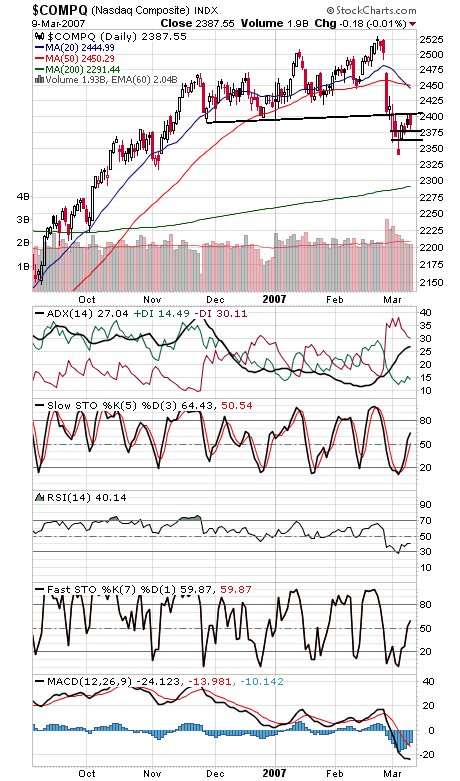

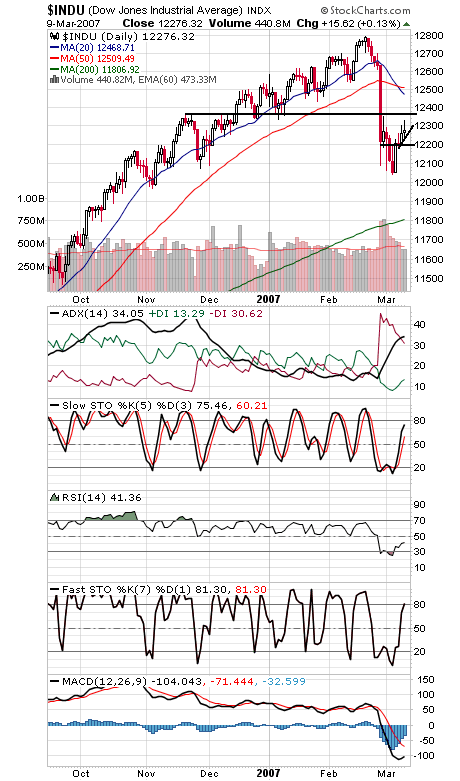

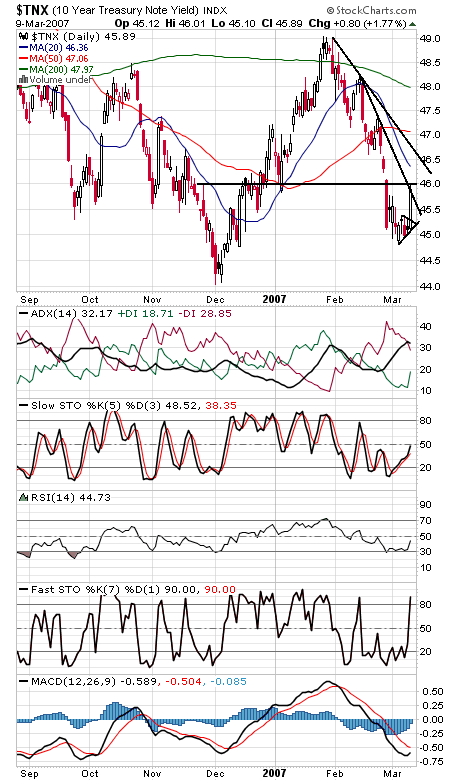

An ugly reversal today, but with chip stocks and small caps outperforming and another day near 52-week lows in the ISE sentiment index, it’s hard to get too bearish here. A retest of the lows may still lie ahead, but we could still see our upside targets of 1418 on the S&P and 12,386 on the Dow first. One negative, though, is that the indexes established a pattern of lower lows and lower highs today; that pattern needs to be broken on Monday or we could see more selling — keep an eye on the first resistance levels below. The Nasdaq (first chart below) gapped up into major resistance at 2405 and sold off from there. First resistance is 2395, and support is 2372-1375 and 2361. The Dow (second chart) faces resistance at 12,303, 12,330, 12,353 and 12,386, and support is 12,260, 12,229 and 12,193-12,200. The S&P (third chart) faces resistance at 1407, 1410, 1416 and 1418, and 1397, 1395 and 1389-1391 are support. Treasury yields (fourth chart) turned up sharply today; a market that frequently confounds expectations.