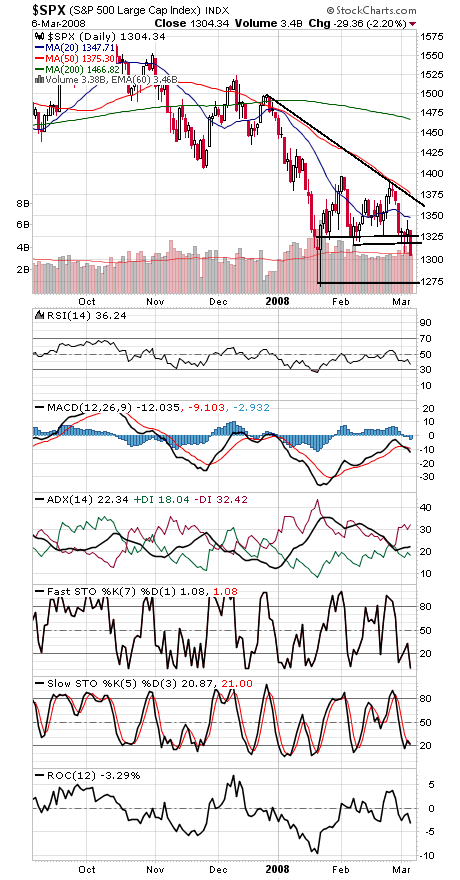

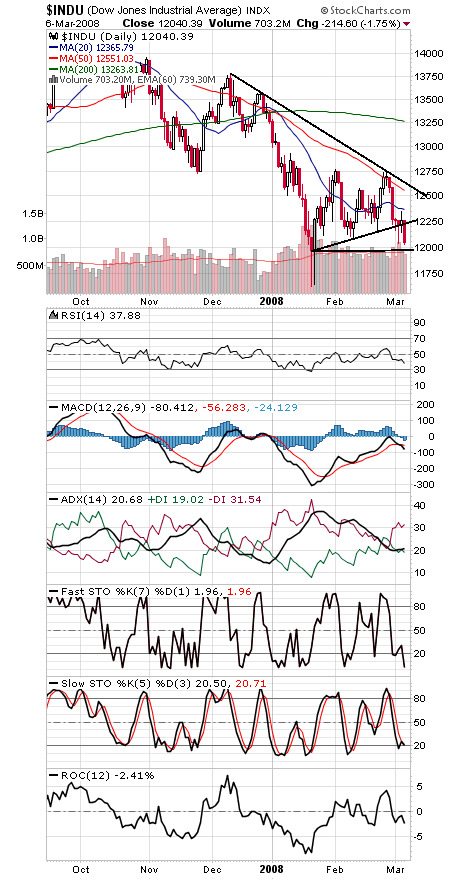

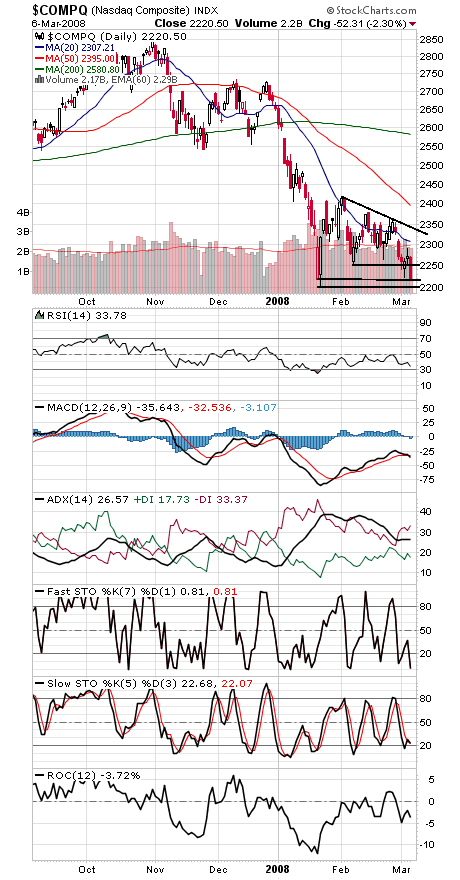

Stocks are approaching their January lows here; can they hold on this retest? Sentiment is in the bulls’ favor, as we’ve stated ad nauseum, but so far that’s done little to create higher prices.

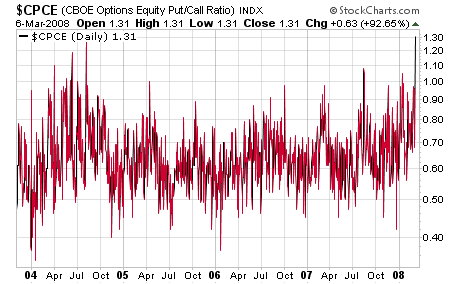

Today’s spike in the CBOE equity put-call ratio (first chart below) was the biggest in 3 1/2 years, the latest evidence that investors are plenty scared.

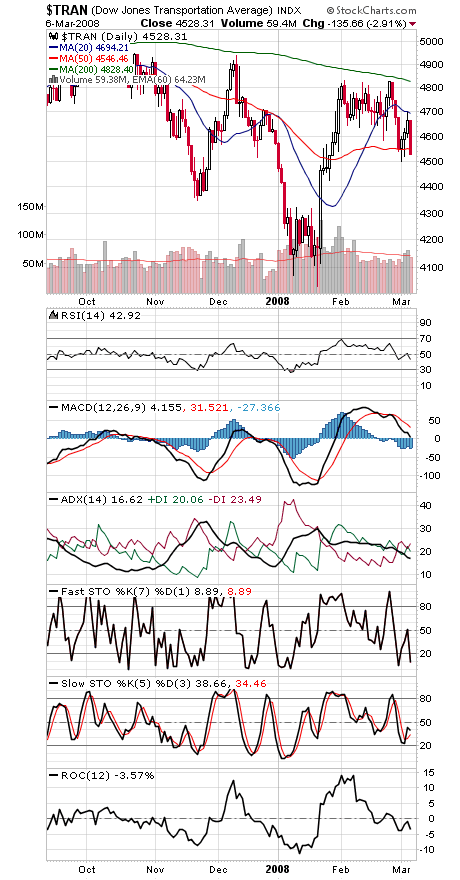

With the major indexes (charts two through four) at their January closing lows, we’ll note one hopeful chart here: the Transports (chart five), which are holding well above their January lows. A hopeful sign for Dow Theorists, but we’d need to see new intermediate-term highs for a confirmed bull signal under Dow Theory.

The S&P 500 appears to be on its way to a retest of the lows at 1270-1275, and 1320-1325 is first resistance.

The Dow has major support at 11,971, and 12,250 is first resistance.

2200 is important support for the Nasdaq, and 2250 and 2300 are first resistance levels.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.