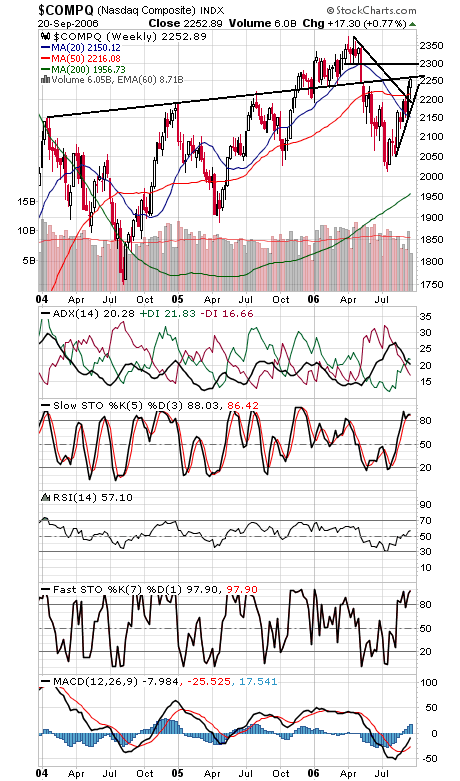

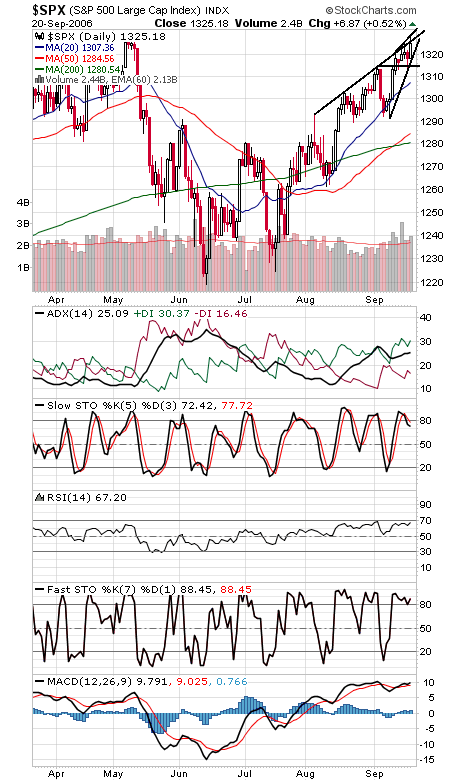

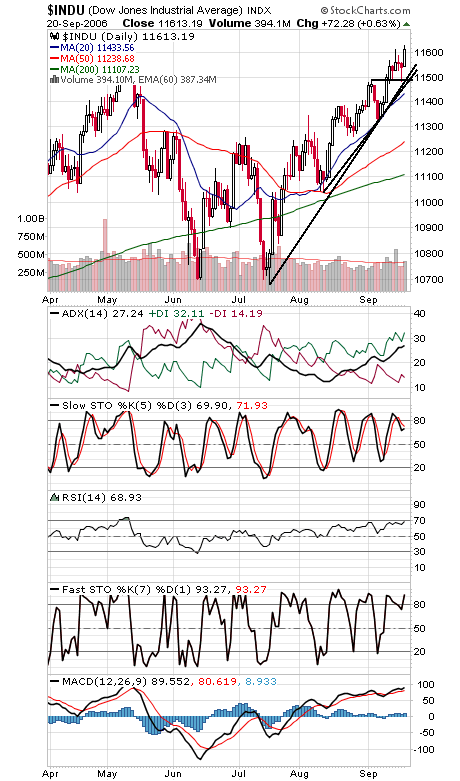

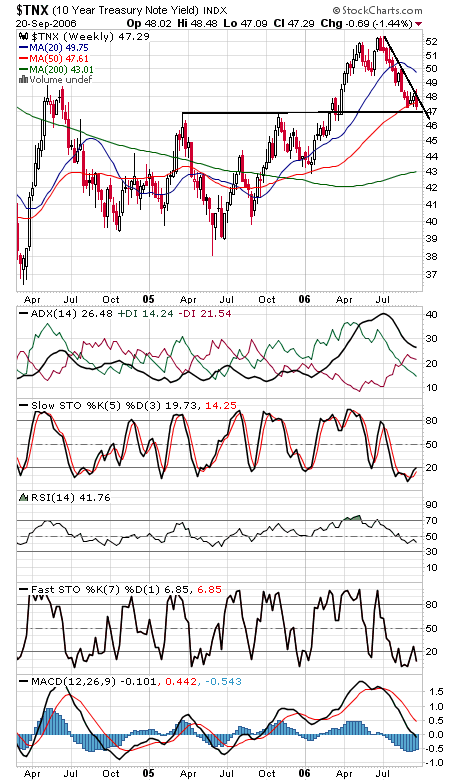

The rally has been choppy and internals unimpressive (just 63% upside volume on the NYSE today), but the indexes continue to grind higher. The big attraction drawing the indexes back to these levels, of course, is the Dow’s all-time high of 11,722-11,750 (closing and intraday). So can the bulls push the index through those levels in what has historically been the weakest part of the year? It’s certainly possible, but a healthy correction might be preferable first. When the big day comes, it likely will bring big headlines in every paper and on every newscast, so there is some danger of creating excessive bullish sentiment whenever it happens. But based on the weak underpinnings here, we’d prefer to see a pullback first. The Nasdaq (first chart below) faces some big resistance at 2260; a move above that could set up a test of 2300. Support levels are 2242, 2223, 2216 and 2200. The S&P (second chart) set a new multi-year high today, yet remains constrained by a rising resistance line. Support is 1321 and 1311-1315. The Dow (third chart) could run into sellers at 11,640-11,670 and 11,722-11,750, and support is 11,580-11,600 and 11,480-11,510. Bond yields (fourth chart) are also continuing their trend, running into the big 4.7% level today.