The next few days will be important for the presidential election — and not just because of the pending debate and financial bailout plan.

According to Ned Davis Research, if September in a presidential election year is an up month for stocks, the incumbent party tends to hold onto the White House. If the month is down, the other party tends to win.

With two trading days to go in the month, the Dow is down 404 points for the month. That makes a weekend financial rescue plan followed by big gains in the stock market critically important for the candidacy of John McCain.

But if the market can’t pull it off, there’s a bright side for investors: historically the stock market has performed better under Democratic presidents than Republican ones.

There’s a lot at stake over the next four days.

Assuming a bailout bill passes — and it’s almost unimaginable to think that it won’t happen — what will traders be looking at? Most likely the TED spread, the difference between the London Inter Bank Offered Rate (LIBOR) and the three-month T-bill rate, a measure of credit risk. The spread is usually around 100 basis points or less; in the last week or so, it has exceeded 300 basis points, surpassing the record hit after the 1987 crash. An easing in that rate will be the best sign that credit markets are loosening up.

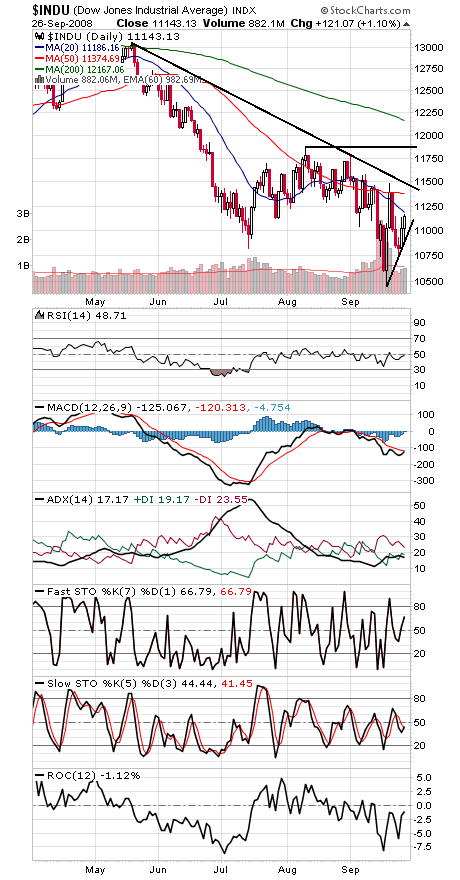

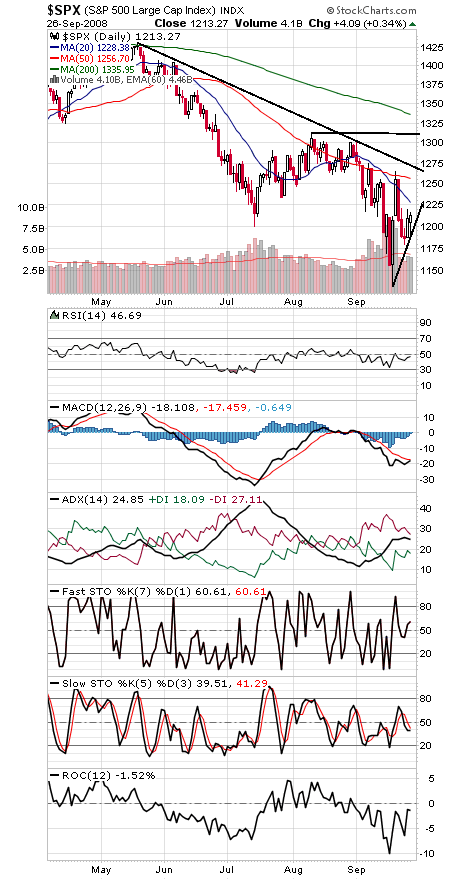

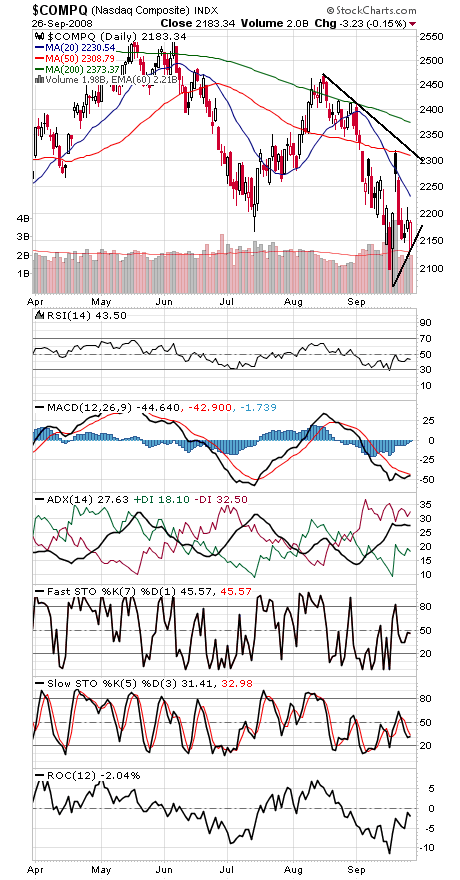

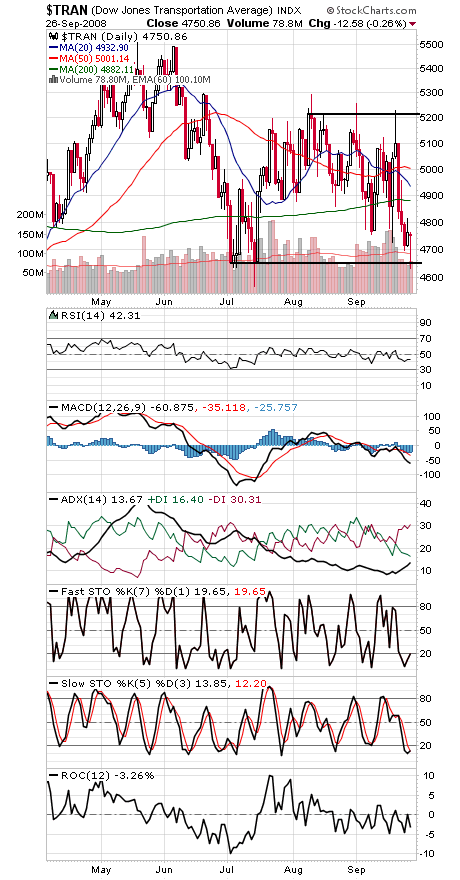

And of course we’ll continue to monitor the index charts (see charts below), and the most important thing we need to see there is higher intermediate-term highs above the August peaks. Those levels are 11,734-11,867 on the Dow, 1313.15 on the S&P, 2473.2 on the Nasdaq and 5216.5-5293.41 on the Transports. That would break the cycle of lower highs that have plagued the indexes since last October.

To the downside, it would be nice if the indexes can hold their higher lows set this week, at 10,753 on the Dow, 1180 on the S&P and 2136 on the Nasdaq. And 4653, the Transports’ closing low over the summer, is critically important under Dow Theory.

11,000 and 11,374-11,500 are first levels to watch on the Dow; 1255-1270 and 1200 on the S&P; and 2210, 2318 and 2150 on the Nasdaq.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.