support for the Nasdaq (second chart) is 2531, with 2500 below that, and resistance is 2570-2580, 2607-2615, and 2631. The Dow (third chart) has support at 13,200 and 13,132, and resistance is 13,500-13,520, 13,552, 13,640 and 13,700. The 10-year yield (fourth chart) got a little flight to quality today, but not enough to reverse a short-term uptrend.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association