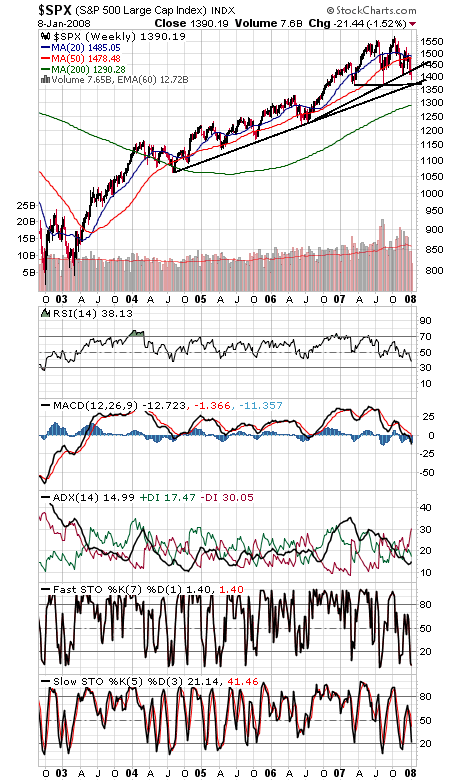

Not much new to add from last Friday: the bears are still in charge, the Fed remains out of touch, and the last chance for the bulls remains 1360-1370 on the S&P, about 2% lower from here (see first chart below).

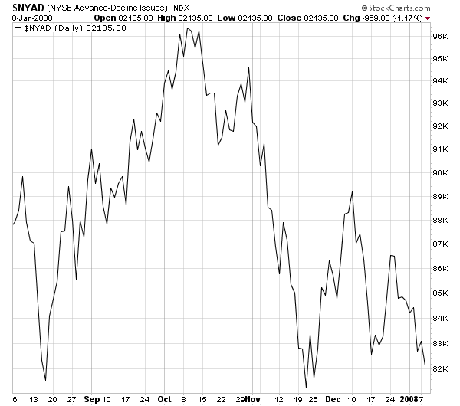

All isn’t lost quite yet, however. The NYSE advance-decline line (second chart) remains above its November and August lows, a sign that downside momentum could be waning, and the CBOE equity put-call index showed quite a spike today, a sign of fear by investors. But time is clearly running out for the bulls — and the economy. It would take a move above 1430-1440 on the S&P for the bullish case to begin to reassert itself.

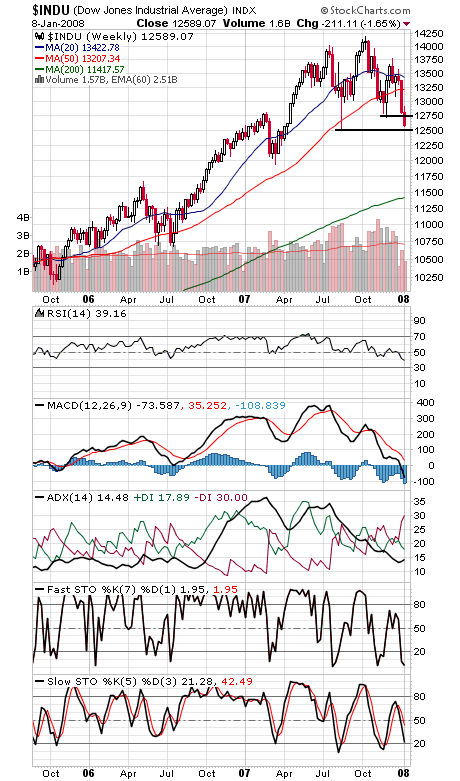

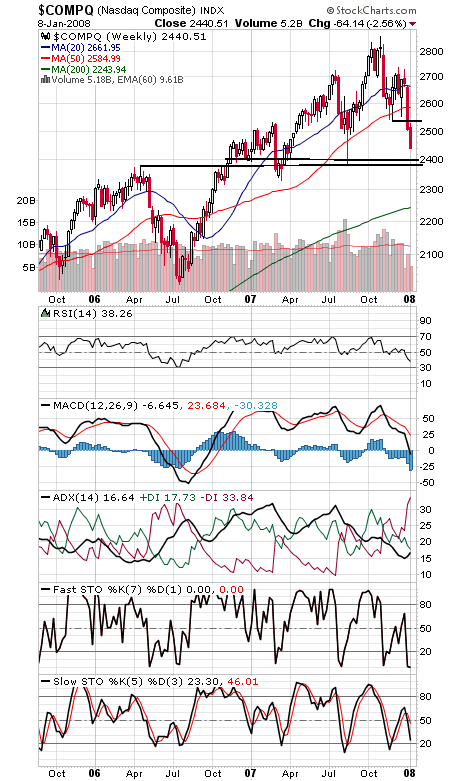

The Dow (third chart) is also running out of room here, with 12,500 a critical level, and the Nasdaq (fourth chart) needs to hold 2386-2400. To the upside, 12,724-12,748 and 2540-2554 would be a good start.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.