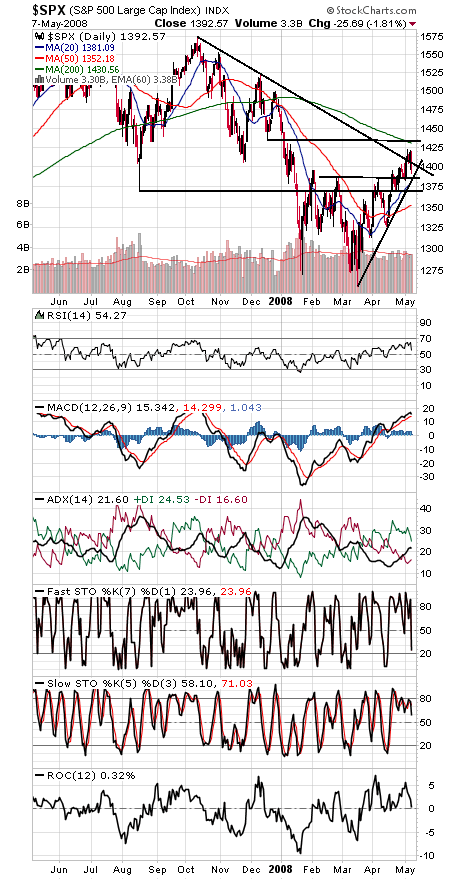

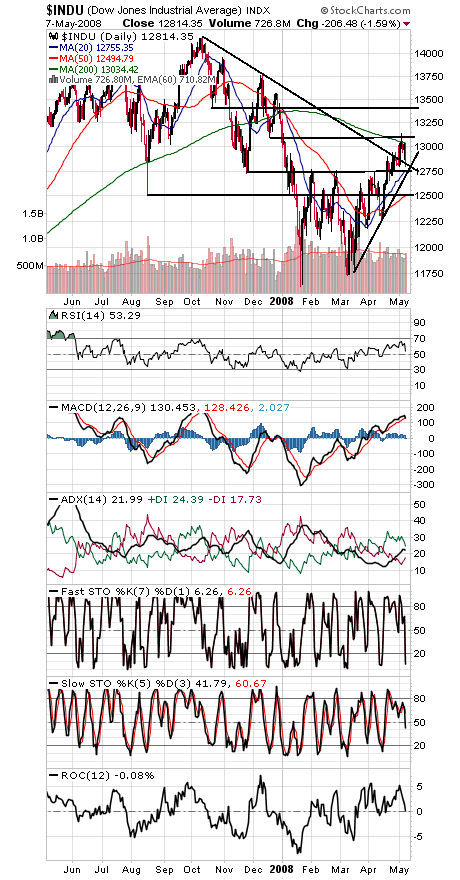

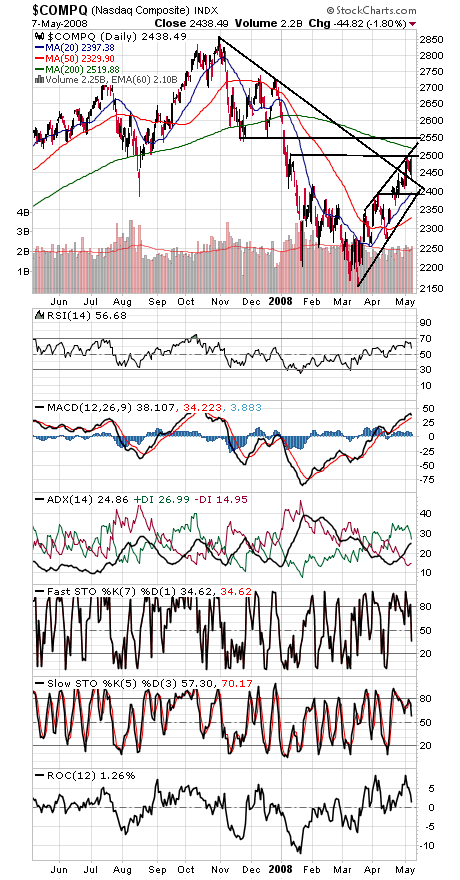

The indexes didn’t get very far into our resistance zone before correcting. With any luck, the pullback will be just as shallow.

The S&P (first chart below) has support at 1385-1390 and 1370, and we’d like to see the correction hold there. To the upside, 1430-1435 is the level we want to see cleared, and 1400-1406 the first hurdle.

On the Dow (second chart), we’d like to see 12,743 hold or 12,500 could come back into play. To the upside, 13,000-13,100 is once again resistance.

2390-2400 is critical support on the Nasdaq (third chart), while 2500-2550 is a very big hurdle for the bulls. 2425-2430 is first support for the techs.

In short, not a surprising place for a pullback, but one we’d like to see remain shallow, in keeping with market history after Dow Theory buy signals and important support levels just below here.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.