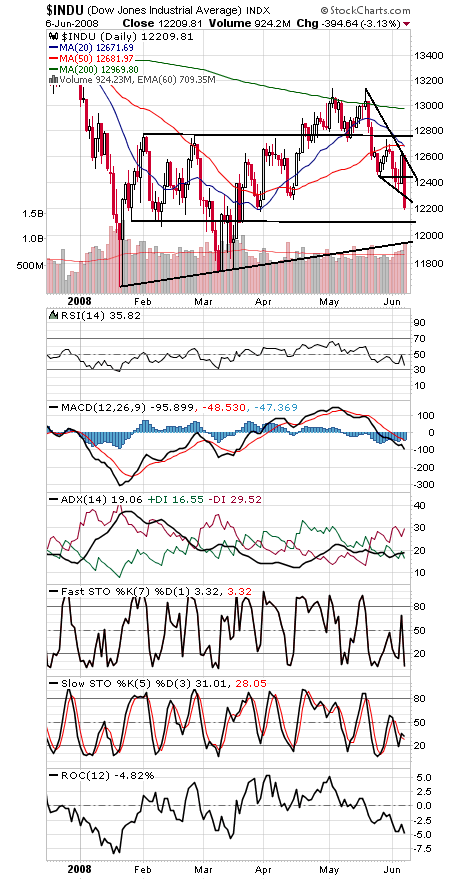

Not a lot to like in today’s market, as the lagging blue chips and financials continue to be a problem for the market that technology leadership alone can’t overcome.

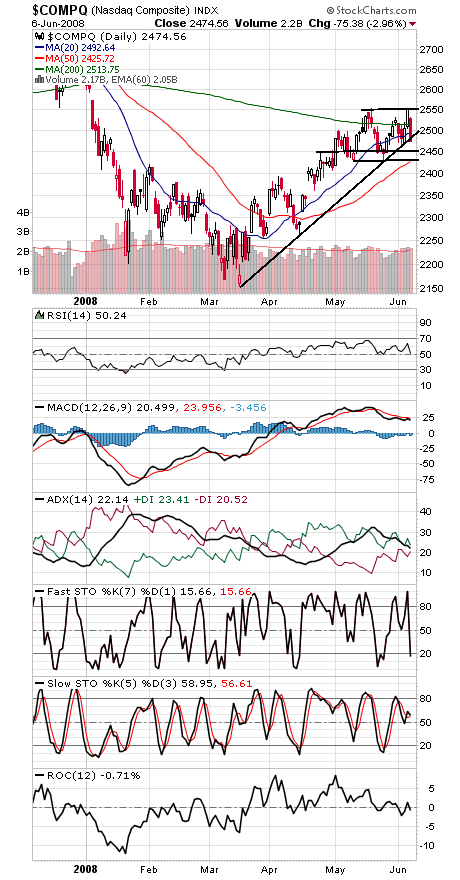

Even the techs finally gave in today, as the Nasdaq (first chart below) closed below its March uptrend line. 2450 and 2425-2430 are next support, and 2490, 2514 and 2551.5 are resistance.

We’re not seeing a huge amount of fear just yet, although a 26% spike in the VIX today and 90% downside volume on the exchanges could be some evidence of climactic selling.

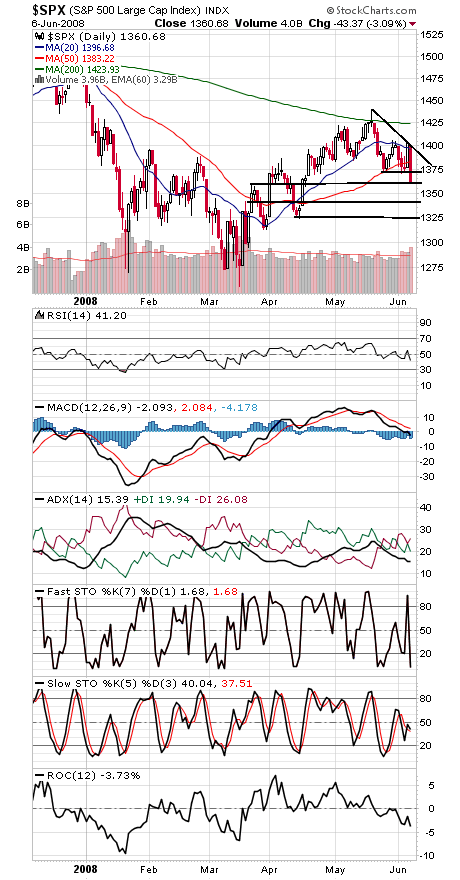

The S&P’s (second chart) next support levels below 1360 are 1340 and 1325, and 1370, 1383, 1390 and 1400-1406 are once again resistance.

The Dow (third chart) has some support around 12,100 before 11,960-12,000 comes into play, and resistance is 12,240, 12,420, 12,500 and 12,600, with 12,683-12,743 above that.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.