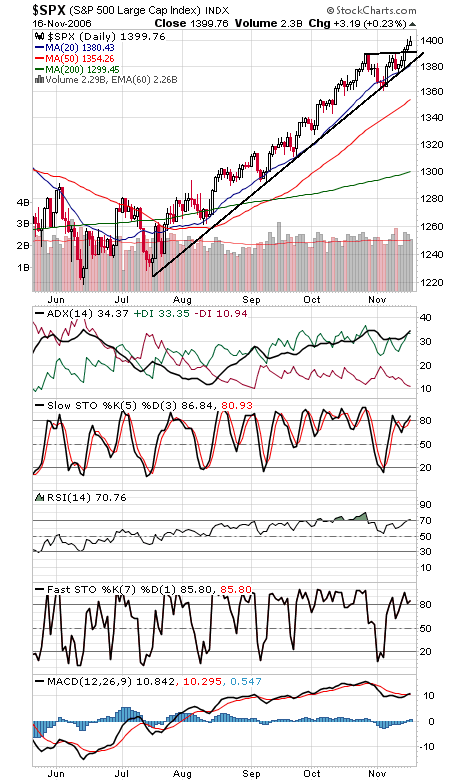

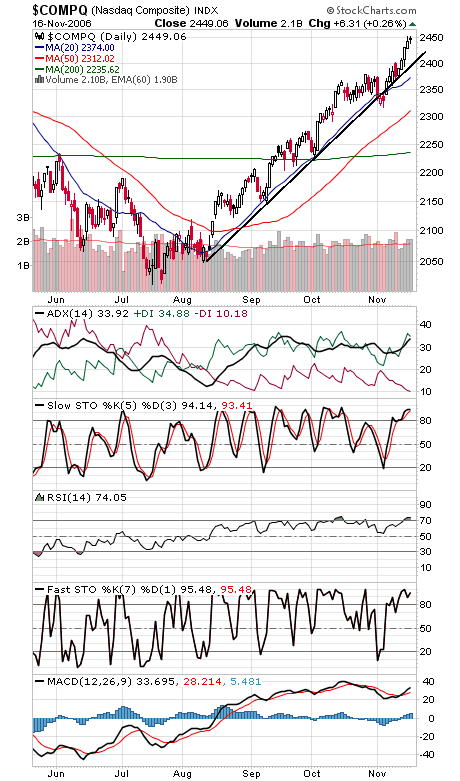

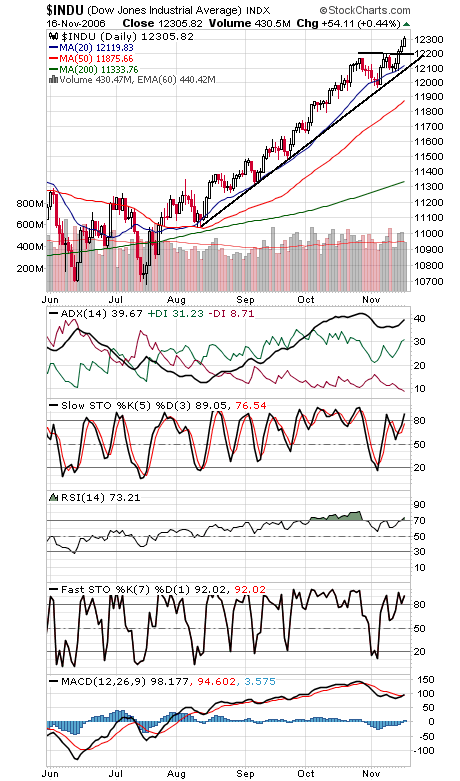

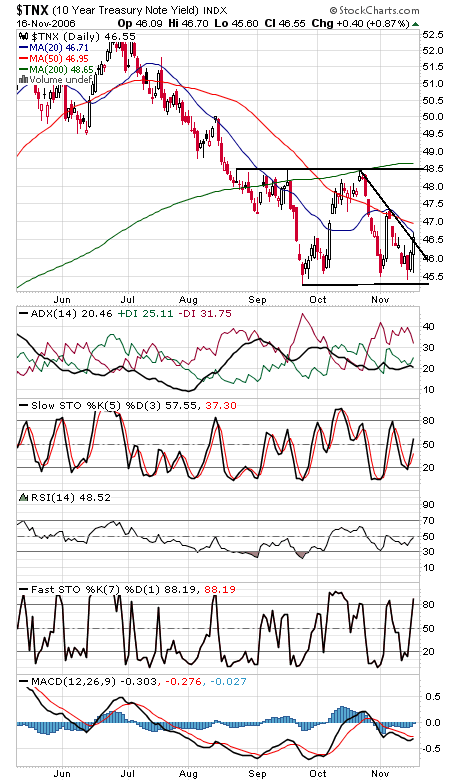

Not the broadest of rallies today, but stocks remain pointed up until proven otherwise. Still, with a number of indicators overbought and sentiment getting a little frothy, there’s plenty of reason for caution here. The S&P (first chart below) continues to stall at 1400, with 1414-1426 a big resistance zone above that. First support is 1395, with 1389 and 1383 below that. The Nasdaq (second chart) put in an unimpressive-looking doji star today at 2450 resistance today. Support is 2438, 2425-2430 and 2400. The Dow (third chart) has first strong support at 12,200, and 12,100 is critical. Once again, we’d note that -DI remains at or below 10 on the major indexes, which suggests that we could see some selling pressure enter the market soon, but the ability of RSI to get back above 70 on the indexes shows continuing momentum. Bond yields (fourth chart) continue to key on Fedspeak instead of the data; perhaps the data is as good as it’s going to get.