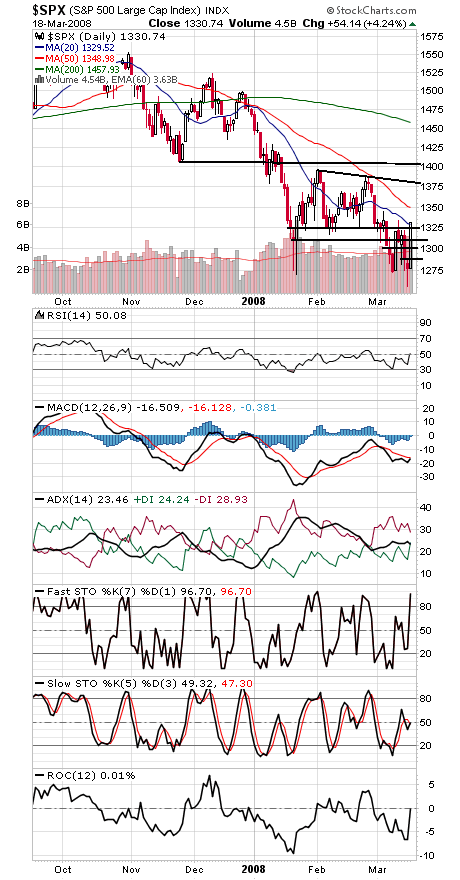

As we said last Friday in the midst of the Bear Stearns implosion: “at the first sign the world isn’t going to come to an end, we could get a heck of a rally.” We got that today from Lehman Brothers, and stocks responded with a powerful upside move.

We’ve had a cathartic sell-off with extreme bearishness followed by a powerful upside reversal: if the bulls can’t make this one stick, they should probably throw in the towel.

In the short-term, we could get a pullback after today’s action, but at this point, the lows have held on multiple tests and shouldn’t be seen again if we’ve begun a new uptrend.

The S&P 500 (first chart) has support at 1310, 1300 and 1287, and resistance is 1350, 1370-1380, and 1396-1406.

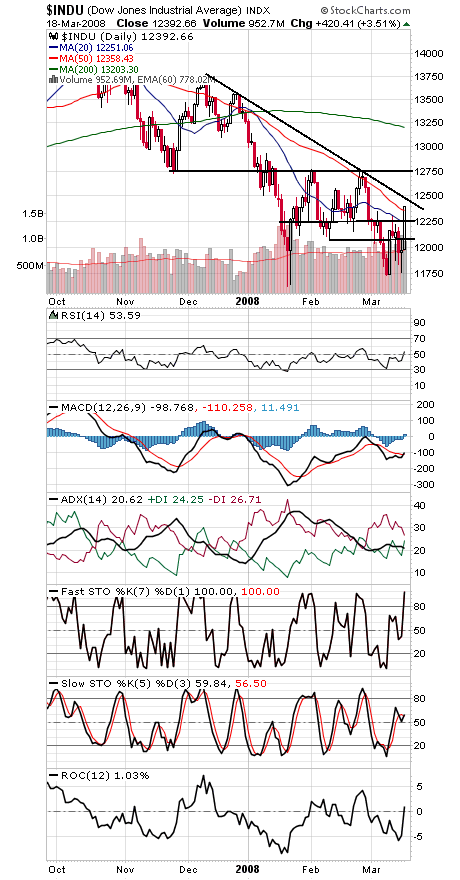

The Dow (second chart) has support at 12,250 and 12,076, and resistance is 12,450-12,500 and 12,750.

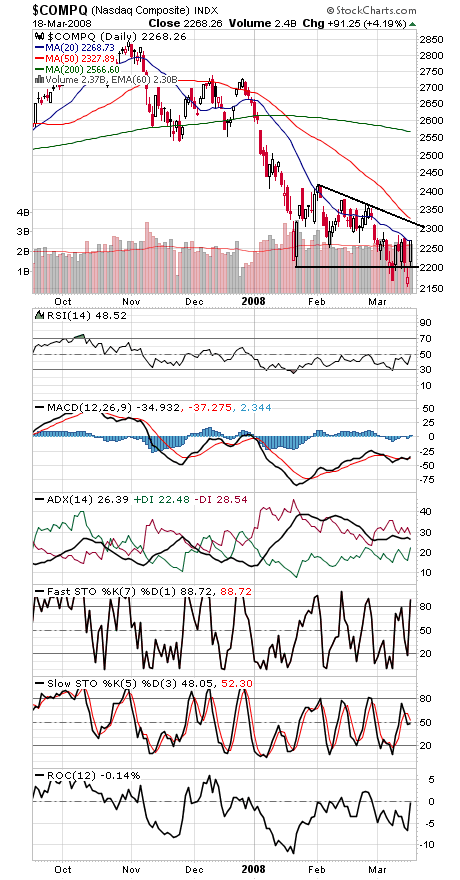

The Nasdaq (third chart) has support at 2200-2220, and 2325 is important resistance, with 2363-2387 and 2419 above that.

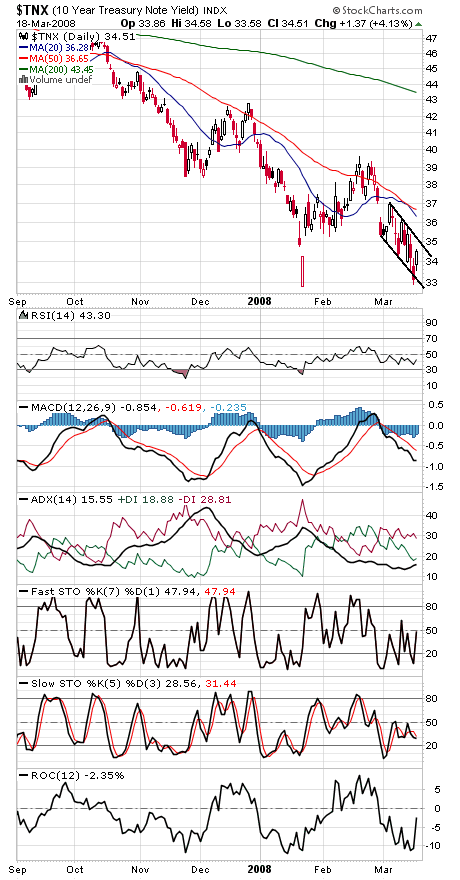

The 10-year yield (fourth chart) could be headed higher if it gets back above 3.5%.

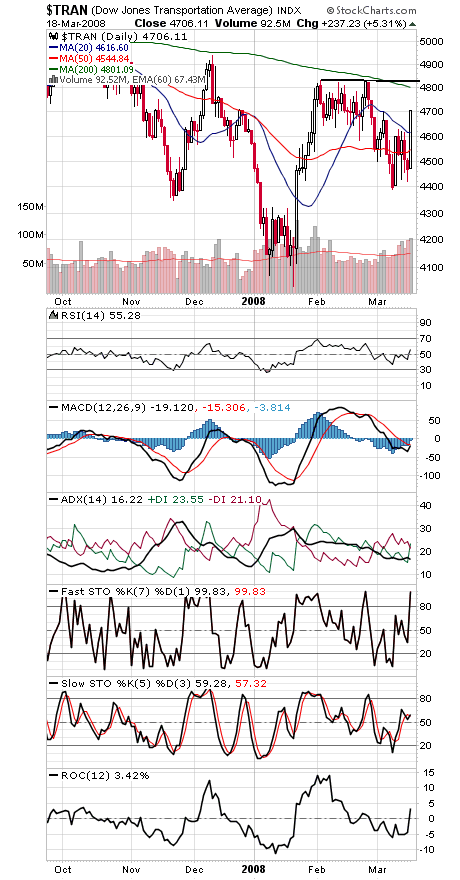

And the Transports (fifth chart) aren’t far at all from giving the first hint of a new uptrend under Dow Theory.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.