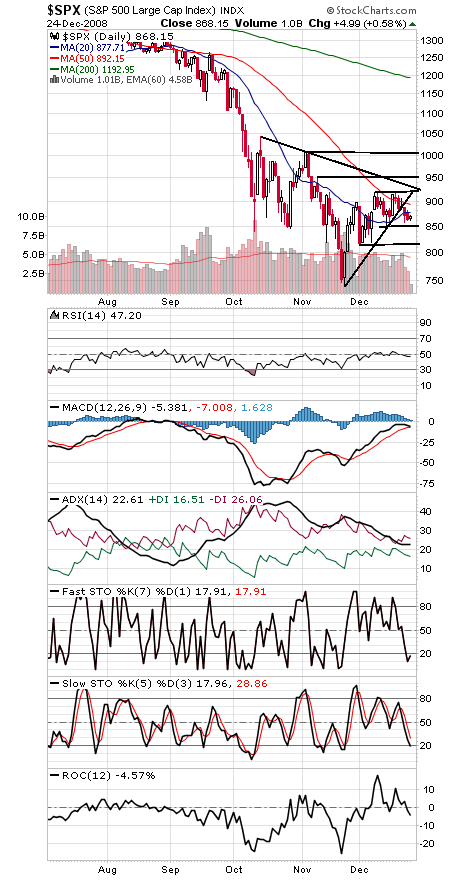

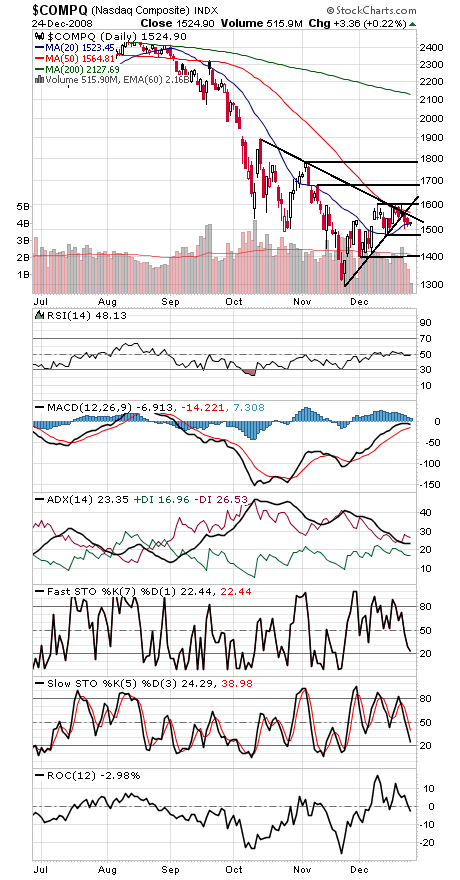

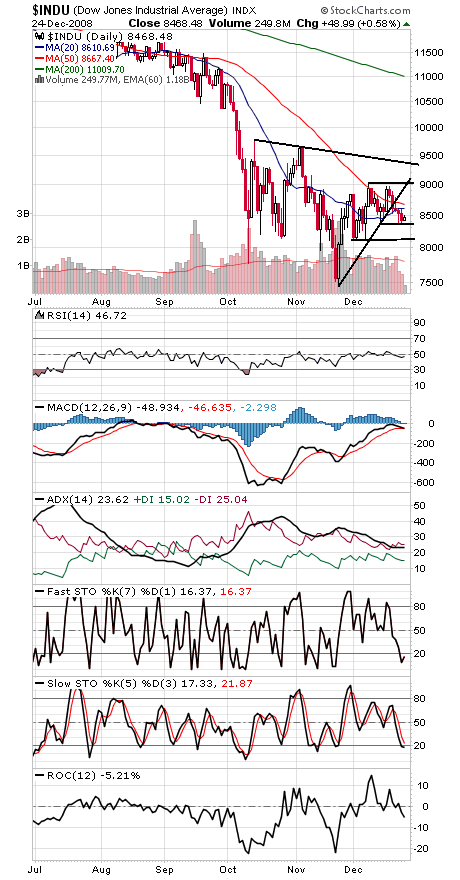

The major stock indexes broke their three-week uptrends earlier this week, but so far selling hasn’t picked up. That suggests that stock market bulls may yet find the strength to put together a year-end rally.

The S&P (first chart below) has support at 850, 840 and 815, while 918 has been difficult resistance.

The Nasdaq (second chart) has support at 1500, 1478 and 1400, while 1603 has become a very difficult hurdle.

The Dow (third chart) has support at 8347 and 8118, while the index needs to clear 9026 to the upside.

In short, not the prettiest of rallies, and the indexes are once again threatening to put in a lower high in the wider timeframes, but the bulls still have some room to pull it out.

One negative we’d note: after clinging to bearish positions for months, this week’s Investors Intelligence survey showed a big swing toward bullishness, from 47-27 bears-to-bulls to 38-35. Since doubt is a rally’s best friend, we’ll call that development negative.

The Technical Analysis column will resume on January 5. Happy holidays, and best wishes for a prosperous 2009.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.