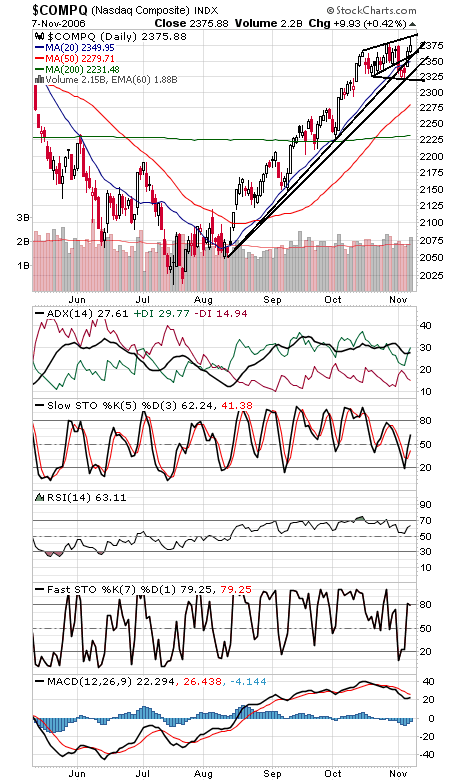

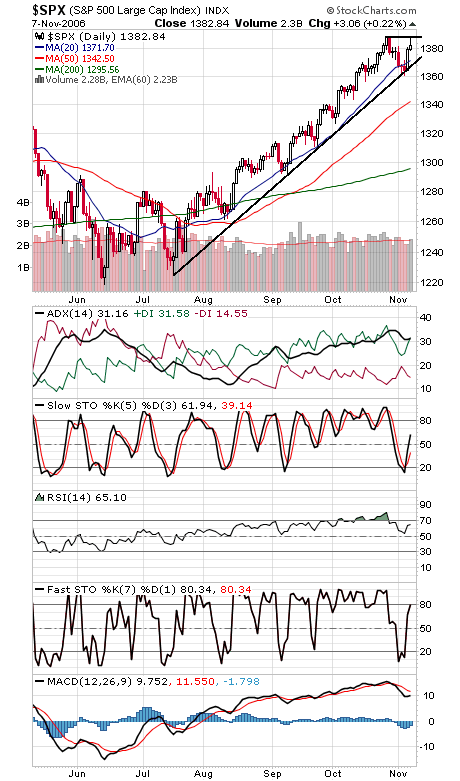

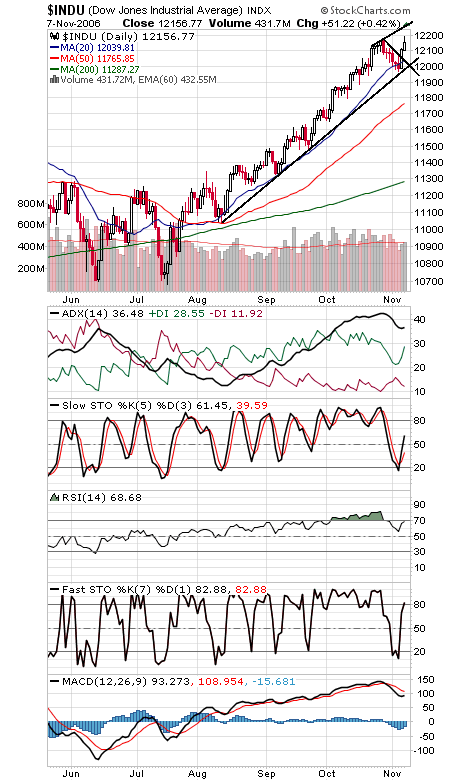

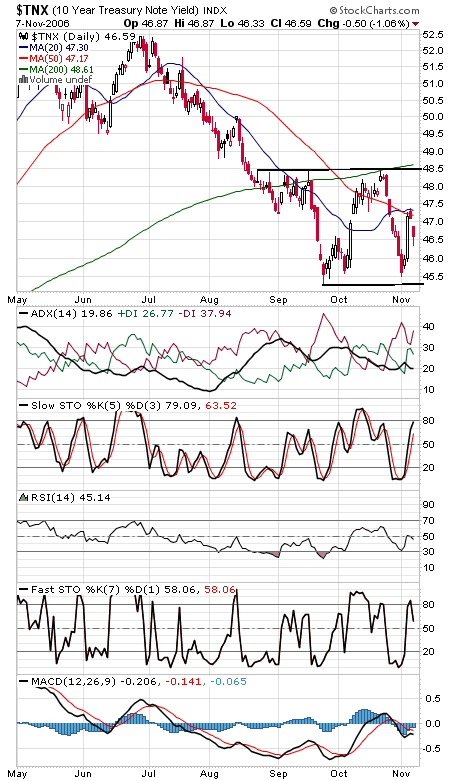

A bit of jitteriness ahead of tonight’s results, as the indexes backed away from multi-year highs. That’s not unexpected given what’s at stake, and we wouldn’t be surprised if the volatility continues into tomorrow. If you believe what you read, the markets like the idea of a divided government, so it will be interesting to see how the market reacts to events. The expectation is for a Democratic House and a Republican Senate; anything else will be a surprise. The Nasdaq (first chart below) seems to be in a bit of a broadening pattern here. Resistance is 2393 and 2400, and first support is 2360, with 2340, 2335 and 2320 below that. The S&P (second chart) stopped just short of its multi-year high of 1389, with 1400 a big level above that. Support is 1379 and 1372. The Dow (third chart) faces resistance at 12,200 and 12,250, and support is 12,100, 12,060 and 12,000. Bond yields (fourth chart) still haven’t seen any follow-through to Friday’s big rally; another fakeout for bonds? They seem to be in a big range here; it might be best to wait for the breakout.