One heck of a rally the last two days, and why not? As the financial crisis has now claimed the biggest U.S. financial company by assets, it could certainly be argued that the news can’t get any worse.

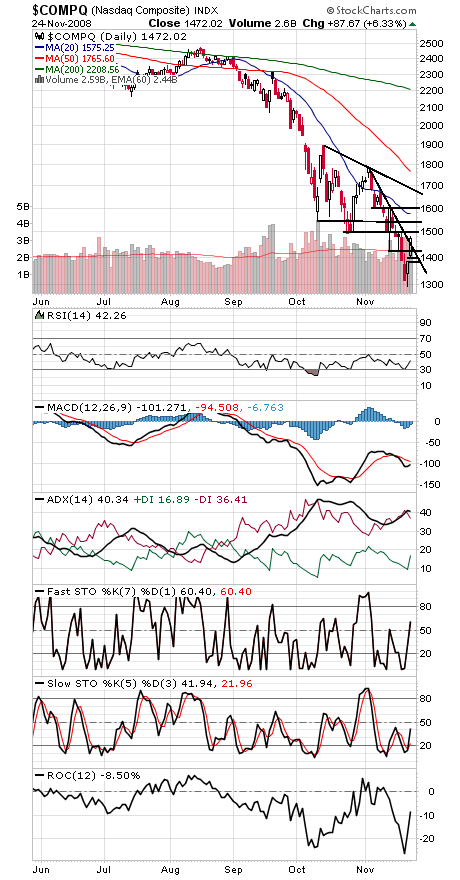

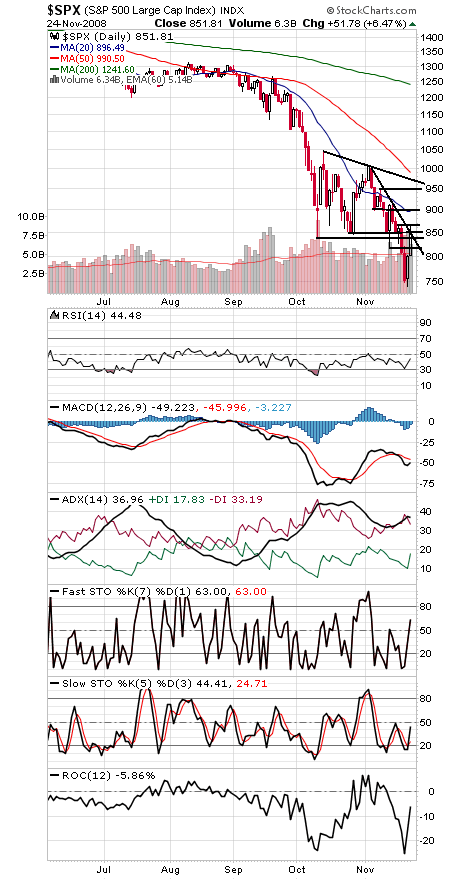

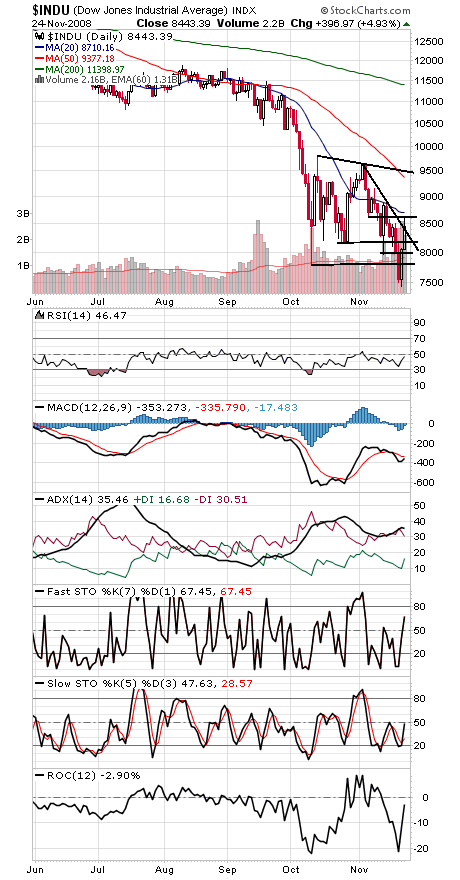

The indexes have now moved back into their October trading ranges, a nice reversal of last week’s breakdowns. They have much more work to do if they’re going to put in a major bottom, but the ability to recover from a major breakdown is a good start.

The Nasdaq (first chart below) had a nice breakout above a downtrend line today. 1493-1500, 1542 and 1604 still lie ahead, while 1428-1430 and 1384-1410 are support.

The S&P (second chart) faces resistance at 866, 900 and 950-960, while support is 840, 818 and 800.

The Dow (third chart) faces its first upside test at 8637, with 8929-9153, 9350 and 9500 above that. Support is 8300, 8200, 8000 and 7900.

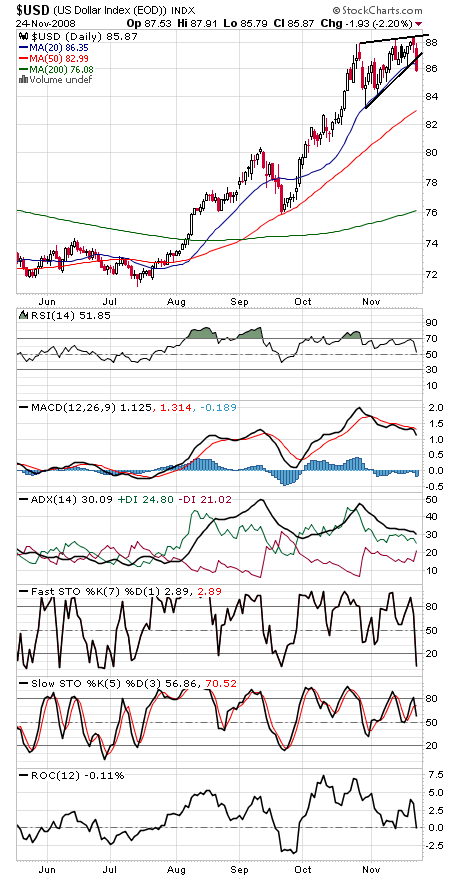

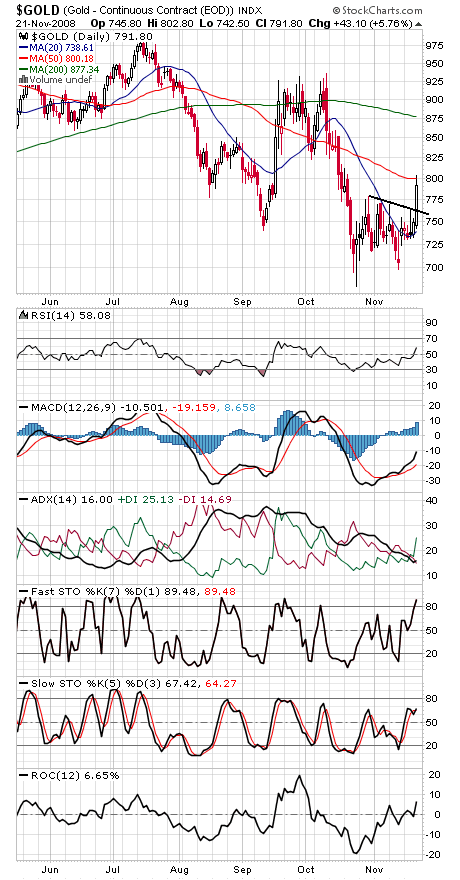

Finally, the dollar (fourth chart) could be topping out here, which could provide an opportunity for gold (fifth chart).

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.