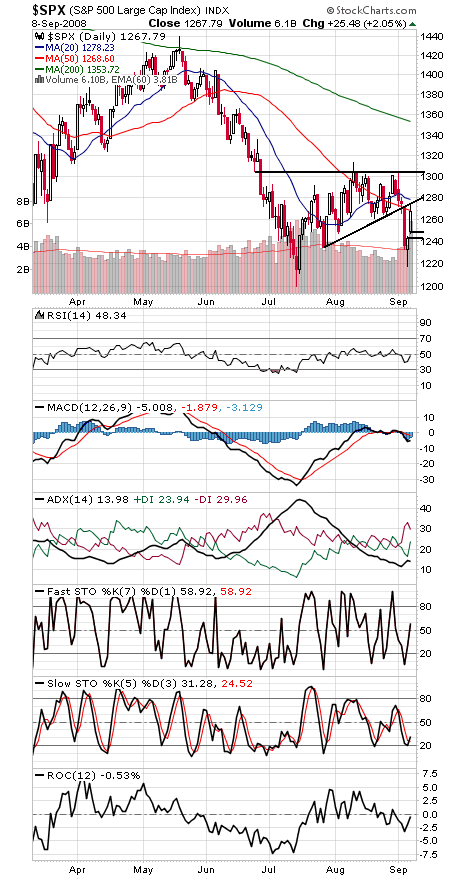

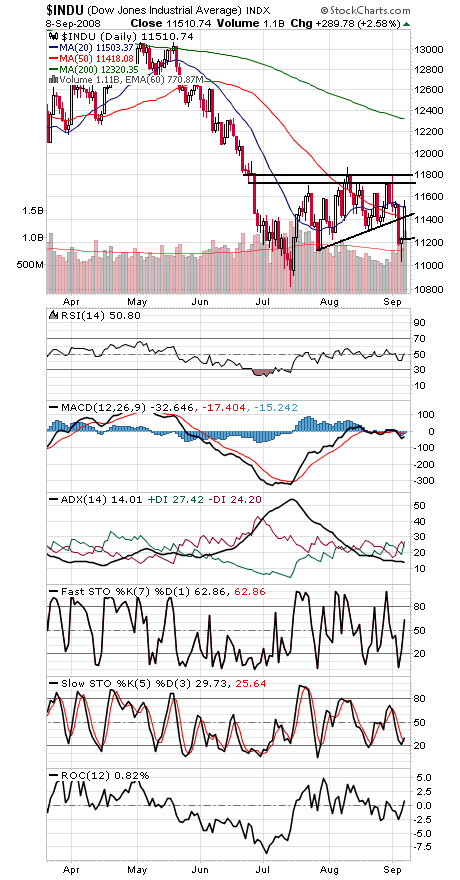

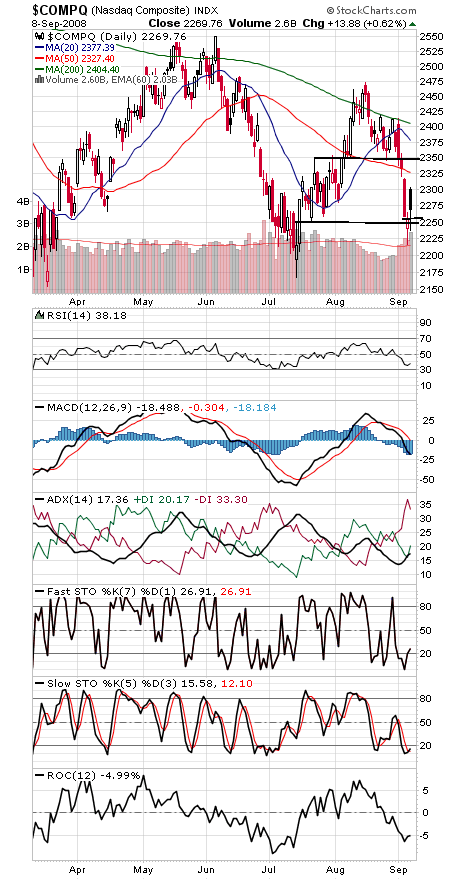

Last week’s DeMark sequential buy signal is so far working out well, but we’re still lacking a 90% upside volume day that could signal a major bottom. In fact, today’s internals (upside volume and advancing and declining issues) were unusually poor for a big up day. And that lack of conviction on the part of stock buyers remains a big problem for the market here.

The S&P (first chart below) got stopped right at an old uptrend line — a move above 1276 could open the way for another test of 1304-1313. 1247-1250 is first support, with 1242 below that.

The Dow (second chart) fared better, breaking through the same resistance. 11,400-11,420 is now first support, with 11,320 and 11,221 below that. 11,730-11,800 is resistance.

The Nasdaq (third chart) looked weaker than its blue chip counterparts today, closing well below the open. Support is 2250-2255, 2237 and 2217, and resistance is 2300, 2325 and 2350.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.