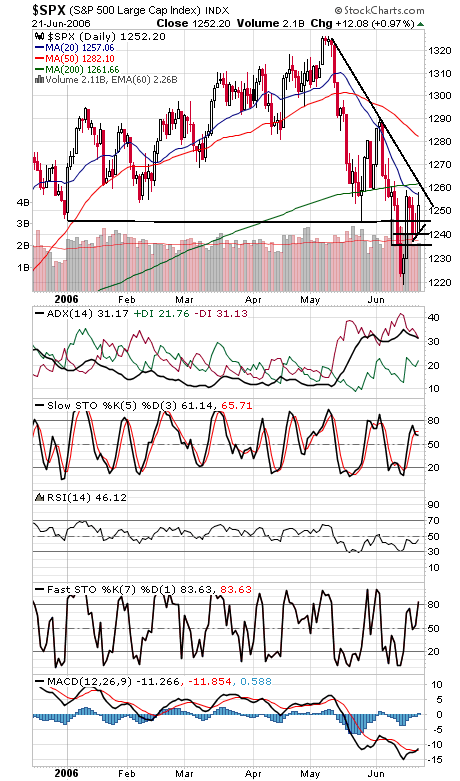

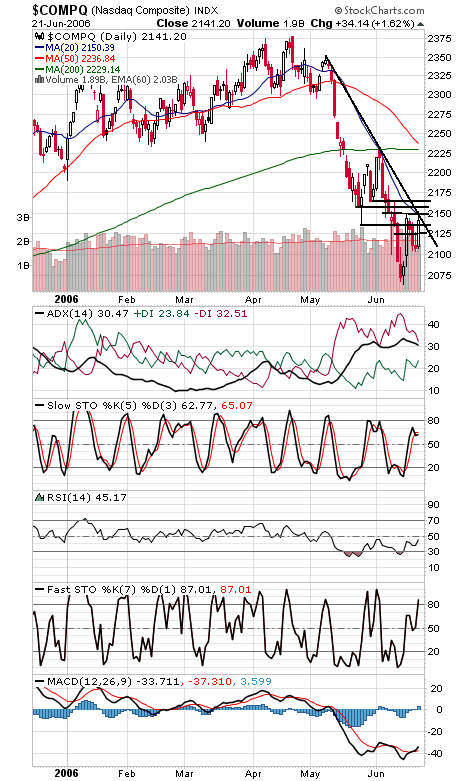

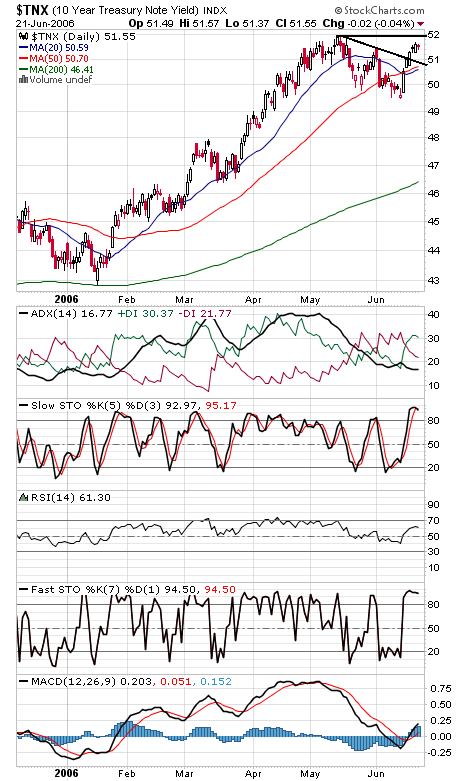

Today marks the second time in a week that stocks started a rally with poor internals and were able to recover to post strong gains the next day. Buyers were also able to push the Dow (first chart below) through the major resistance level of 11,030-11,050, which is now important first support, with 11,000, 10,950 and 10,900 below that. The next resistance levels are 11,208 and 11,280. The S&P (second chart) faces tough resistance at 1260-1262, and support is 1245, 1240 and 1235-1237 and 1230. The Nasdaq (third chart) could take out a downtrend line with a move higher tomorrow. Resistance is 2150, 2157 and 2165, and support is 2135 and 2125. Long bond yields (fourth chart) paused today and remain in a large trading range. One important data point released today: in the Investors Intelligence survey, bulls and bears are now even at 35.6% each. While that’s another positive for the bullish case, the gold standard used to be 55% bears, last seen in 1994. It will be interesting to see where the market — and that survey — are in October, the window for the four-year cycle low.