The S&P 500 (first chart below) says it all today, as the index broke down out of a 15-month trading range. That’s bad news for the bulls — and opens up the possibility of a move as low as 1170, the 200-point range break projected to the downside.

First, though, the index has to get through what should be very strong support at 1327 and 1280-1290. To the upside, the mission for the bulls is simple: get back above 1370 and back into that trading range.

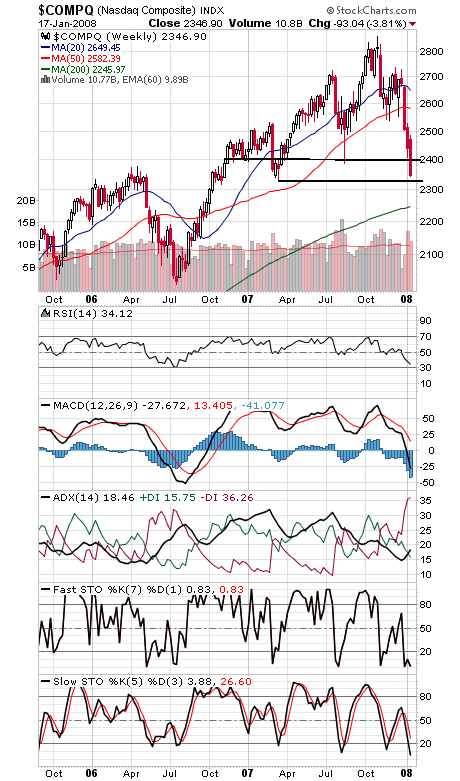

The Nasdaq (second chart) has support at 2331 — and then 2250. To the upside, a move back above 2386-2400 would be a start.

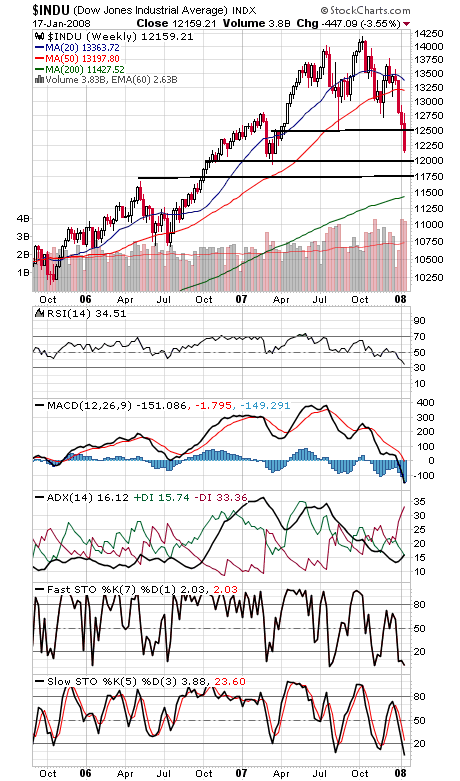

The Dow (third chart) has the most obvious and important support, the 11,750-12,000 zone, one that should hold on first test. To the upside, a move above 12,500 would be a bare beginning.

In short, the bears have seized control of the market for the first time in five years, but the indexes are deeply oversold, puts are piling up, and the cycles remain relatively positive. Don’t count out the bulls yet, but they clearly have their work cut out for them.

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.