The bulls just keep running here, pushing one index after another to new or multi-year highs. We’re in a seasonally weak period for the next three weeks, so some kind of pullback could materialize soon, but Oct. 30 begins the strongest period of the year, so if the S&P 500 is going to clear its all-time highs by a substantial margin, the stage is set. That said, this remains an area of no small importance: any remaining notion that the broad market could still be in a long-term bear market off the 2000 peak lives and dies with the S&P’s 2000 peak, and the bulls appear poised to take that level. That’s no small victory in the big picture if they can pull it off.

The sentiment picture remains mixed, however, with commercial futures traders solidly long the big S&P futures contract, but measures of broad market sentiment nearing extreme levels. Investors Intelligence bulls-bears stand at 56-25, just a few points from toppy readings, and the ISEE sentiment index has been flirting with 52-week highs.

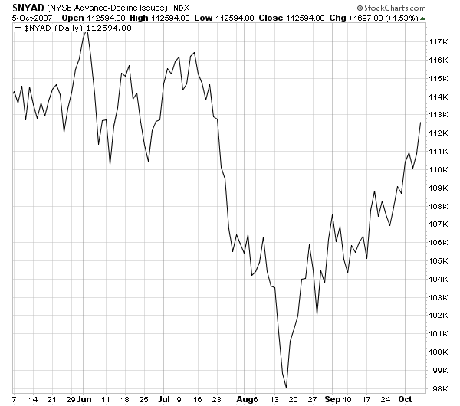

The NYSE advance-decline line (see chart below) continues to lag, but is at least headed in the right direction and appears to be accelerating, showing gathering strength in the broader market. In short, a solidly positive technical picture for now, but sentiment could pose a near-term problem for the market, perhaps leading to a high of some significance later this year or early next if the technicals begin to erode. The S&P’s all-time high may yet turn out to be the level that finally generates enough bullish sentiment for a major top. We will keep you updated as market conditions change.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.