An extraordinary day today, from a historic collapse that possibly exceeds the Enron and WorldCom fiascos to the Fed’s unprecedented steps to bail out investment banks.

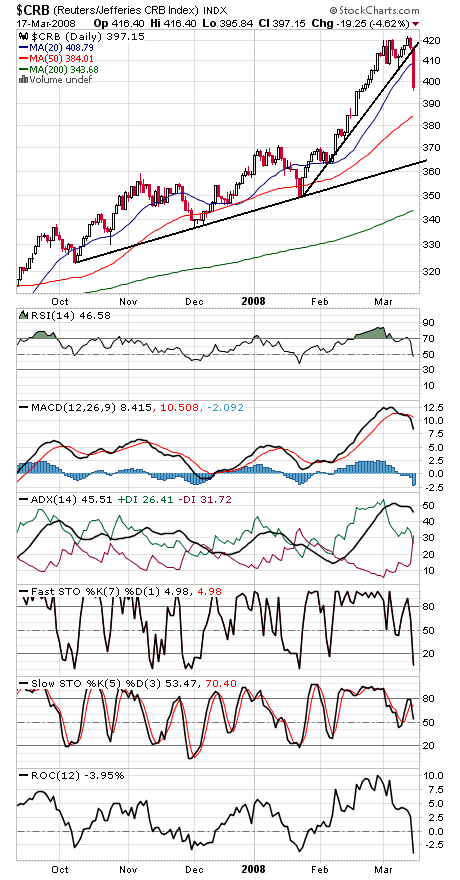

It is almost impossible to record all the significant developments in the market today, but one worth noting is the possible unraveling of the commodity trade (see first chart below), as almost everything in that sector turned lower today. There’s been a lot of speculation there, and we might have witnessed a turn. If that’s the case, the Fed could sure use the help on the inflation front. Let’s hope it’s not a sign of a deepening slowdown.

Speaking of the Fed, we were early critics of Bernanke’s inaction on the brewing financial crisis, but we have to tip our hats to him now. He has shown an aggressiveness and creativity in dealing with the crisis that his predecessor would be hard-pressed to match. Still, we wonder if he might have been able to do more with less if he acted earlier, say when the market gave a Dow Theory sell signal in November. The Fed could do worse than tying economic policy to Dow Theory signals.

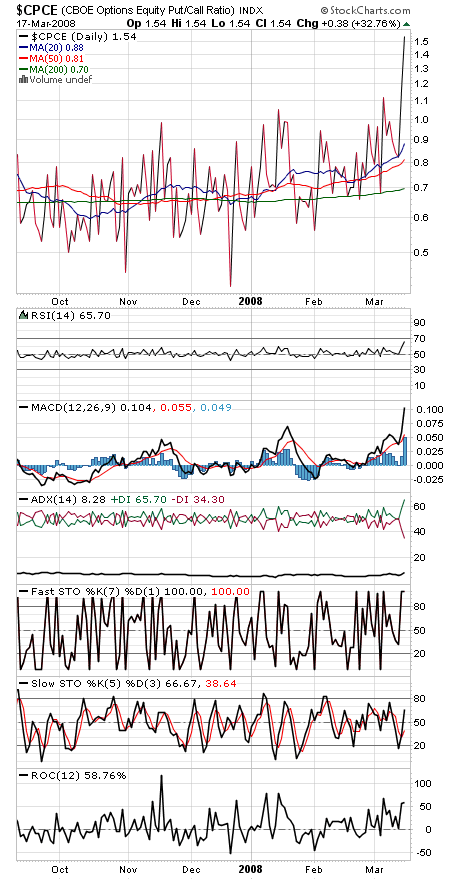

Today’s action was constructive and sentiment remains wildly bearish (see second chart below), but we’re still waiting for a turn that sticks.

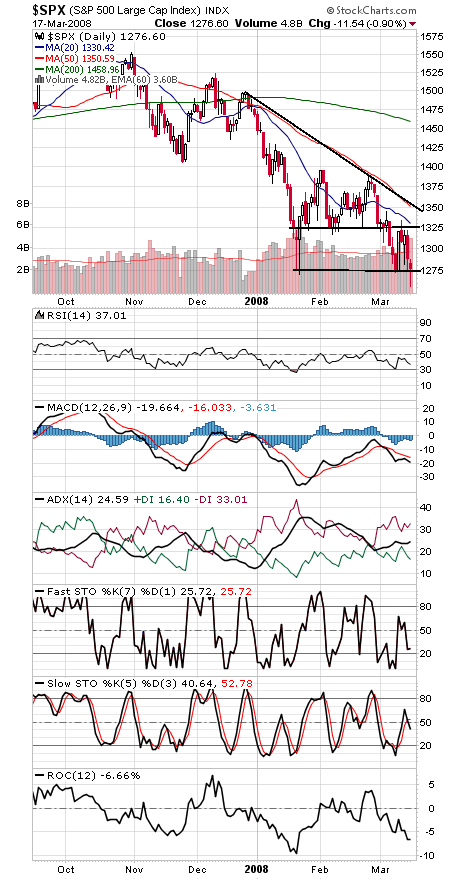

The S&P 500 (third chart) barely held 1270 on a closing basis. 1250 and 1219-1250 are next supports, and 1287-1300, 1325-1335 and 1350 are resistance.

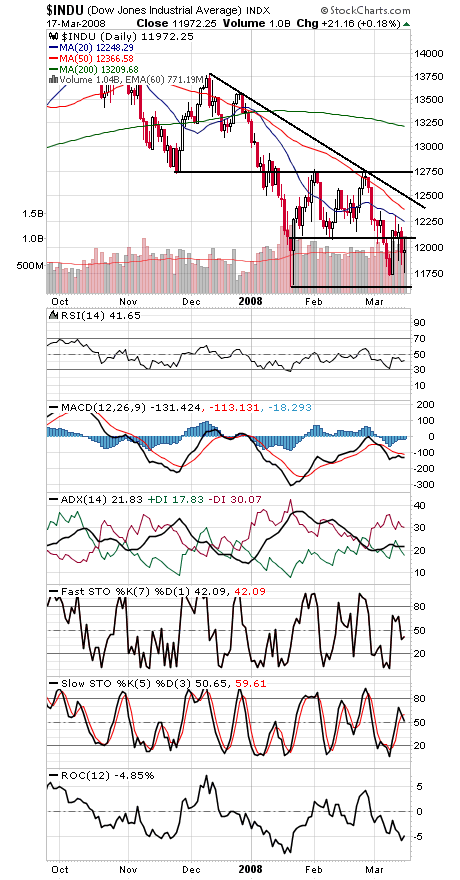

The Dow (fourth chart) was the only one of the Big Three not to set a new low today. Support is 11,750 and 11,635-11,670, with 11,400-11,500 and 11,250 below that. Resistance is 12,100 and 12,250-12,300.

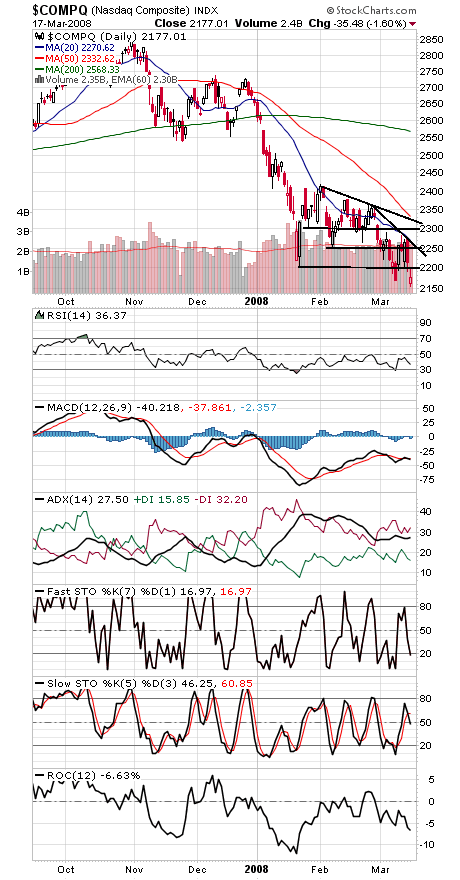

The Nasdaq (fifth chart) has support at 2150 and 2100-2120. Resistance is 2200-2220 and 2250, 2300 and 2325.

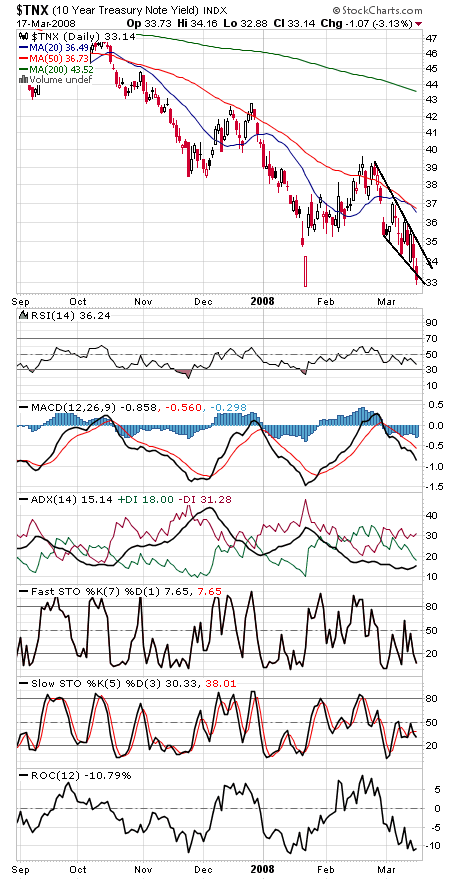

Finally, bond yields (sixth chart) had quite a day — if they don’t reverse quickly, they could be headed for new lows.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.