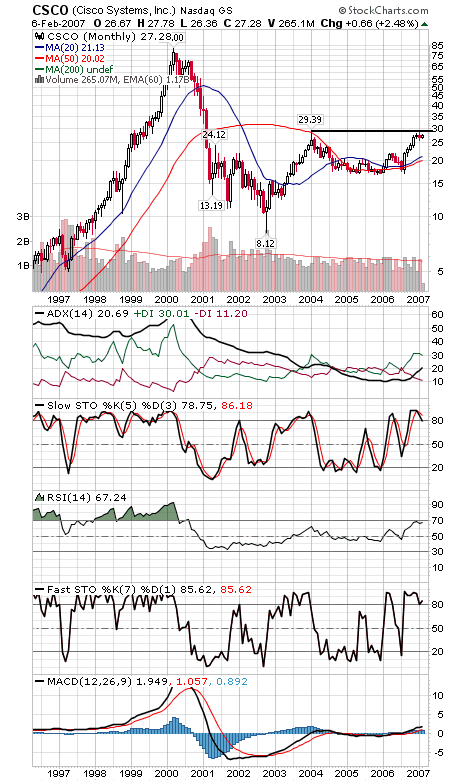

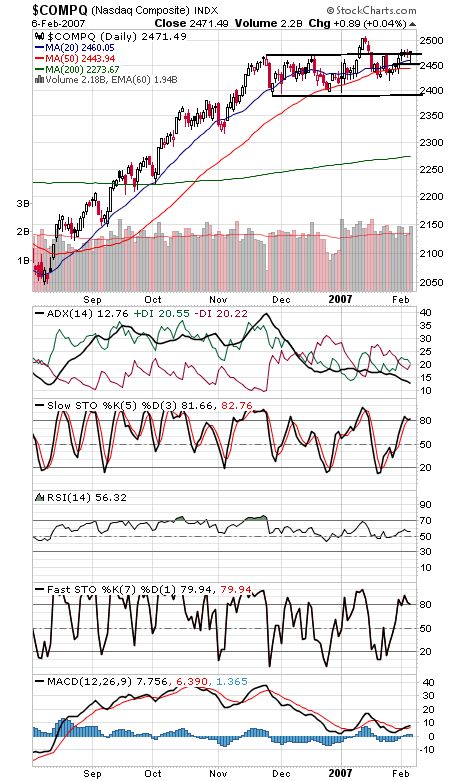

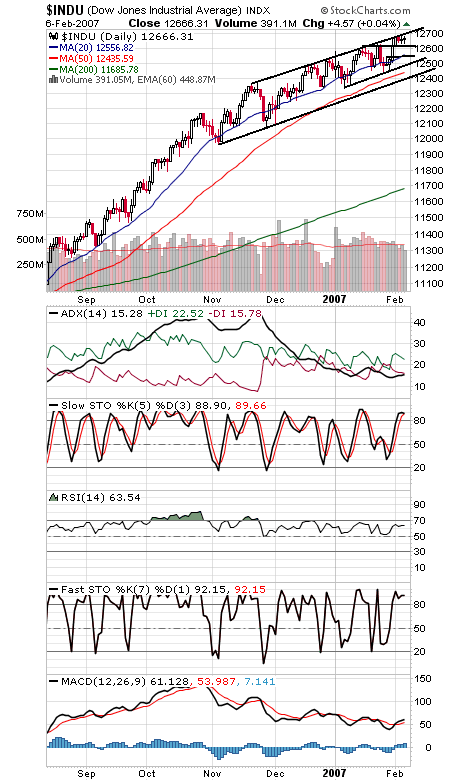

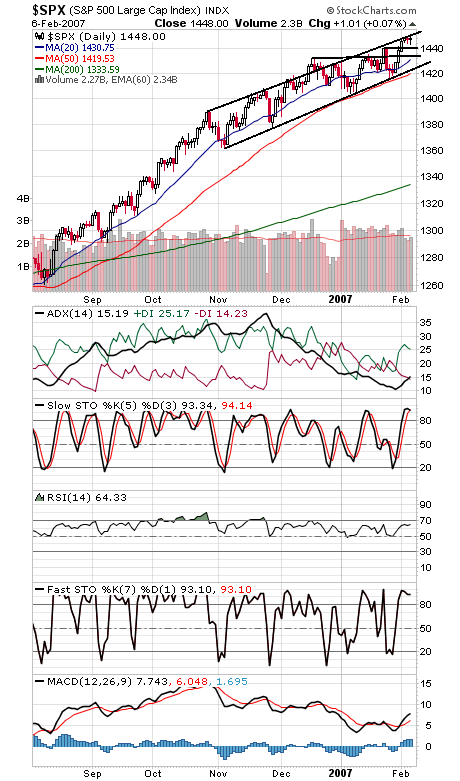

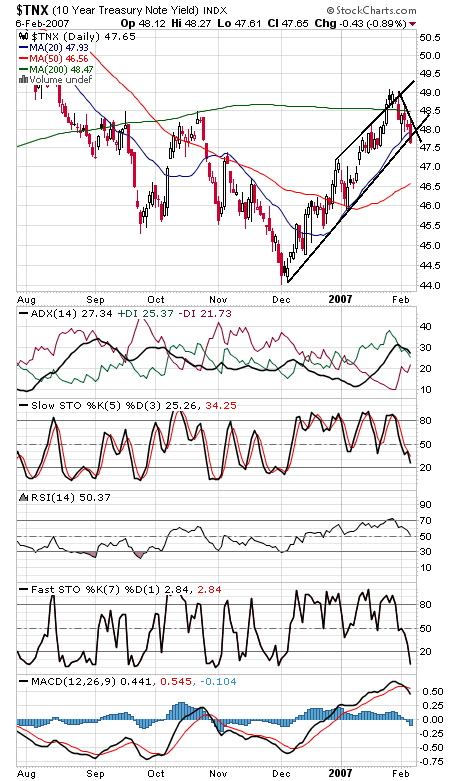

Cisco (first chart below) appears primed for another test of its post-2002 high of 28.99-29.39; if it can clear that level, the stock could be headed for 38, duplicating its initial 21-point rise off the 2002 low. But with the rest of the market facing resistance and Cisco along with it, a pause here seems like the best bet for now. The Nasdaq (second chart) has been unable to clear 2471 resistance with much conviction yet. If it can, 2481 and 2500-2509 remain the next hurdles, and support is 2452-2455. The Dow and S&P (third and fourth charts) are perhaps the biggest obstacles for the market, with both facing rising upper channel lines that date back to November. The Dow faces resistance just above 12,700, and support is 12,630, 12,614 and 12,543. The S&P faces resistance at 1450-1452, and support is 1443, 1441 and 1435. The 10-year yield (fifth chart) had a pretty big breakdown today; perhaps stocks can find some support there.