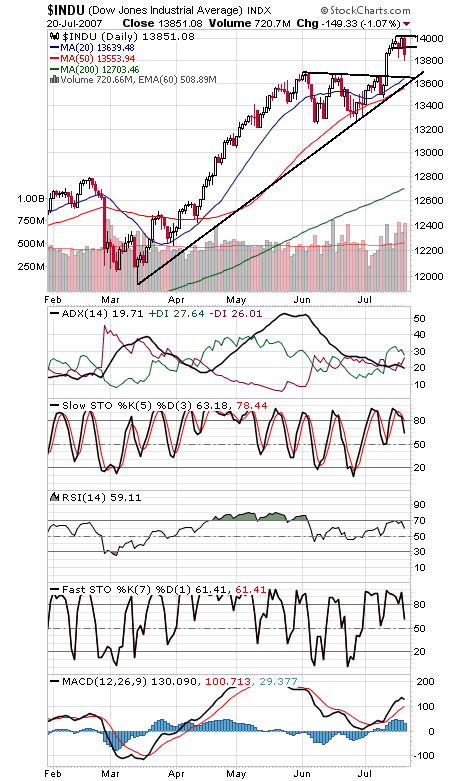

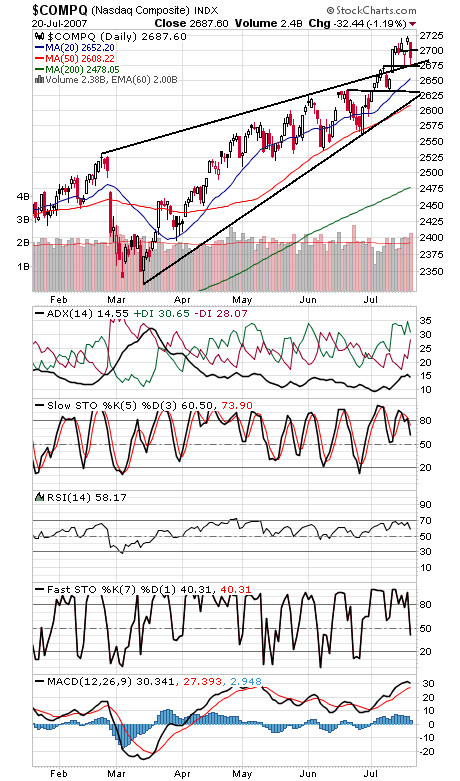

As we noted yesterday, new highs in the Dow and S&P without participation from the financials or the broad NYSE list was a troubling sign, and it didn’t take long for the market to punish the lack of breadth. On the plus side, though, commercial futures traders continue to add to long positions in the big S&P and Nasdaq contracts, so it’s hard to give the bears too much credence here. Still, the market needs some time to correct its imbalances here, so we may have more of a shakeout before the bull can resume. As we all know by now, the S&P’s March 2000 peak was bound to be a tough hurdle for the bulls, and it’s living up to expectations.

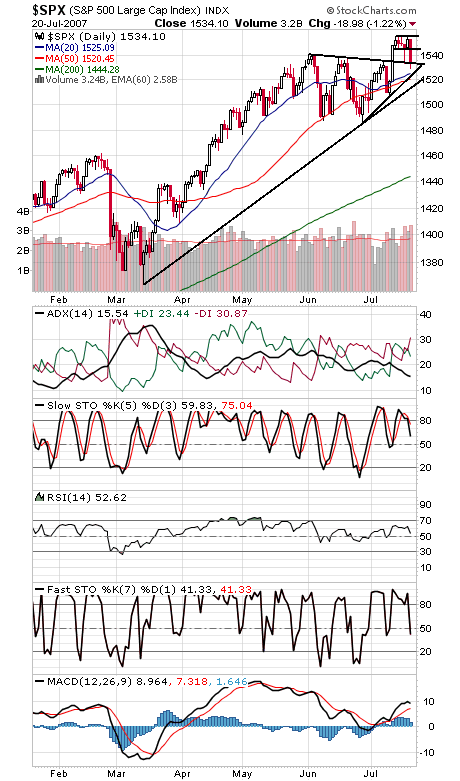

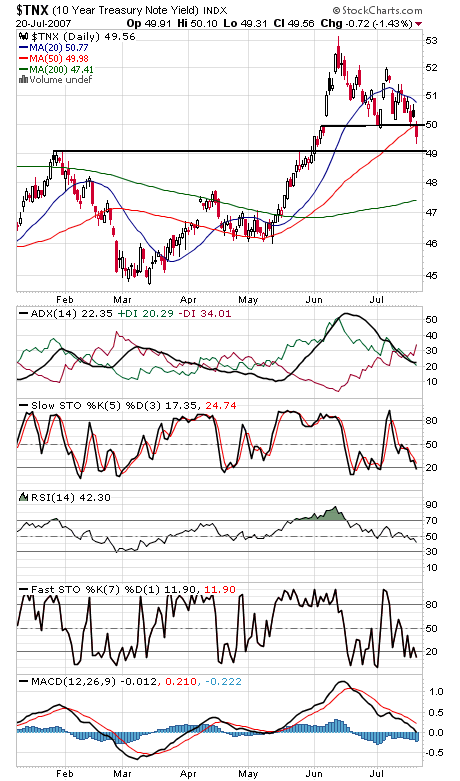

The S&P (first chart below) is barely hanging on to last week’s breakout here. Much lower and 1525, 1520 and 1515 come into play. 1545 and 1556 are resistance. The Dow’s big support (second chart) is down at 13,650-13,700, with 13,800 a first support level. Resistance is 13,900-13,920 and 14,000-14,020. The Nasdaq (third chart) is holding 2674 support nicely. Below that, 2552-2563 would come into play. Resistance is 2700 and 2725. The 10-year yield (fourth chart) broke below 5% today, but 4.9% is still in the way.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association