The stock market remains the best leading economic indicator, and today’s action suggests that the Federal Reserve may finally have solved the credit crunch.

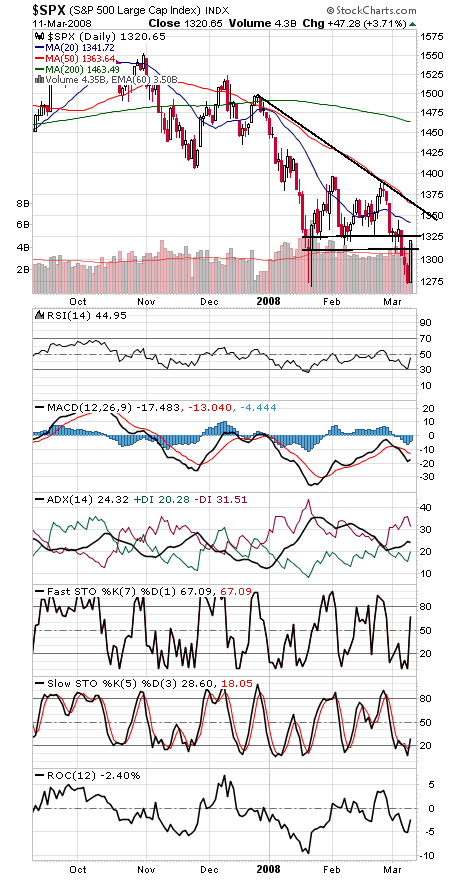

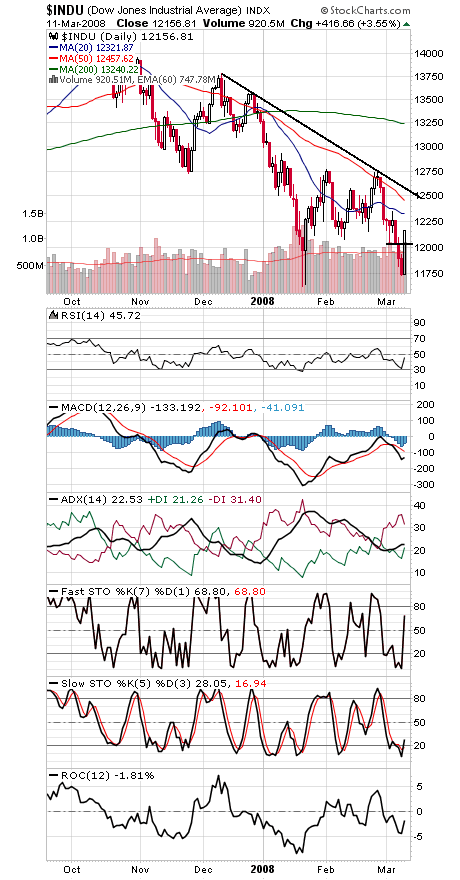

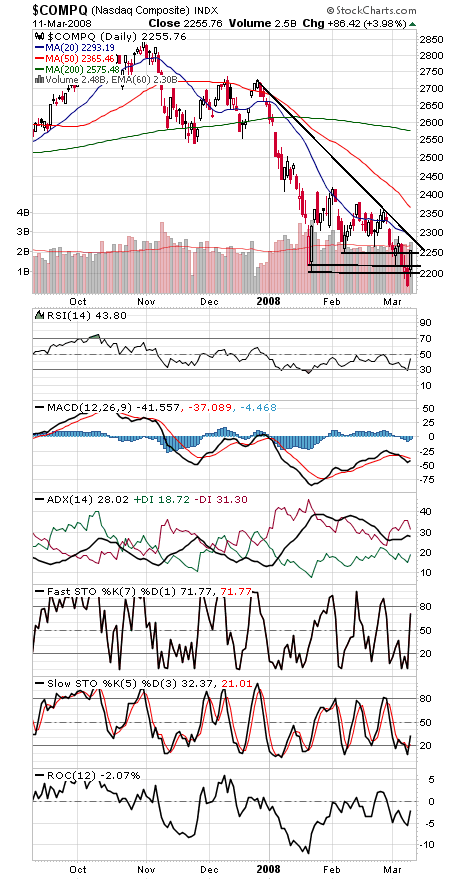

Today’s 90% upside volume day, following right on the heels of yesterday’s 90% downside day and low-volume retest of the January lows, suggests that we may finally have a bottom of some import here. Time will tell if the major indexes can take out the major resistance that lies ahead, but the preliminary verdict is a positive one.

The S&P 500 (first chart below) faces resistance at 1325, 1344 and 1360-1370, and support is 1310, 1300 and 1286-1290.

The Dow (second chart) faces resistance at 12,255, 12,450 and 12,550, and support is 12,000-12,100.

The Nasdaq (third chart) faces its first big test at 2280, with 2290 and 2300 above that, and support is once again 2200-2220.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.