After two weeks of going nowhere, the bulls made an impressive move today, sending the market above resistance and escaping, at least for now, the threat of a complete retest of the November lows.

The S&P (first chart below) broke decisively above 850 resistance today, which is now important first support; if it can’t hold, another test of 800 is possible. To the upside, the levels to beat are 883, 900 and 918.

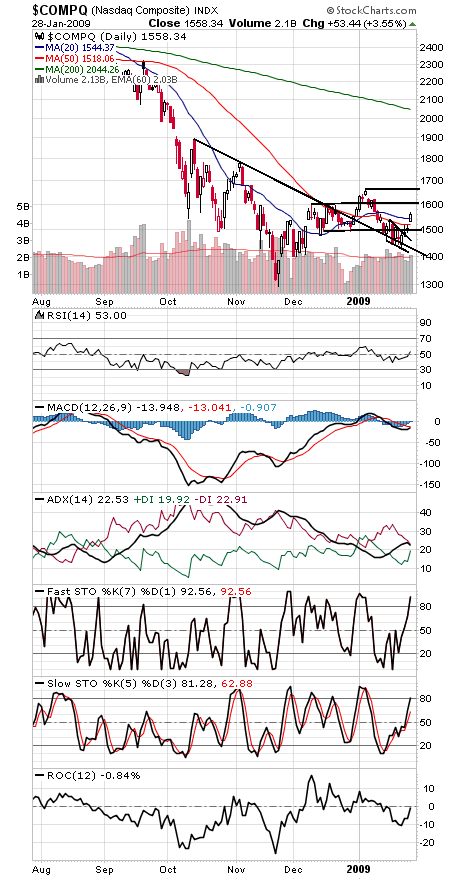

The Nasdaq (second chart) faces its next hurdles at 1604 and 1652-1665, while 1500-1518 is now support.

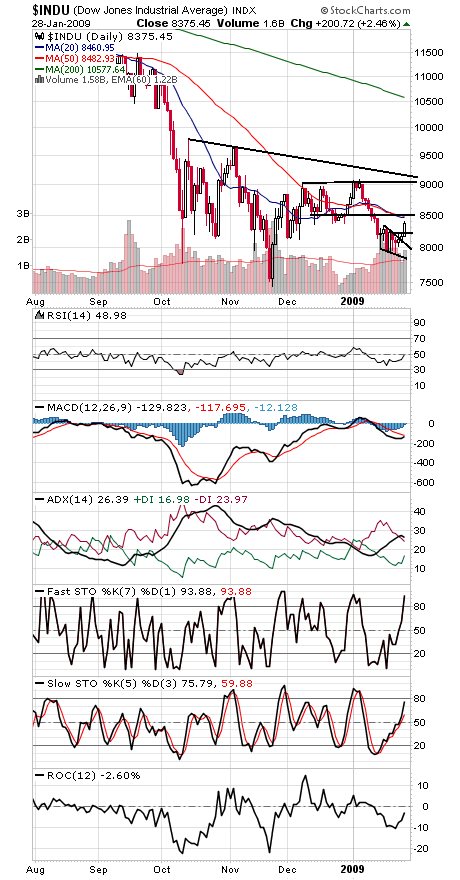

The Dow (third chart) faces one tough resistance level at 8500. A break above that could give the index room to test 9000 once again. Support is 8225-8243.

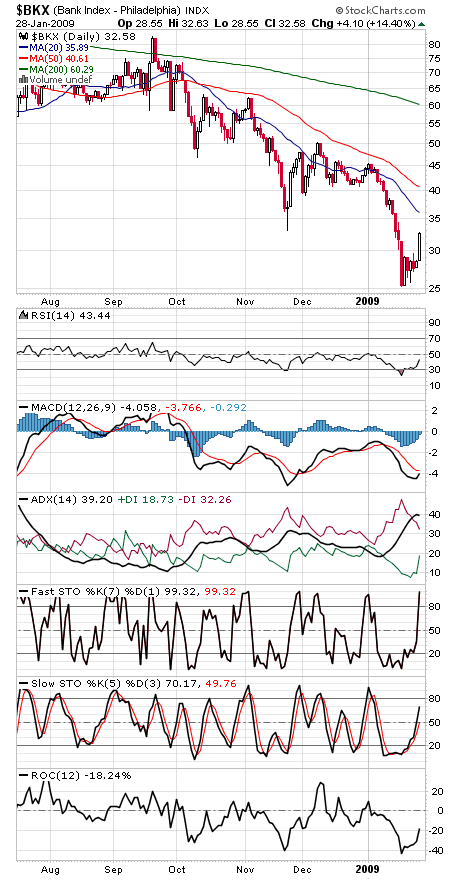

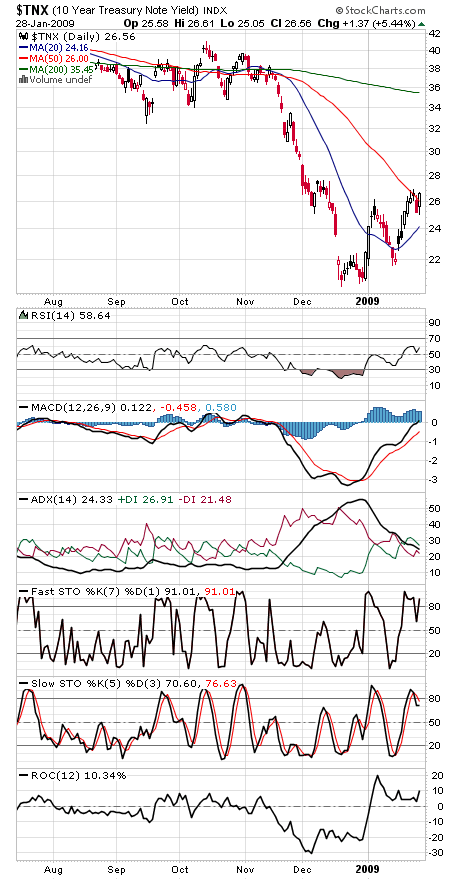

And finally, two very interesting undercurrents: the banks (chart four) are gaining strength — can they really be rescued without further shareholder dilution? — while bond yields (chart five) continue to back up. Are we seeing market participants take on greater risk? Gold and the U.S. dollar are rallying too — some very interesting cross currents at play.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.