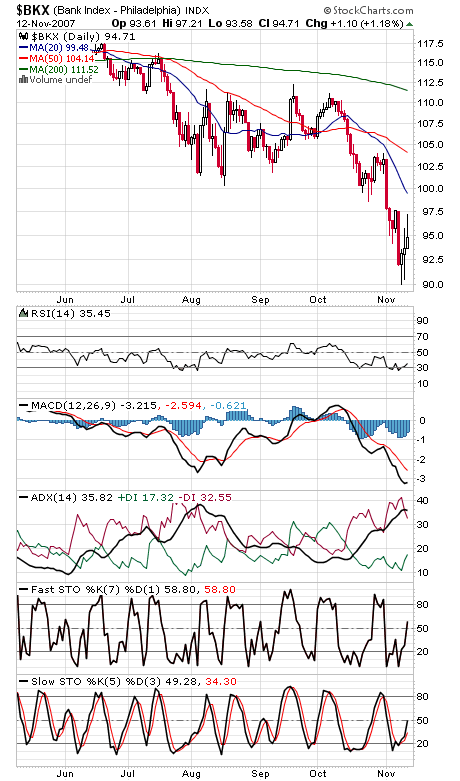

The financials (first chart below) continue to catch a bid here, but that has yet to do much of anything for the rest of the market. Perhaps we can get a good rally later this week, after we get a couple of good inflation reports and the third-quarter SEC filing deadline airs the rest of the financial sector’s dirty laundry.

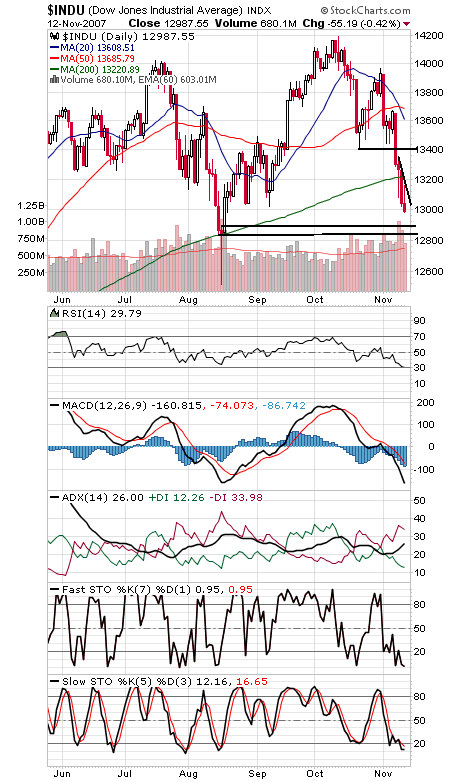

But the rest of the indexes are at major support — and buyers have yet to be found.

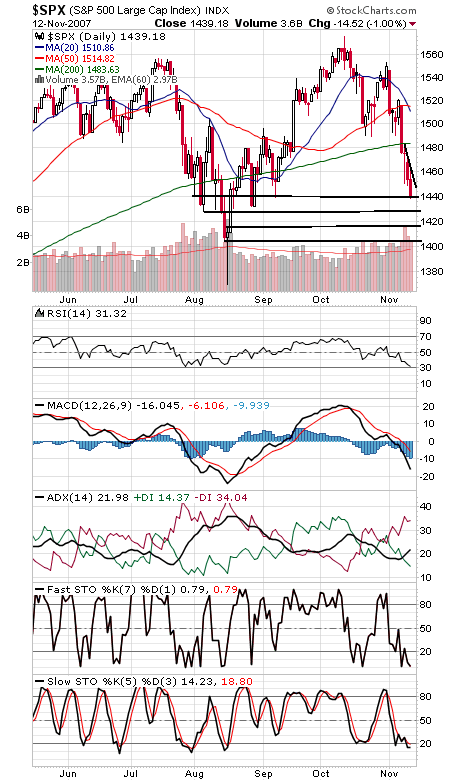

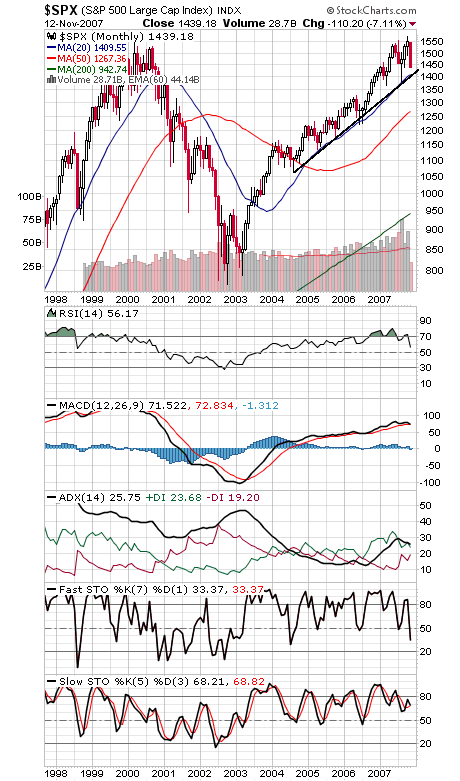

The S&P 500 (second and third charts) has very strong support between here and 1427; below that, 1416 and 1406-1410 could provide some support, but the risk goes up for a complete retest of the August lows. To the upside, 1446-1447 is first resistance, with 1483 and 1490 the main levels to beat.

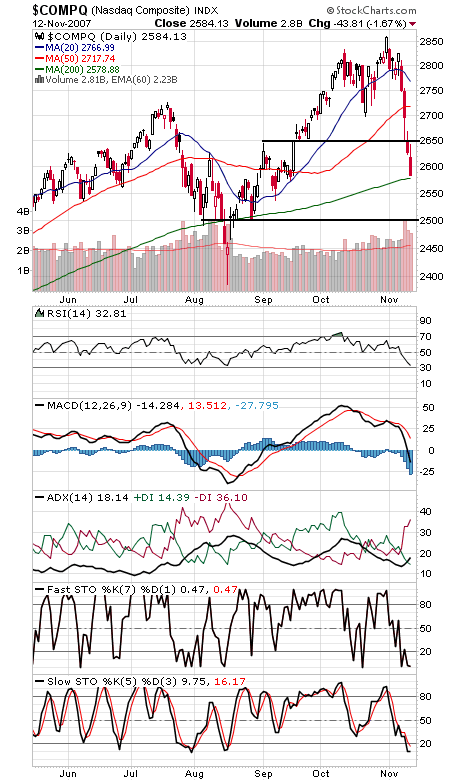

The Dow (fourth chart) has support at 12,850-12,900 and then air down to 12,500. Resistance is 13,120, 13,220 and 13,400. The Nasdaq (fifth chart) needs to find support in the next five points or it too could face another big downdraft. First resistance levels are 2600 and 2650.

Will all those 30 RSI readings be good for a bottom?

Paul Shread is a Chartered Market Technician (CMT) and member of the Market Technicians Association.