We still haven’t gotten the broad buying we were looking for to confirm a major bottom, but it doesn’t mean the bulls don’t have enough fuel to send the major indexes to new highs. We had four 90% downside days on the NYSE in a span of two months, the most concentrated capitulatory selling since 1990. The number of new highs on the NYSE hit levels historically associated with bottoms. We’ve had commercial futures traders buying the decline. And the average trader has become significantly less bullish, witness the swing in the weekly Investors Intelligence survey from 57-18 bulls/bears to 44-32. All of which is plenty for a significant bottom, but a 90% upside day would have cemented it. But we had some sizeable breakouts today, so the benefit of the doubt goes to the bulls unless those breakouts start failing.

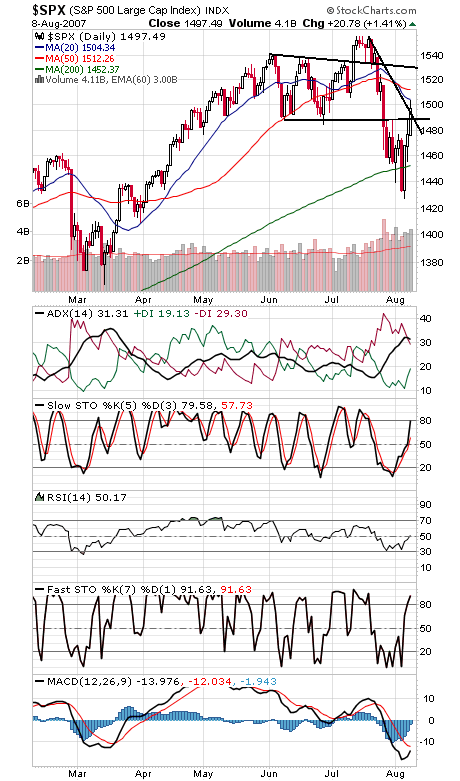

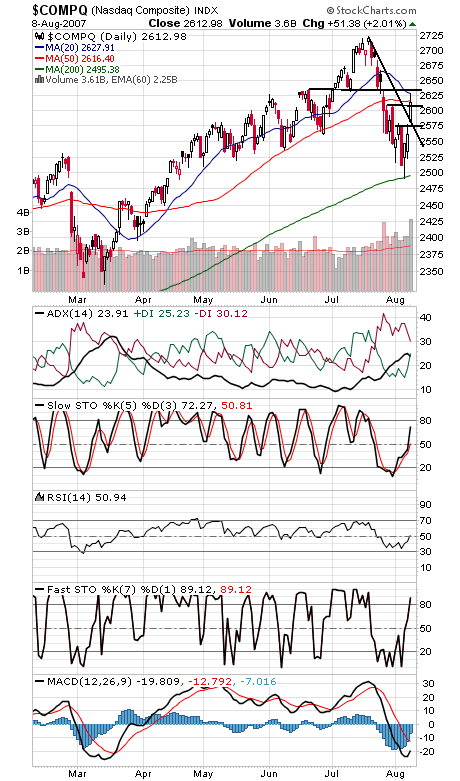

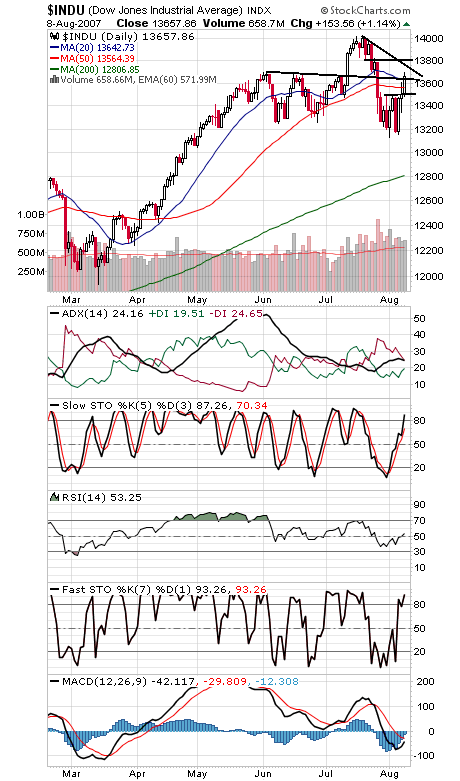

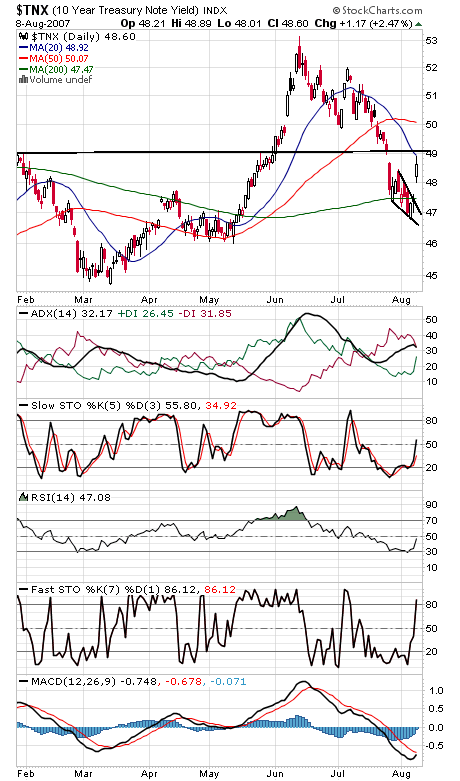

The S&P (first chart below) finally cleared 1488 today, which is now major support, and next resistance levels are 1504 and 1512. The Nasdaq (second chart) almost made it all the way to 2631 resistance today. First support is 1607, with 2570-2580 below that. The Dow (third chart) cleared 13,640 resistance, with 13,750-13,800 up next. Support is now 13,640, 13,600, 13,565 and 13,520. As expected, the 10-year yield (fourth chart) is backing up as money flows into stocks.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association