The Federal Reserve’s historic interest rate cut today was good news for stock market bulls, but signs elsewhere are mixed.

It was a banner day for the stock market, with the major indexes clearing their 50-day averages for the first time since the bankruptcy of Lehman Brothers in mid-September sent Wall Street into a full-fledged financial panic.

Meanwhile, treasuries continue to gain from flight-to-safety, while a hint of inflation is beginning to emerge in other gauges, with gold up and the dollar continuing to tumble. At this point, a little inflation would be good news.

In short, plenty to watch in the days and weeks ahead.

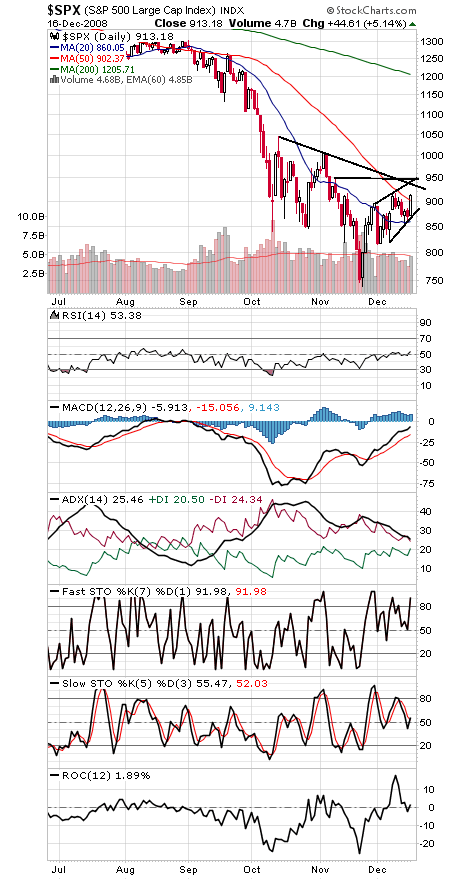

If the S&P (first chart below) can clear 940-950, it should be headed for 1000. 900 and 875 are now support, and 918 is first resistance.

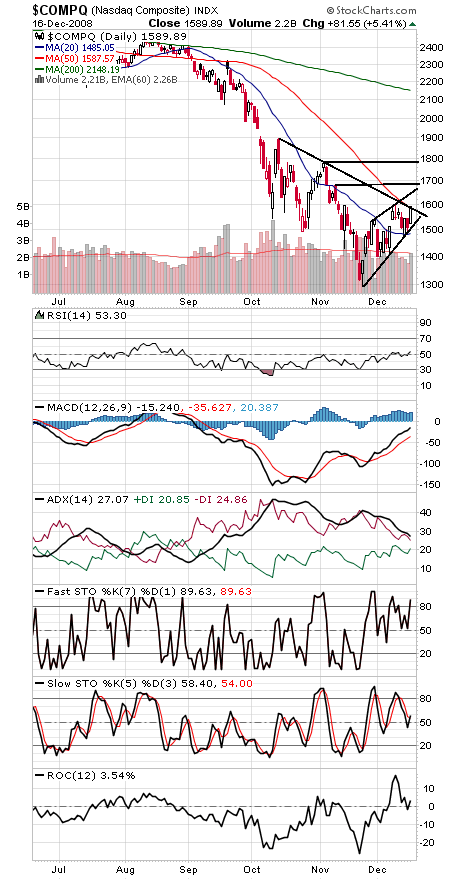

The Nasdaq (second chart) faces a bit of a struggle between here and 1603. Above that, the next resistance zone is 1660-1680. Support is 1544 and 1520.

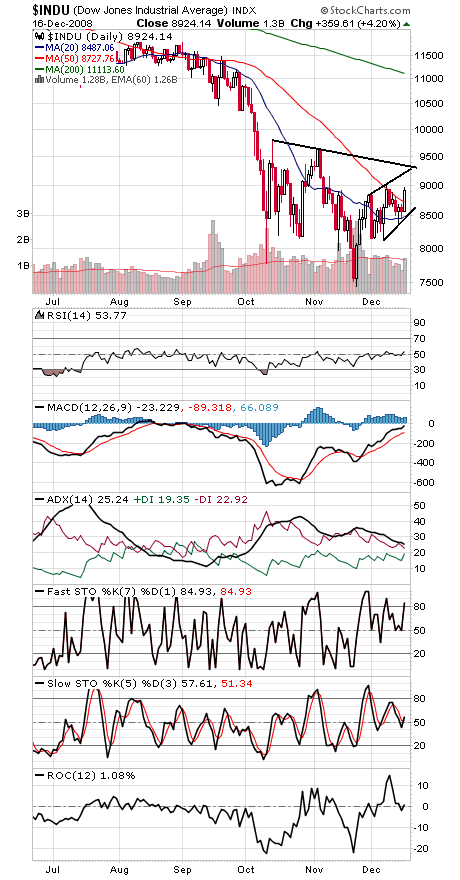

The Dow (third chart) faces resistance at 9000 and 9300-9350, and support is 8720 and 8500.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.