The Dow and S&P 500 need to find support very soon, or they could face yet another wave of selling here.

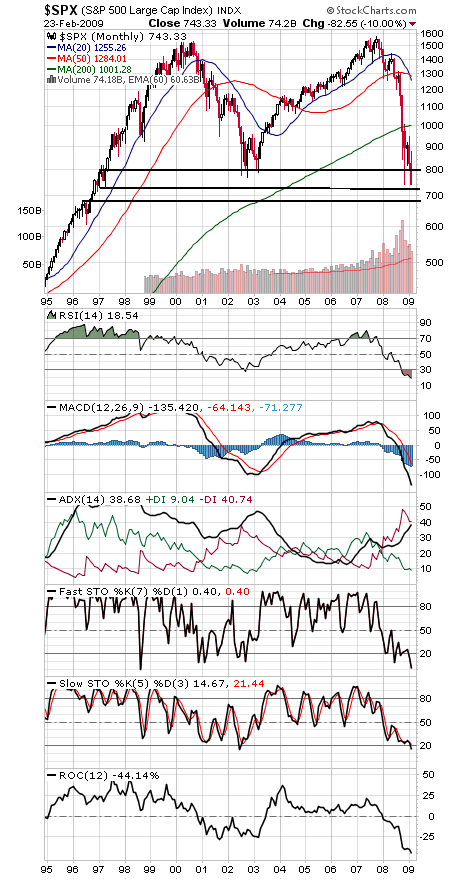

The S&P (first chart below) is sitting right above its November intraday low of 741.02. If that goes, 729-733 and 680-700 are the next support levels for the big cap stocks.

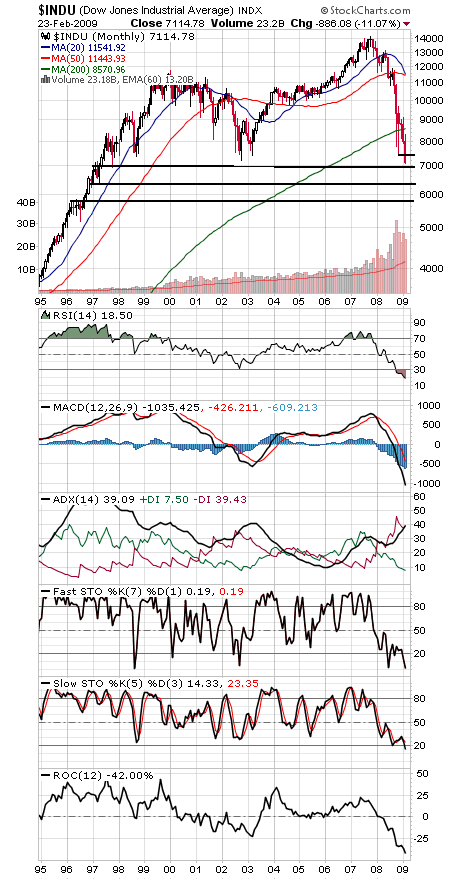

The Dow (second chart) broke both its November and 2002 lows in the last few days. Next up is its October 1997 low of 6971.32, and below that, 6300-6500 and 5800-6000 are the next support zones. A swift and dramatic fall for the blue chips here.

While this is one of the most oversold markets in history — look at almost any indicator in the charts below — that so far hasn’t kept stocks from continuing to fall. Sentiment hasn’t been very helpful here either — advisors remain more bullish than they were at the November lows, while big commercial traders are shorting — that’s the opposite of what we’d like to see.

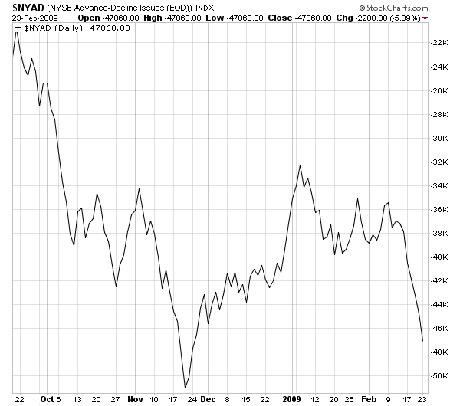

About the only positive is the outperformance of the NYSE advance-decline line (chart three), which remains above its lows as the Dow and S&P set new lows.

In short, not a lot to build a bottom on. The Dow has fallen about 50% from its all-time high of 14,198, and 50% declines have usually been followed by good rallies throughout stock market history. If that pattern can continue, perhaps that 6971 level can hold for now.

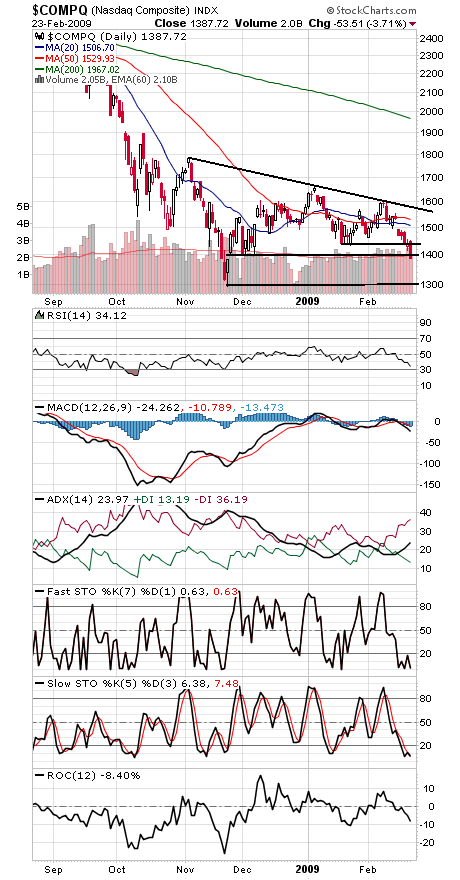

The Nasdaq (fourth chart) remains well above its November low of 1295.48. While Nasdaq outperformance is usually a good thing, in this case, it may simply be a recognition that tech stocks have far better balance sheets than a whole lot of blue chips right now.

To the upside, the technical picture would improve if the Dow could recover 7449-7552 and the S&P 800-804. The Nasdaq faces resistance at 1440 and 1500-1530.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association. He is a co-author of an upcoming book on Dow Theory from W&A Publishing.