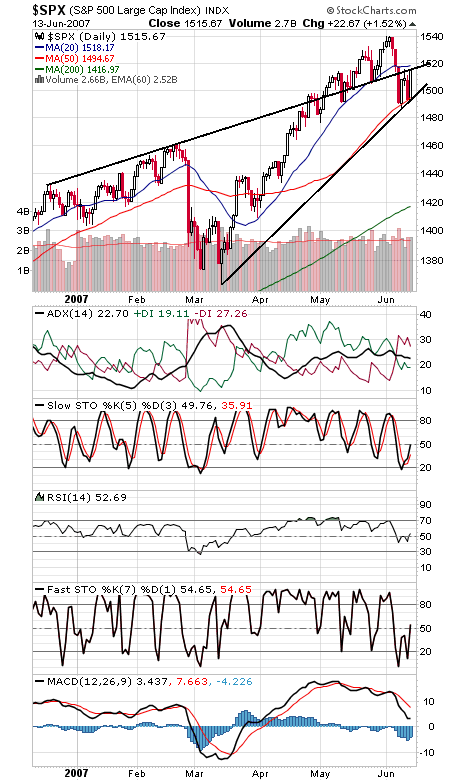

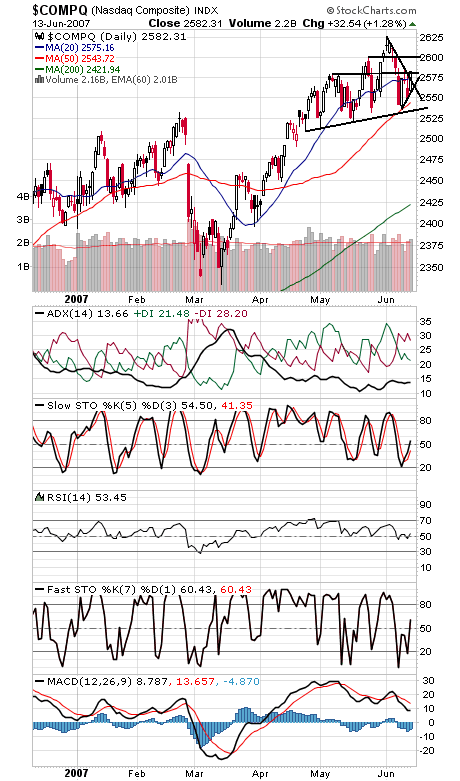

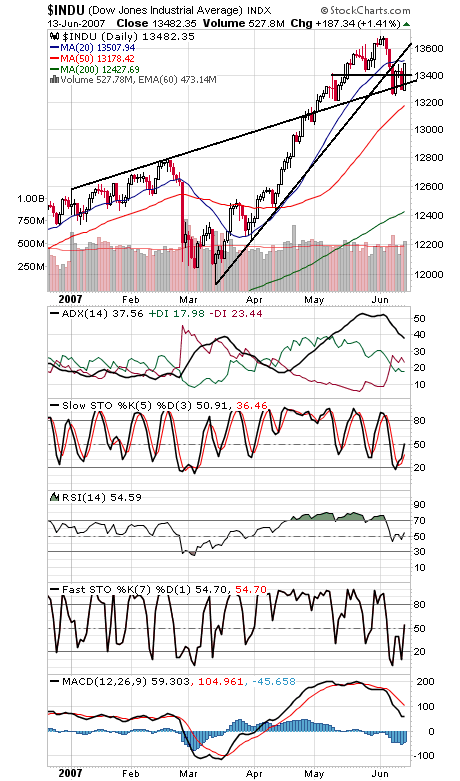

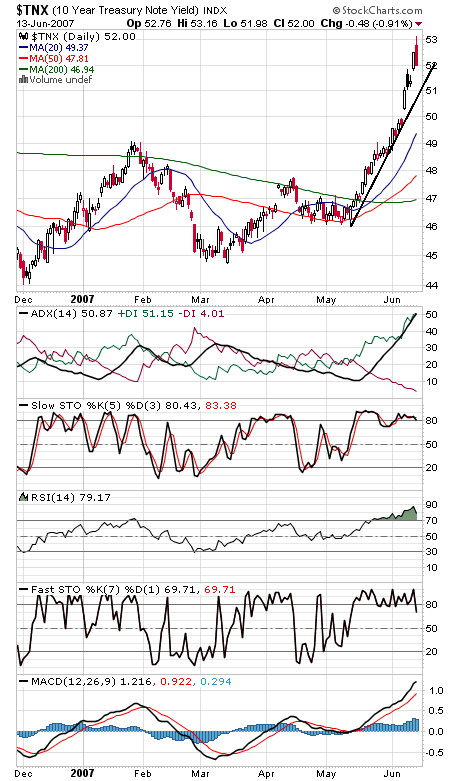

Another nice showing by the bulls today, but the NYSE stopped just short of the 90% upside volume level that might have suggested an end to the correction. The market will likely be volatile the next couple of days as investors digest inflation data, and we’re also entering earnings warning season. While we expect market conditions to remain favorable for another month or so, we’re not sure they’re ready to head higher just yet, but a little higher from here and the bulls will strengthen their case. The S&P (first chart below) is bumping up against a major trendline here. If the index can clear 1521, it would have exceeded its initial leg up off the June 8 lows and could be on its way to new highs. 1511 is first support, with 1505, 1500 and 1495 below that. The Nasdaq (second chart) broke its downtrend today, a good sign for the bulls. 2565 is important support, and 2600 is next resistance. The Dow (third chart) faces resistance at 13,508, 13,535 and 13,600, and 13,400 and 13,340 are support. The 10-year yield (fourth chart) finally took a break today and remains neutral; bond traders’ reaction to inflation data the next couple of days could say a whole lot about the direction of interest rates.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association