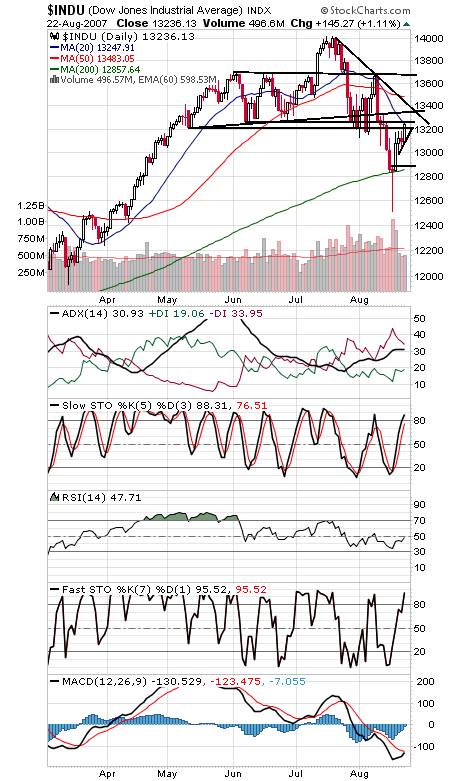

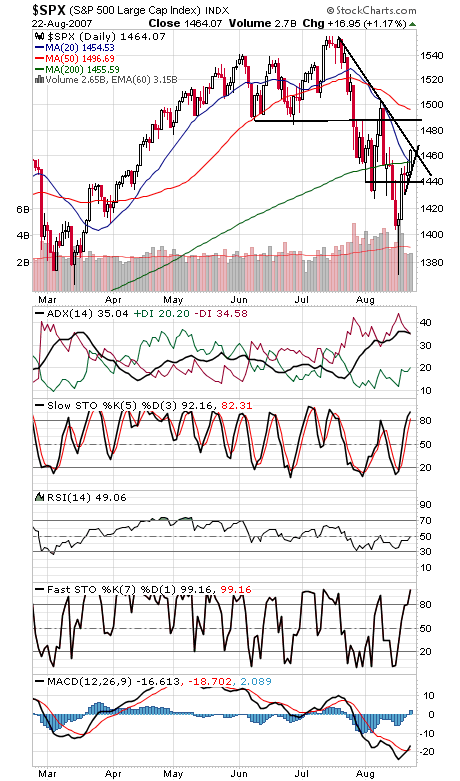

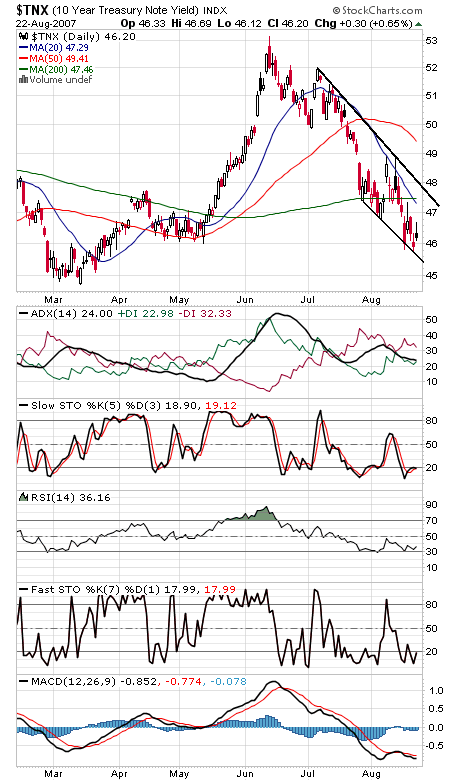

Buyers are finally making some progress against significant resistance here, but they still have quite a bit of heavy lifting ahead of them. One positive to note here is that the Investors Intelligence weekly survey showed bulls and bears narrowing to 40.6 to 37.4, a whole lot of skepticism to base a rally on. The Dow (first chart below) faces resistance at 13,300, 13,350, 13,400, 13,500 and 13,700, and first support levels are 13,200 and 13,150. The S&P (second chart) finally took out its 200-day average at 1455, which is now first support, but the index faces a big test tomorrow when it opens right at its main downtrend line. The Nasdaq (third chart) will also open right at its main downtrend line tomorrow morning — two very interesting set-ups heading into the morning. First support is 2525-2535. The ten-year yield (fourth chart) remains stalled, but it has a long way to go to break out of its down channel.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association