About the only bright spot to come out of the last couple of days is that the Federal Reserve doesn’t look nearly as out of touch as investors thought on Tuesday, after the Fed cut interest rates by a measly quarter point.

But the bad news is that the Fed may be running out of room to cut interest rates, giving the Fed less leverage in the historic battle it is facing here.

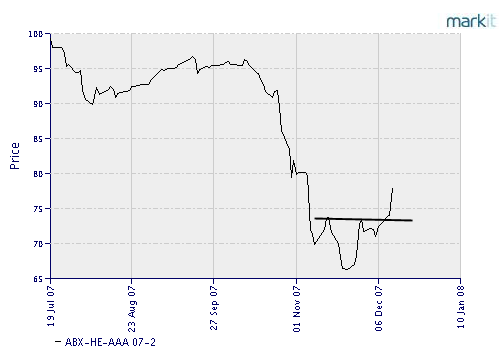

One hopeful sign is that the subprime sector (see first chart below) is showing some bullish charts for the first time in a while. That suggests that the Fed may have already done enough to stem the subprime meltdown — as long as those bottoms hold.

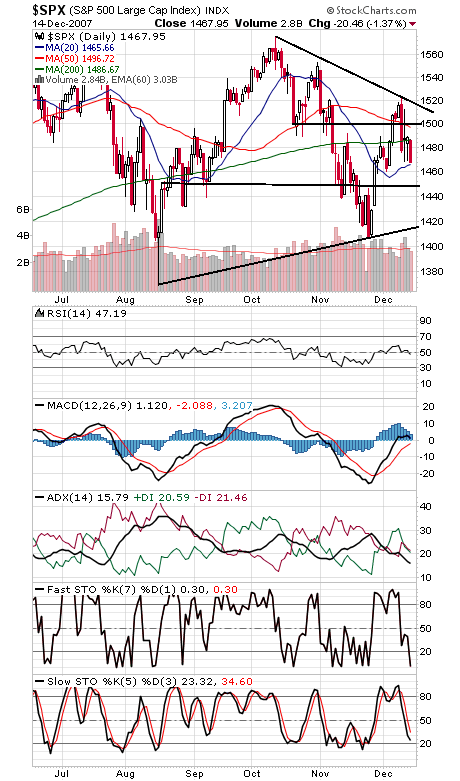

But the stock market has yet to signal that the Fed has done its job successfully, as it remains near the bottom of a multi-month trading range. The S&P (second chart below) has support at 1460, 1445-1450 and 1406-1416, and resistance is 1487-1500.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.