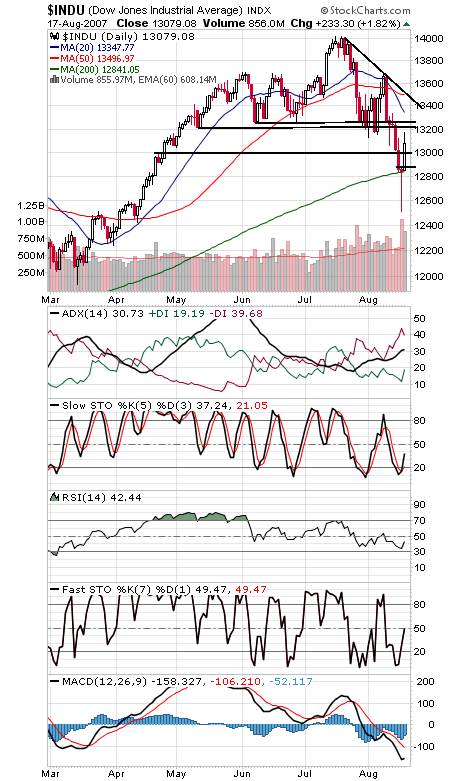

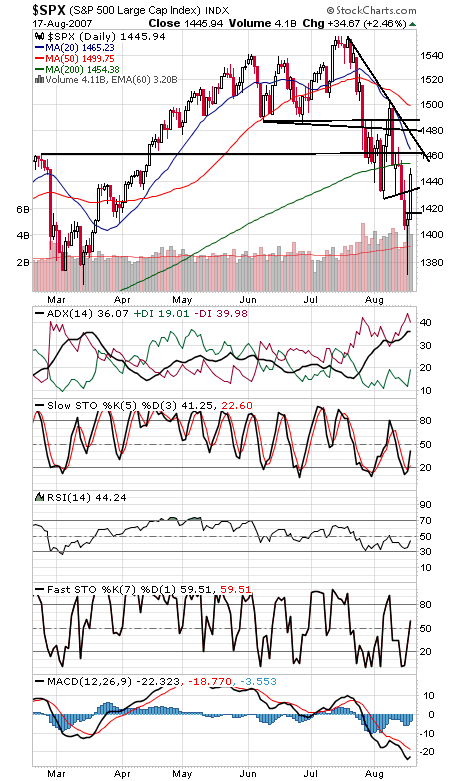

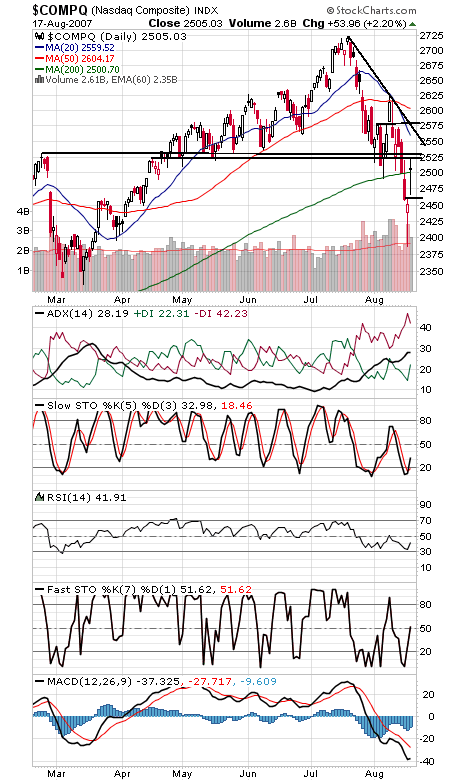

Well, we asked for a 90% upside volume day to cement a bottom, and we got it, courtesy of the Federal Reserve (talk about good market timing — cutting rates before the market open on an expiry Friday). We should note that the bulls barely got the job done: we count 90.67% upside volume on the NYSE today; shaky, but good enough. Much depends on the health of any rally from here, and seasonality remains negative for two more months, but the market appears to be forming a classic bottom here. We wouldn’t rule out a retest of the lows or another leg down in October, but for now, the bulls have the floor; let’s see what they can do with it.

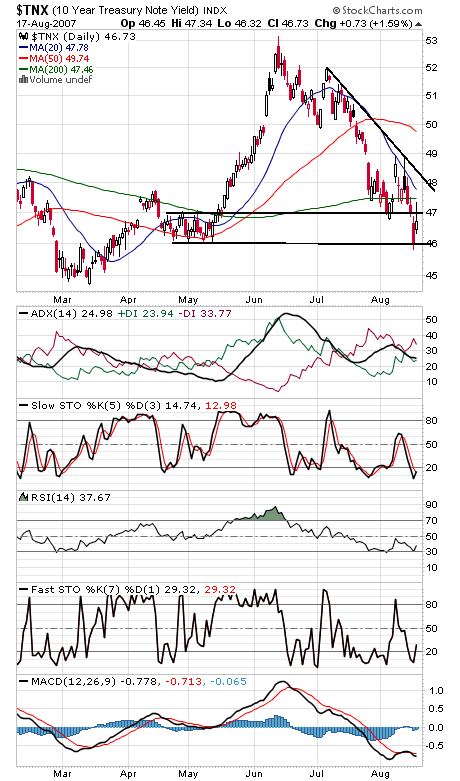

Obviously their first order of business is to take out this morning’s highs of 13,167 on the Dow, 2525 on the Nasdaq, and 1450 on the S&P (first three charts below). 13,200-13,300 is important resistance on the Dow, and support is 13,000 and 12,840-12,900. The S&P faces resistance at 1454, 1461, 1473, 1480, 1488 and 1504, and 1427-1430 and 1416 are support. The Nasdaq faces important resistance at 2525-2631, with 2570-2576 above that. 2500 and 2460 are support. The 10-year yield (fourth chart) backed up today after bond traders didn’t quite get the fed funds cut they were betting on.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association