The U.S. dollar has stopped falling, oil is going down and financial stocks are outperforming, yet the stock market continues to fall, as the focus has shifted from the credit crunch to inflation and recession overnight. In short, the bulls just can’t catch a break here.

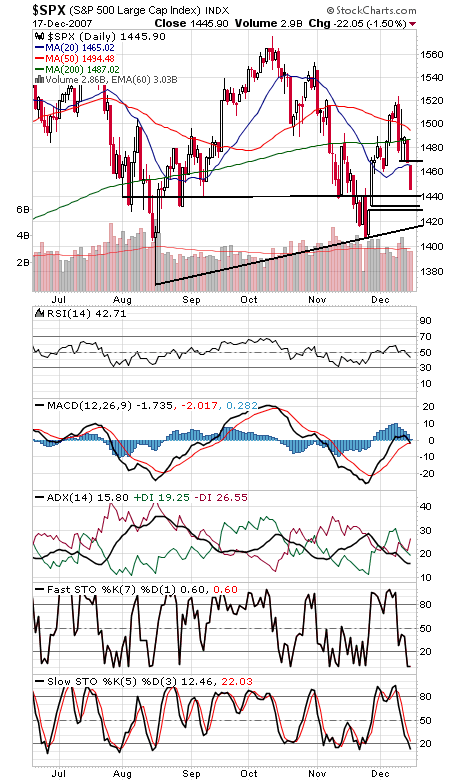

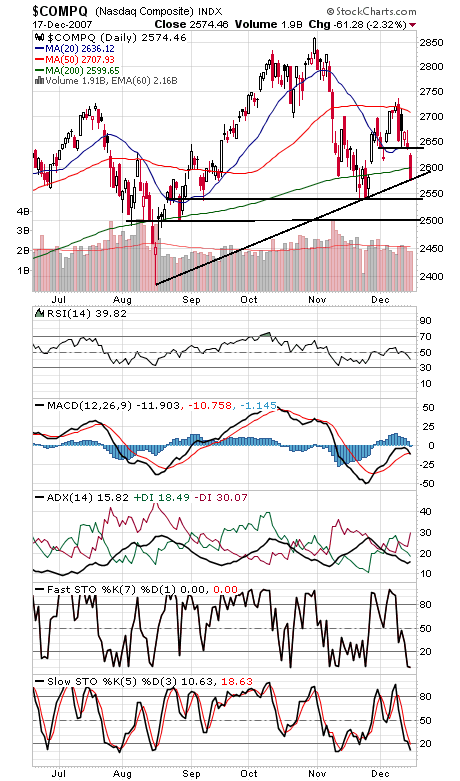

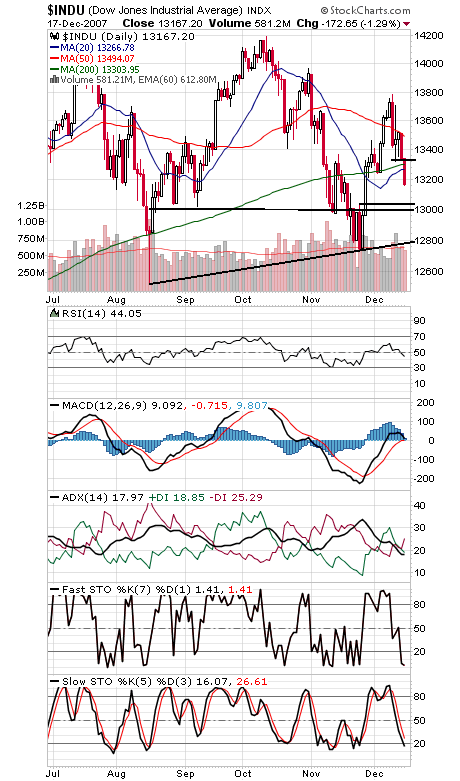

The major indexes (see charts below) were less than inspiring today, looking more like breakaway gaps that could see some follow-through selling. A year-end rally next week could provide some relief, but weakness at a seasonally strong time of year in the face of Fed rate cuts sounds a little more like 2000-2001 than we’d prefer.

The S&P has support here at 1445, with 1440, 1428-1432, 1416 and 1406 below that. To the upside, 1465-1468 would be a good start.

The Nasdaq ended the day right on a major trendline, with 2540 and 2500 the next support levels down from here. Resistance is 2600 and 2623-2635. It looks like the tech sector and other cyclicals are leading the way lower here, a sign of a potential slowdown.

The Dow has support at 13,000-13,020, and resistance is 13,266-13,320.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.