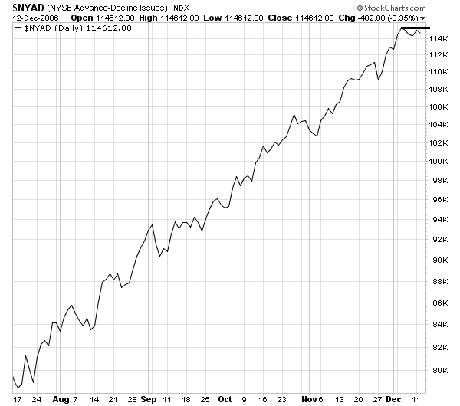

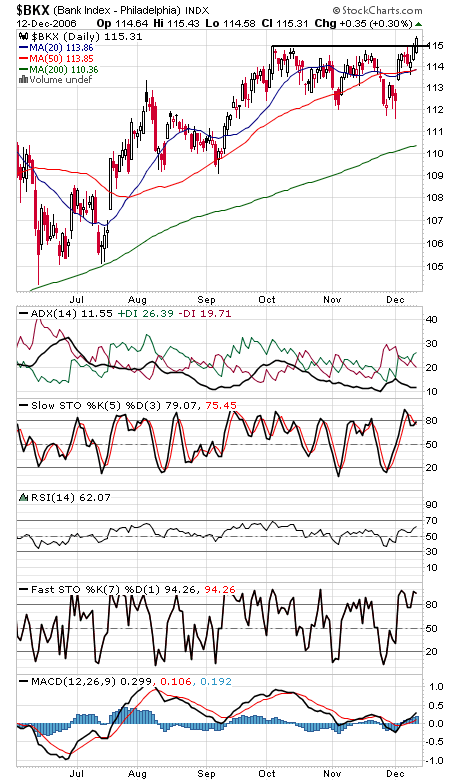

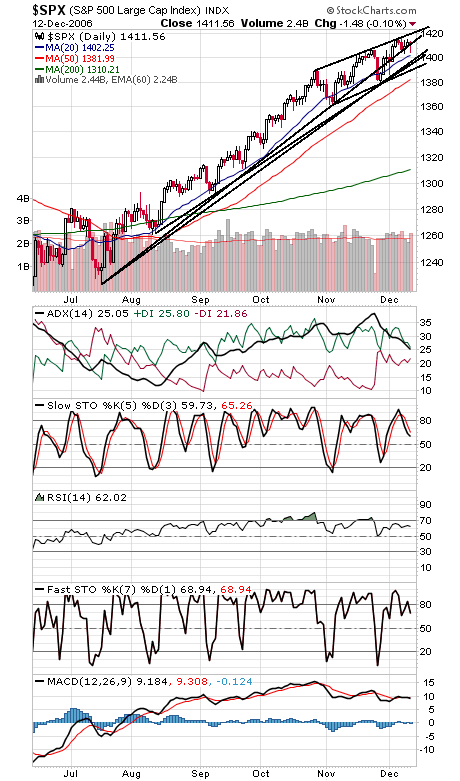

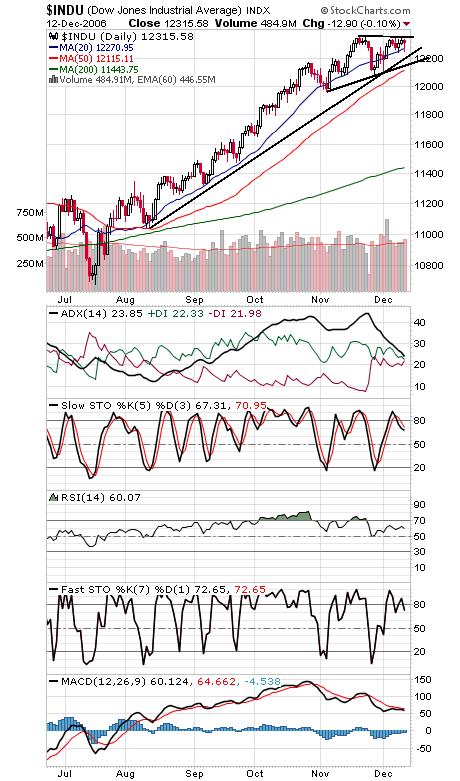

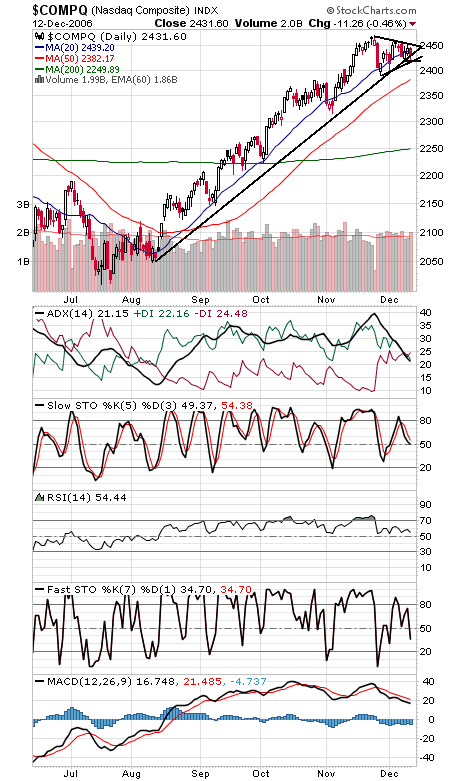

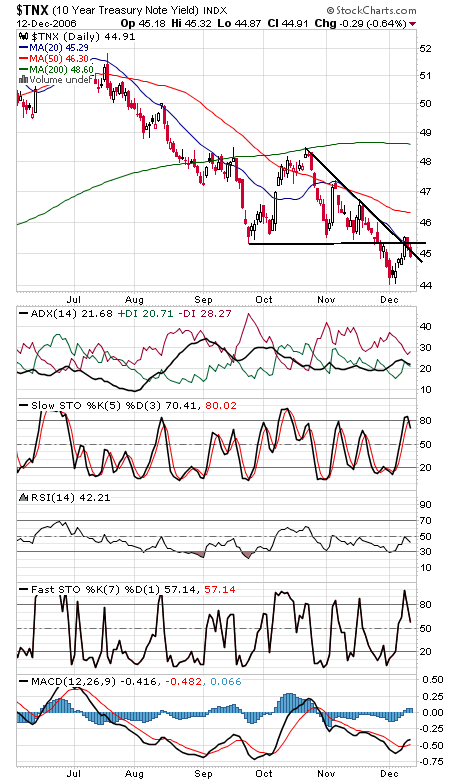

Downside remains tough to come by, suggesting that the next move for the market may be up. The NYSE advance-decline (first chart below) is showing a modest negative divergence here, but with the bank stocks (second chart) breaking out of a two-month consolidation, it may not last. We continue to focus on the S&P (third chart), which remains constructive-looking. Resistance is 1421, and support is 1404, 1400, 1398, 1396 and 1392. The Dow (fourth chart) remains stuck at 12,355-12,361 resistance, and support is 12,240-12,250, 12,210 and 12,150. The Nasdaq (fifth chart) remains weak and underperforming, the one sign of potential trouble for the market. 2450 is resistance, and 2419-2420 is support. Bond yields (fourth chart) are looking constructive again after today’s Fed announcement.